SeaWorld Entertainment Inc

Latest SeaWorld Entertainment Inc News and Updates

SeaWorld Isn't Going Out of Business — Update on Unpaid Rent Status

SeaWorld San Diego has defaulted on its deferred rent and could be facing serious repercussions for doing so. Is SeaWorld going out of business?

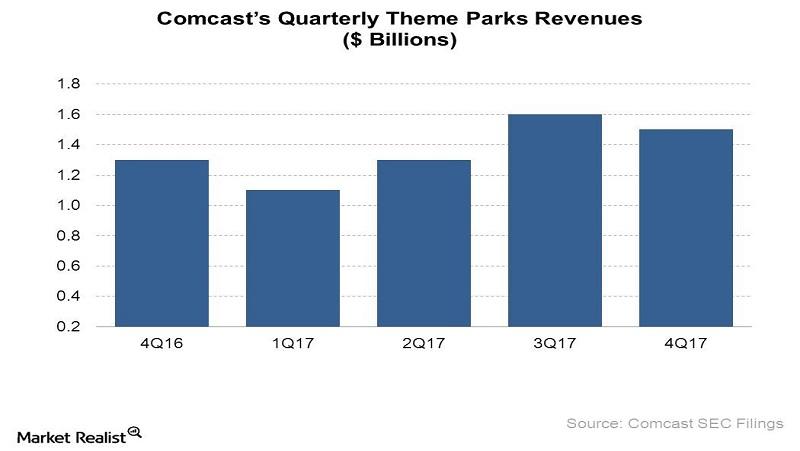

Here’s How Comcast’s Theme Park Business Performed in 4Q17

Comcast’s (CMCSA) Theme Parks business was a star performer in 4Q17, with revenue growth accelerating over the previous quarter.

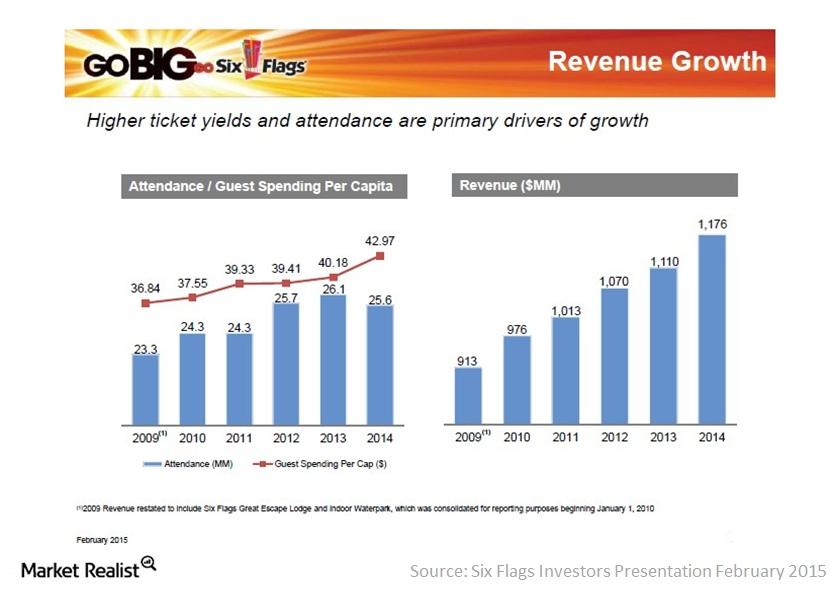

Six Flags Entertainment: An overview of the largest theme park

Six Flags Entertainment Corp. (SIX) is the world’s largest regional theme park company with $1.1 billion in revenue and 18 parks across North America.

