Waste Management Inc

Latest Waste Management Inc News and Updates

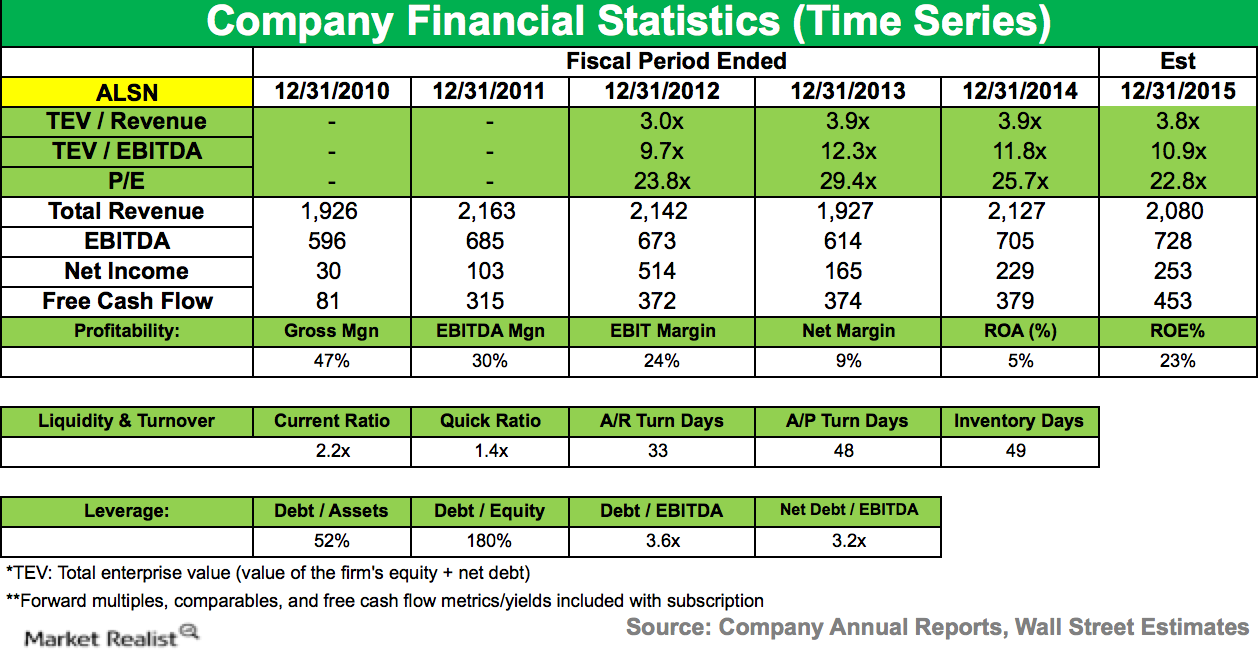

ValueAct Capital Ups Its Stake in Allison Transmission Holding

Allison Transmission Holding and its subsidiaries design and manufacture commercial and defense fully automatic transmissions.

Maverick Capital Decreases Position in Allison Transmission

Allison Transmission and its subsidiaries design and manufacture commercial and defense fully automatic transmissions. In 4Q14, net sales grew 11% to $544 million.

Investing in CBD? Real Brands Is Making Big Moves

The CBD market is growing, and acquisitions are heating up. Real Brands is a top, under-the-radar investment candidate that should be on your radar.

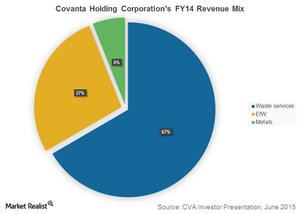

An Overview of Covanta Holding’s Business Model

Covanta Holding Corporation (CVA) generates revenues through waste collection and services, energy from waste, and metal recycling.

What Happens to Waste? The Basics of Municipal Waste Management

In simple terms, municipal solid waste is trash or garbage discarded by households and commercial establishments.