New EV Tax Credit Sparks Excitement Among Electric Car Enthusiasts

The new EV tax credit was part of the Inflation Reduction Act signed by President Joe Biden in 2022. It gives EV buyers up to $7,500 in tax credits.

April 28 2023, Updated 9:53 a.m. ET

Have you always dreamed of buying a Tesla but can’t afford the hefty price tag? Well, you’re in luck. In early 2023, Tesla began knocking down the prices on select vehicles including the Model 3, Model X sport utility vehicle (SUV), and the Model S luxury sedan.

Even better, you can potentially save another $7,500 if you qualify for the new EV tax credit, which passed in 2022.

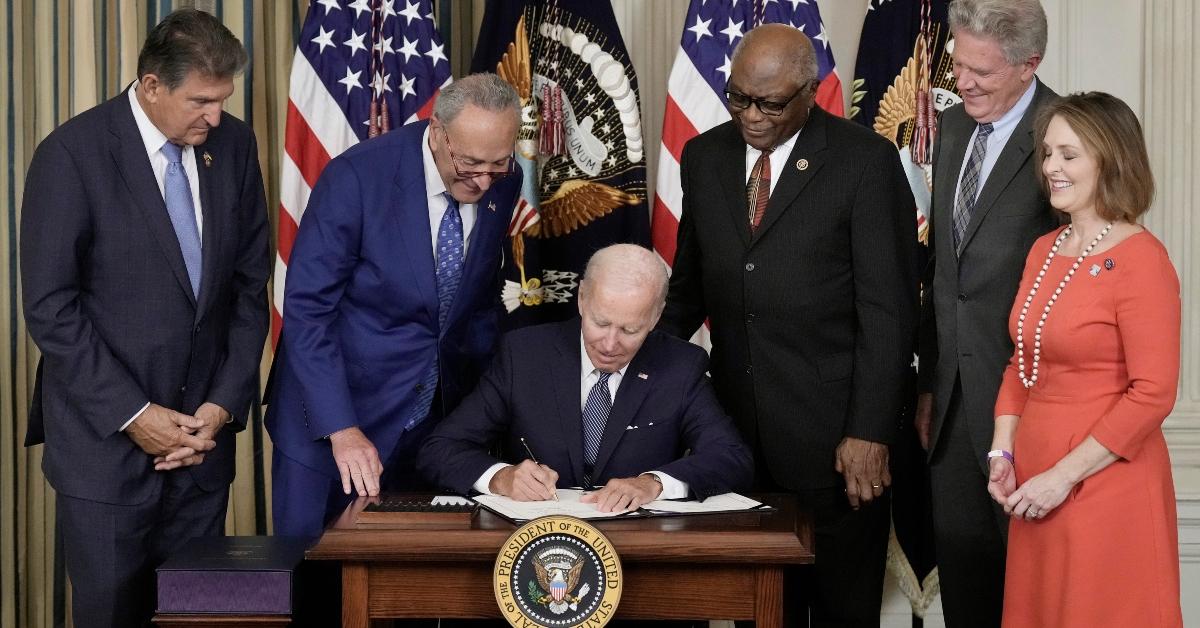

Changes to the EV tax credit were part of the Inflation Reduction Act signed by President Joe Biden in August 2022.

Here's everything to know about the new EV tax credit, including which vehicles qualify for it and when it took effect.

President Joe Biden signs the Inflation Reduction Act.

Which cars qualify for the new EV tax credit?

Under the new EV tax credit guidelines, the EV you plan to purchase must have a manufacturer-suggested retail price (MSRP) under $55,000 for most vehicles and under $80,000 for vans, SUVs, and pickup trucks.

Before Telsa recently cut its prices by almost 20 percent, most of the company’s vehicles wouldn’t qualify for the new EV tax credit. The cost of a Model Y was over $65,000. Now, after the price cut, you may be able to find it selling for around $52,990.

Both plug-in hybrid vehicles and fully electric vehicles may qualify for the tax credit. The IRS website has a list of vehicles that may qualify as long as they meet several other restrictions, the price being just one of them.

Another requirement for the tax credit is that the EV must undergo its final assembly in North America. EVs made by foreign car manufacturers like Kia, Toyota, and Hyundai currently aren't eligible. Some Volkswagen ID.4 vehicles would qualify for the tax credit if the final assembly were done in Chattanooga, Tenn. and not Germany.

The U.S. Department of Energy provides information on EVs with final assembly in North America. If you aren't sure whether a vehicle qualifies for the EV tax credit or not, you can search using the Vehicle Identification Number (VIN).

In addition to those requirements, the EV must also have a battery capacity of at least 7-kilowatt hours and a gross vehicle weight rating of less than 14,000 pounds to qualify for the tax credit.

Are there income restrictions for the EV tax credit?

Yes, your income also plays a big part in whether or not you’re eligible for the tax credit. Single taxpayers must have a modified adjusted gross income (AGI) under $150,000. For married couples filing jointly, their income can’t exceed $300,000, and the income threshold for heads of households is $225,000.

You can use your income from the year you take delivery of the EV or the year before, whichever is less. The tax credit is applied against your tax bill and isn't refundable. That means you have to owe the tax man at least $7,500 to benefit from the credit fully.

Do used EVs qualify for the new tax credit?

If you buy a previously owned EV, you may still be able to get a tax credit. The new rules allow for a $4,000 tax credit for EVs that cost less than $25,000 and are at least two years old. The income threshold is lower for used EVs. The income cap is $75,000 for a single taxpayer and $150,000 for a married filing jointly.

When did the new EV tax credit take effect?

If you purchased an EV in 2022, you may be able to claim a tax credit on the condition that you meet all the requirements laid out by the IRS. Because new rules were imposed in 2023, it has made it a little more difficult for taxpayers to take advantage of the tax break. For example, the IRS now requires that your vehicle undergo final assembly in North America if purchased on or after Aug. 17, 2022.

So, if you buy an EV between now and 2032, you can potentially claim the new EV tax credit as it was extended for another nine years. However, you are only able to claim the EV tax credit once per vehicle.