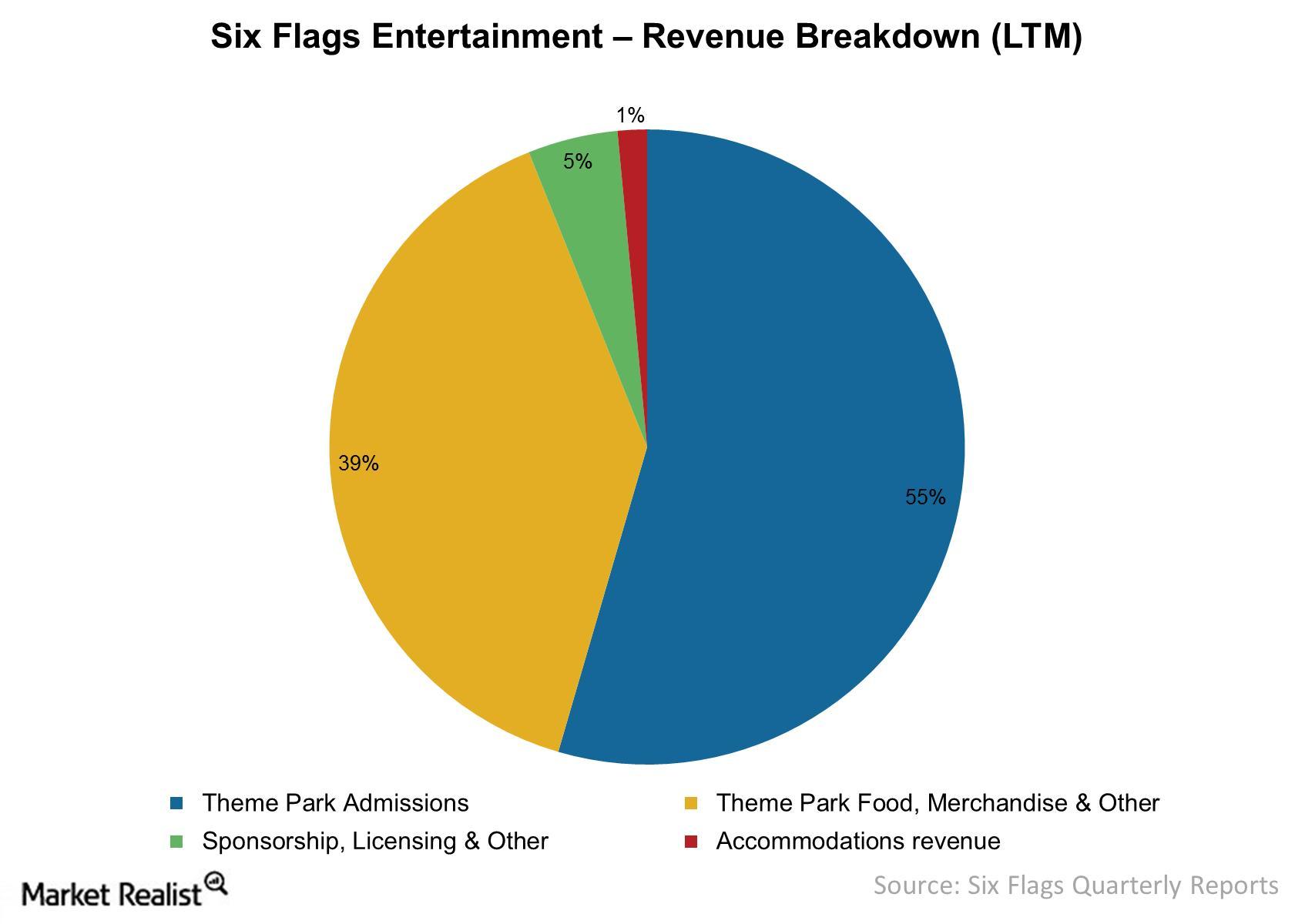

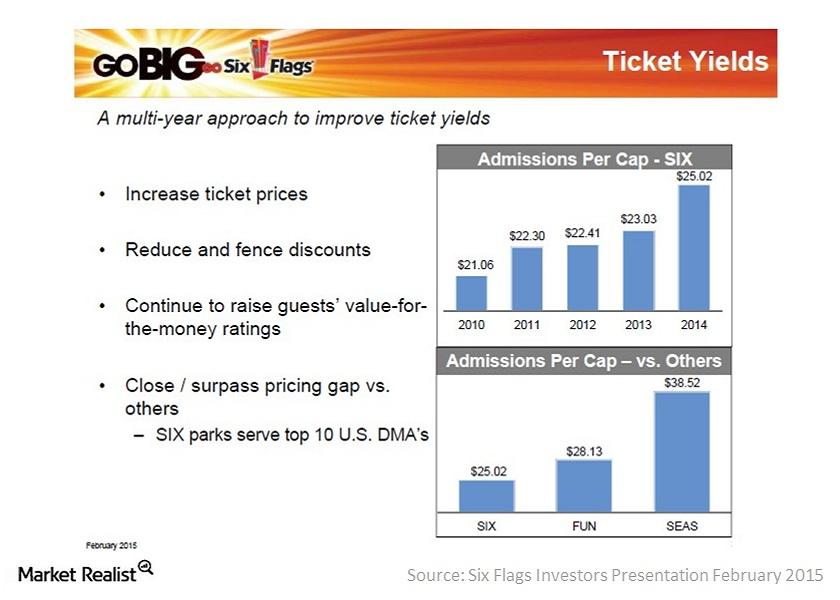

Must-know: How Six Flags generates its revenues

Six Flags derived 55% of its revenues from theme park admissions for the last 12 months ended September 30, 2014.

