Direxion Daily Semicondct Bull 3X ETF

Latest Direxion Daily Semicondct Bull 3X ETF News and Updates

What Imparts Transparency to Digital Assets?

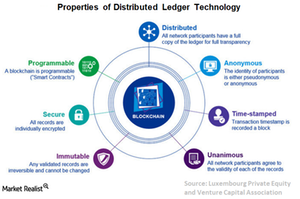

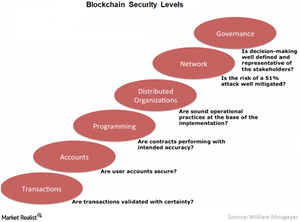

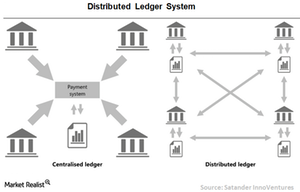

Digital assets based on DLT (distributed ledger technology) allows users to initiate and verify their own transactions without any central authority such as banks.

Things to Know Before You Buy Bitcoin

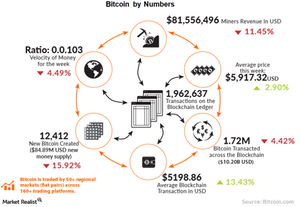

The sharp rise and fall in the price of bitcoin are mainly because ownership of the currency is heavily concentrated in just a few hands.

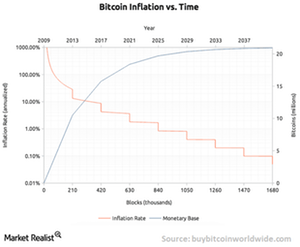

Is Bitcoin a Bubble?

The price of bitcoin (SOXL) (SOXX) has risen 69,278.6% over the last five years. On the other hand, in the last seven days, it has plummeted 27% to $12,466.

Blockchain and Bitcoin: But What Else Is Blockchain Used For?

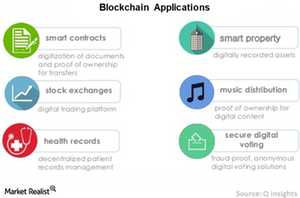

Deutsche Bank is planning to use blockchain technology in currency settlement, trade processing, and derivative contracts.

Is Bitcoin Ready to Replace Real Currency?

Despite the higher number of transactions that need to be updated regularly by users, the transaction capacity is intentionally kept very low by the bitcoin founders.

How Blockchain Technology Could Reduce Criminal Activities

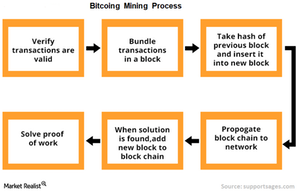

Before updating data on a blockchain, users must agree about the veracity of the transaction through a process called consensus.

Why the Future Belongs to Digital Assets

In DLT (distributed ledger technology), details of the transactions are recorded in multiple places called blocks. These blocks are then chained together on a shared network.

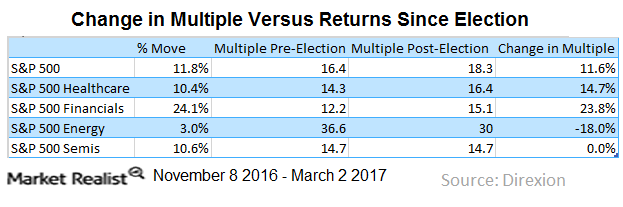

How Trump’s Proposed Policies Have Caused Sector Divergence

Despite the stellar run that financials (FAS) have had since the US elections in November 2016, financials are trading at very reasonable levels.