Sempra Energy

Latest Sempra Energy News and Updates

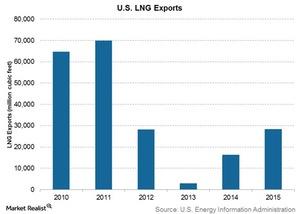

An Overview of US LNG Production and Exports

Investors may be seeing a lot of reports about rising US LNG (liquefied natural gas) exports. Let’s review the basics of LNG.

Warren Buffett Has Loads of Cash and No Takers

Berkshire Hathaway’s huge cash pile might stay in place for a while. Warren Buffett was outbid by Apollo Global Management in his efforts to buy Tech Data.

Where PG&E Stock Might Go amid Interest from Mayors

PG&E gained for the sixth straight day amid increased uncertainty. The stock has gained more than 80% during this period and closed at $8 on Tuesday.

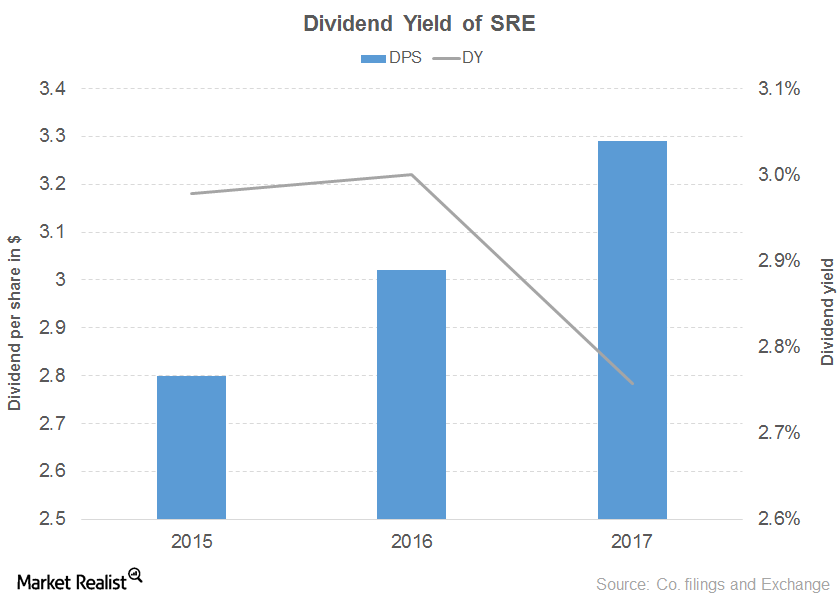

What Led to Sempra Energy’s Sharp Fall in Dividend Yield?

Sempra Energy’s revenue for the first half of 2017 rose 7.0%, driven by every segment.

Must-Know: Key Upcoming LNG Export Terminals in the US

The LNG sector faces steep competition not only from other domestic terminals but also other countries in the international LNG market.

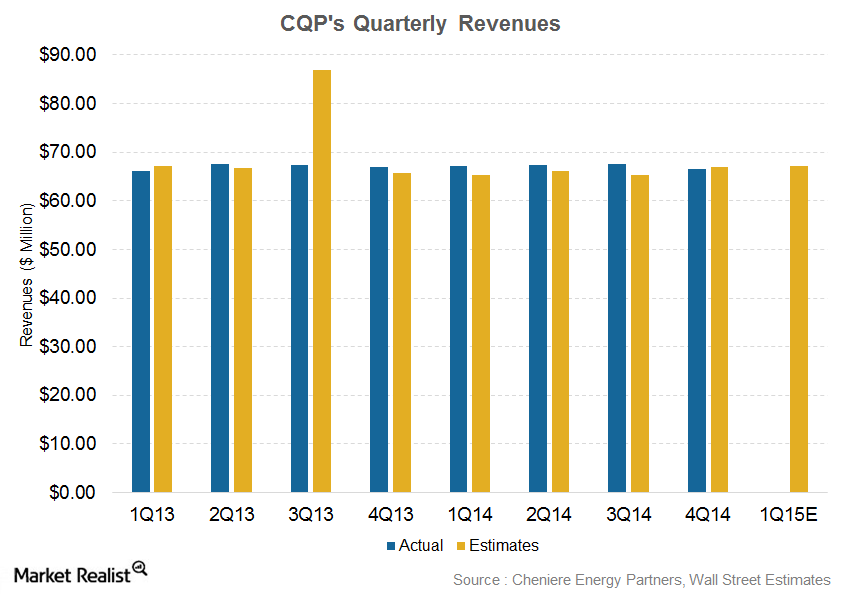

Analyzing Cheniere Energy Partners’ Historical Performance

For 1Q15, analysts are expecting Cheniere Energy Partners’ revenue to come in at $67.1 million. The loss per share estimates have been pegged at -$0.113.