Market Vectors® CEF Municipal Income ETF

Latest Market Vectors® CEF Municipal Income ETF News and Updates

What Caused the Muni Defaults in 2016?

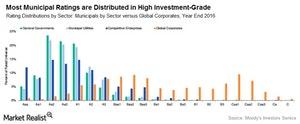

In 2016, Puerto Rico defaulted on constitutionally guaranteed GO (general obligation) bonds. On May 3, 2017, Puerto Rico filed for Title III bankruptcy.

Municipal Bonds’ Credit Quality Still Prevails

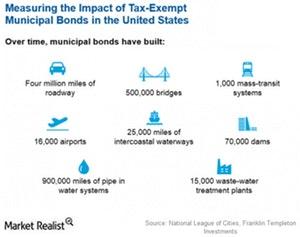

In this series, we will shed light on Moody’s recent data report, US Municipal Bond Defaults and Recoveries, 1970–2016. Muni bond prices sparked in 2016, especially when President Trump announced his infrastructure spending plans.

A Glance at Muni Bonds’ Performance in 2016

The performance of municipal bonds has fallen since the 2016 election, as President Trump’s tax reform and infrastructure spending plans have caused some concern among investors.

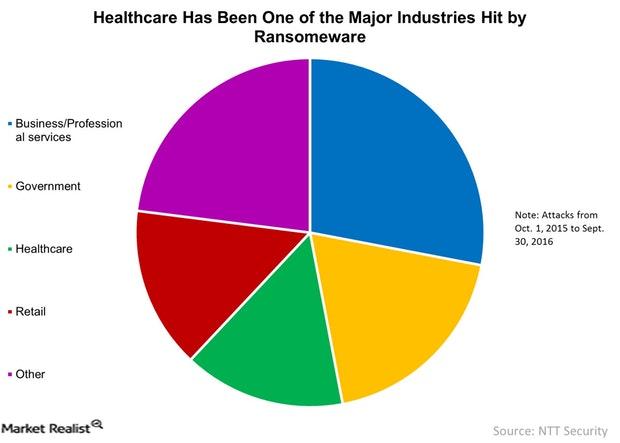

How Municipalities Can Prevent Cyber Attacks

One possible driver to action could simply be alerting the public through their local media outlets just what havoc can be, and has been, wrought by cyberattacks.

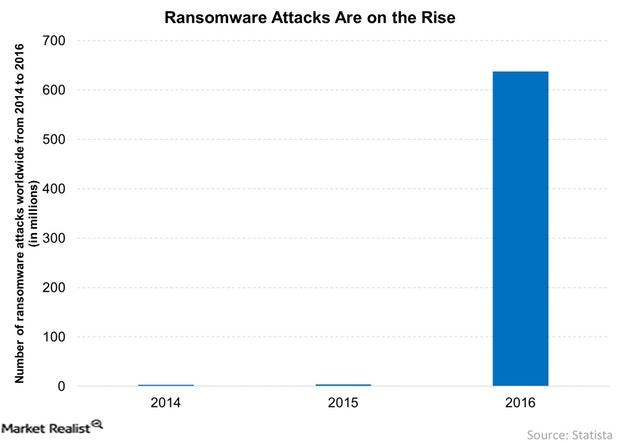

Ransomware Attacks Are on the Rise

We are all potentially at risk of cyberattack – directly or indirectly. When it comes to municipalities, this may not always be obvious to the average state or city taxpayer.

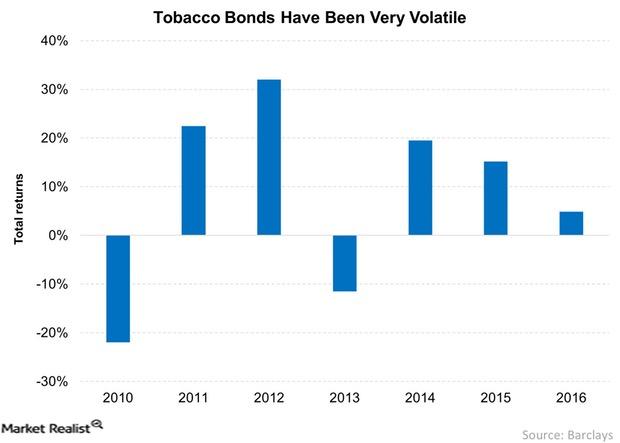

Do Tobacco Bonds Warrant a Place in Your Portfolio?

