Vanguard Mid-Cap Value ETF

Latest Vanguard Mid-Cap Value ETF News and Updates

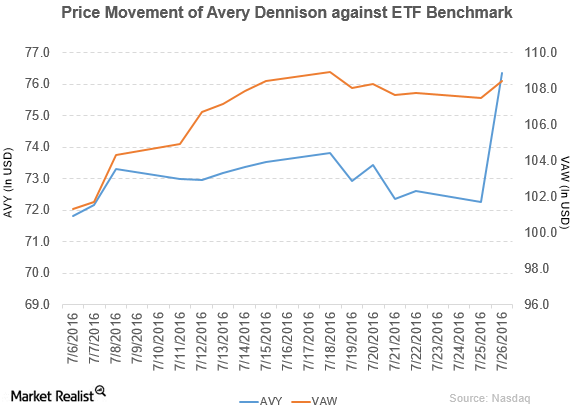

Avery Dennison’s Top and Bottom Lines Rose in 2Q16

Avery Dennison (AVY) has a market cap of $6.8 billion. It rose by 5.7% to close at $76.37 per share on July 26, 2016.

Quest Diagnostics Is Targeting 3 Focus Areas to Accelerate Growth

Since 2012, Quest Diagnostics (DGX) has spent about $1.0 billion on capital investments and $1.0 billion on ten acquisitions to support inorganic growth.

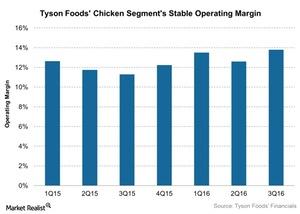

How Is Tyson Foods Improving Its Chicken Operating Margin?

In fiscal 3Q16, Tyson Foods’ Chicken segment reported an operating margin of 13.9% with an improved product mix.

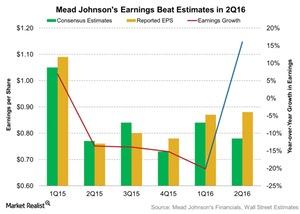

Why Did Mead Johnson Nutrition’s Earnings Rise 16% in 2Q16?

In 2Q16, Mead Johnson Nutrition’s (MJN) EPS (earnings per share) increased 16% to $0.88, compared to $0.76 in 2Q15.

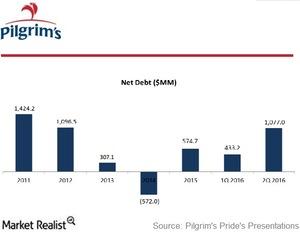

How Has Pilgrim’s Pride Made Room for Strategic Investments?

Consistent with its strategy to improve capital structure and generate shareholder value, Pilgrim’s Pride (PPC) paid $700 million, or $2.75 per share, in special dividends.

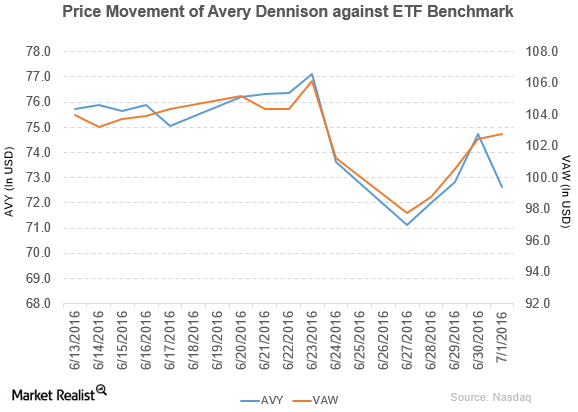

Bank of America Merrill Lynch Downgrades Avery Dennison

Avery Dennison (AVY) has a market capitalization of $6.5 billion. It fell by 2.9% to close at $72.62 per share on July 1, 2016.