Pay Taxes Like a Pro: The Best Credit Cards to Pay Your 2023 Tax Bill Revealed

Looking for the best credit cards to pay taxes with in 2023? Discover the top credit card picks that will help you pay smarter and save big!

April 26 2023, Updated 10:15 a.m. ET

Taxes are never fun, especially if you owe a lot of money to Uncle Sam. But you may benefit by earning cash back or travel points when using a credit card to pay your taxes (and who doesn't want that). Which are the best credit cards to pay your taxes with? Truth be told, there are actually quite a few, but we've compiled a list of the top cards so you can choose the best one.

Although swiping your card will help you satisfy your tax liability, paying your taxes with a credit card is something you should consider carefully before you do it. For starters, you’ll have to pay fees for using a credit card. So, you should compare how much you can earn using your credit card with how much you’ll have to pay.

Now, let's take a look at the credit cards that reward you for paying off (or paying down) your tax bill.

Which credit cards are best for paying taxes?

When considering which are the best credit cards to pay your taxes with, you should look at cards that have the following:

No annual fee

0 percent APR for 12 or more months

Cashback or travel points for each purchase

Welcome offers of cash back or extra travel points

Here are some of our picks:

Citi Double Cash Card

The great thing about the Citi Double Cash Card is that it gives you $200 cash back when you spend $1,500 in the first six months, which covers the fee you’ll pay for using a credit card. It has no annual fee and 0 percent APR for 18 months. You’ll earn 2 percent on every purchase — 1 percent when you purchase and 1 percent when you pay for it.

Capital One Venture Card

If you love to travel, Capital One offers some of the best travel cards. The basic Venture Card has no annual fee, and you earn 1.25 points for every dollar spent. You also get 20,000 miles after spending $500 in the first three months. The card offers 0 percent APR for 15 months.

Ink Business Unlimited

This card is a good option for business owners. It offers a $750 welcome offer and 1.5 percent cash back on purchases. There isn't an annual fee and 0 percent APR for 12 months.

Chase Freedom Flex

The Chase Freedom Flex credit card gives you a $200 bonus after you spend $500 on purchases in the first three months you open the account. There isn't an annual fee and 0 percent APR for 15 months. You can earn 5 percent, 3 percent, and 1 percent on different purchase categories.

Is there a fee for paying taxes with a credit card?

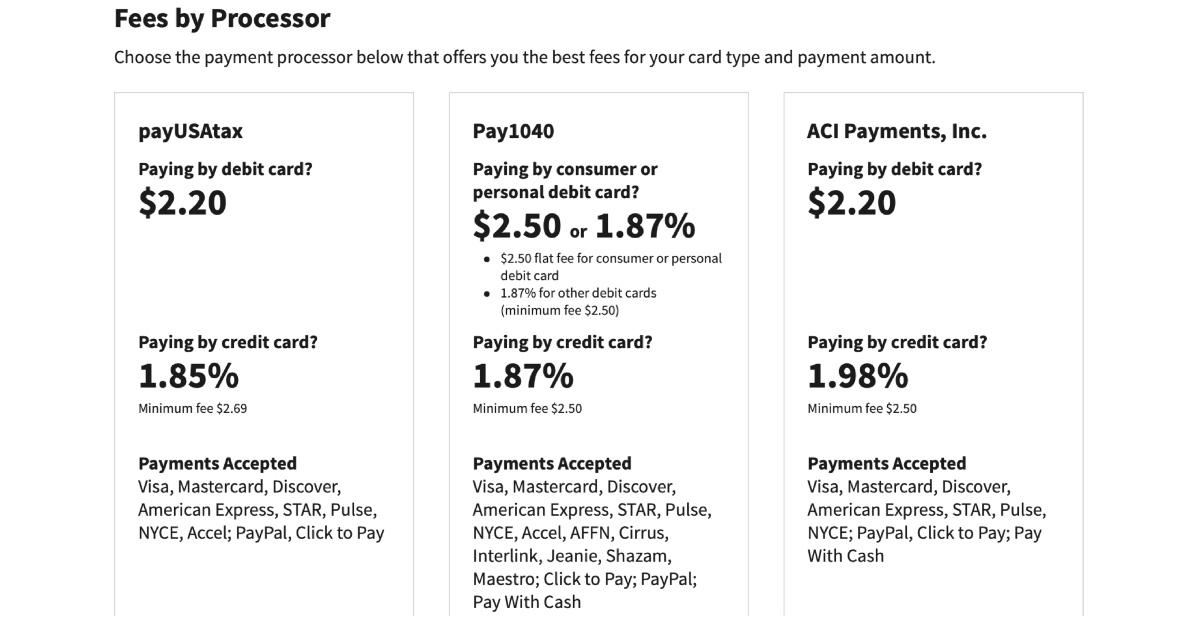

The IRS works with three different companies that process credit card payments for taxes. The fees for each payment processor vary slightly and range between 1.87 percent and 1.98 percent per transaction.

So, if you owe $5,000 in taxes, you would have to pay between $93 and $99 to use a credit card.

The IRS fee schedule for paying taxes with a credit card.

The payment companies also charge small fees for paying with a debit card, which are less than $3. There isn't a charge for paying your taxes with a check, money order, or direct withdrawal from your bank account.

Should I pay taxes with a credit card?

If you have a credit card that doesn’t charge you interest for a year or more, it may be a good option to pay a big tax bill and spread the cost over a few months.

However, if you’re paying interest on your card, it’s probably best to pay Uncle Sam in a different way. You should only consider using a high-interest credit card to pay your taxes if you have the money to pay off the credit card within a month.