Tobacco bonds have been volatile in the last seven years. Falling MSA payments caused the volatility. Tobacco bonds offer relatively good cash flow returns.

Could Lower Tax Rates Affect Municipal Bonds Negatively?

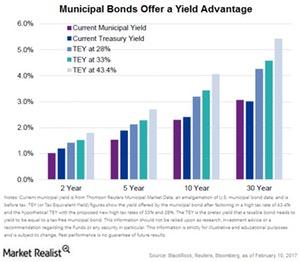

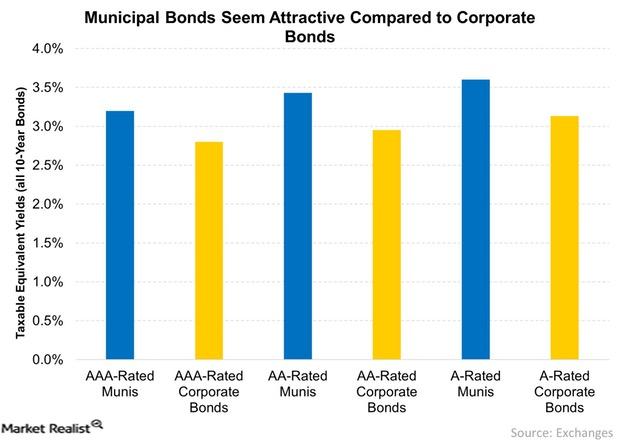

For investors in the top tax bracket, municipal bond (XMPT) yields on a tax-equivalent basis are roughly 5.0%.

How Refundings Could Affect Municipal Bond Returns This Year

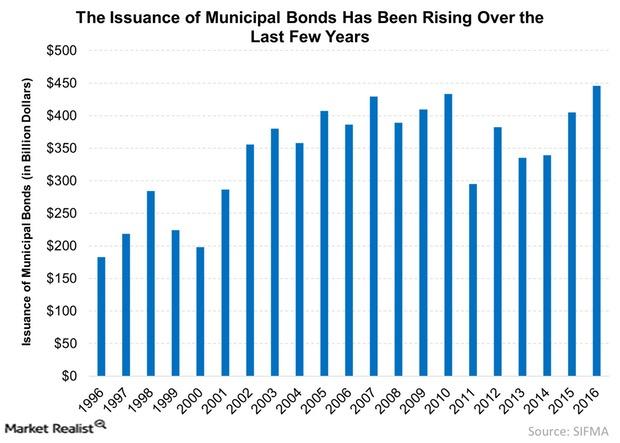

Municipal bond issuance has been rising over the last few years. More refundings would cause the supply to rise further.

The Many Uncertainties Municipal Bonds Face in 2017

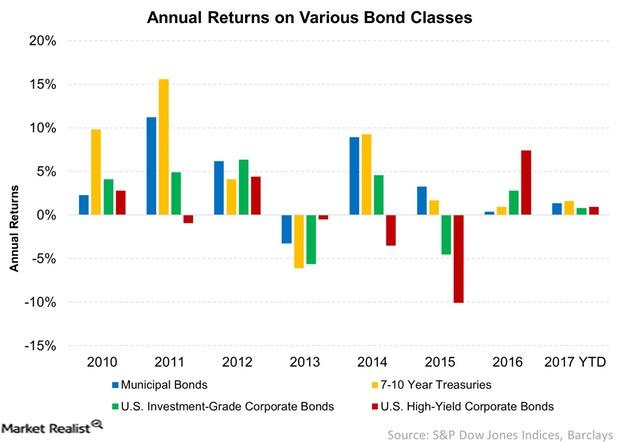

Municipal bonds were the worst-performing bond class in 2016 after solid returns in 2014 and 2015, and high-yield bonds (JNK) outperformed.