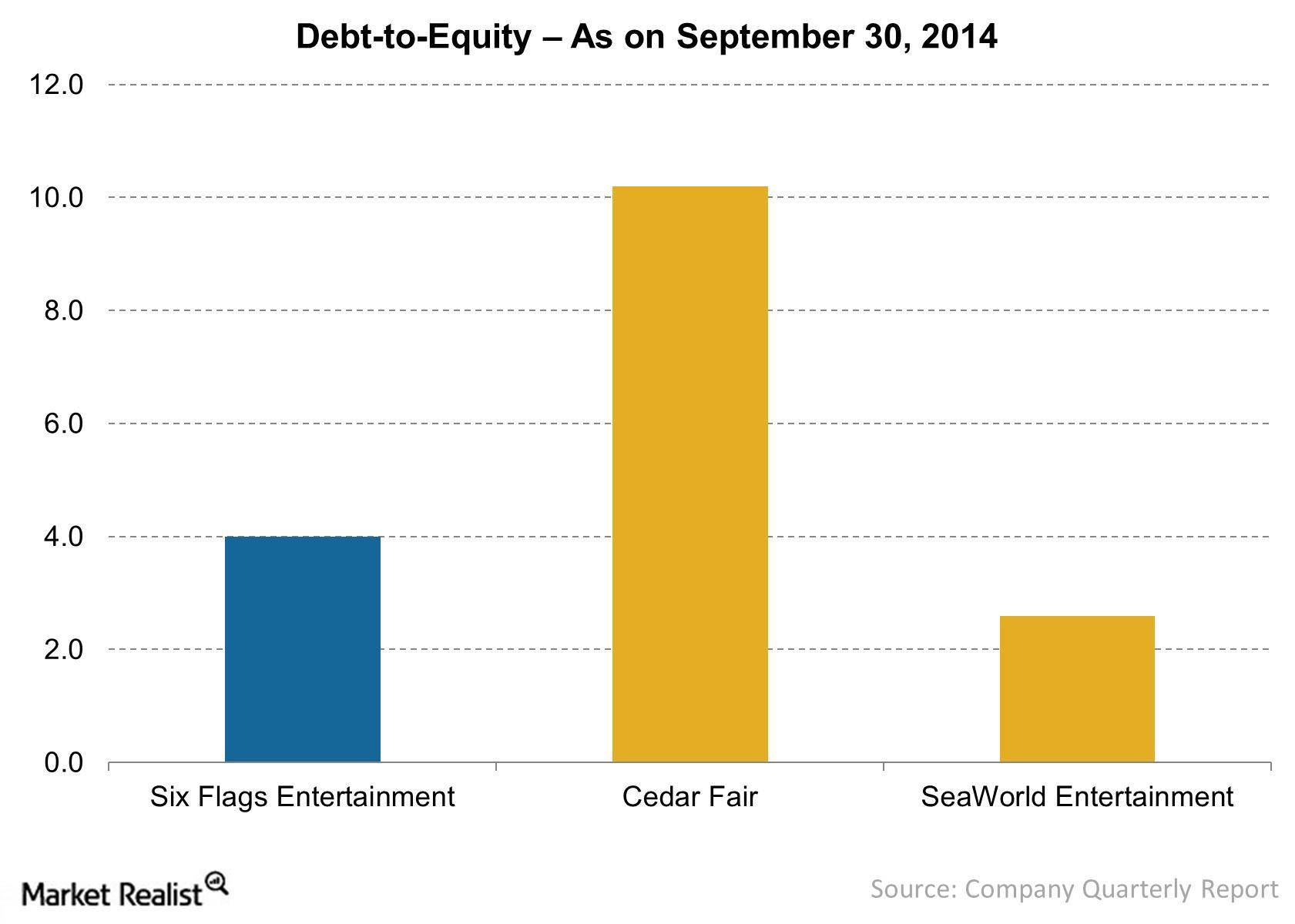

Must-know: A look into Six Flags’ debt-to-equity ratio

Industry debt-to-equity ratio is about 5.5. Six Flags’ debt-to-equity ratio of 4.0 shows the company aggressively finances operations with debt capital.

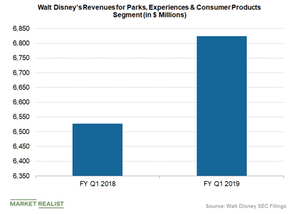

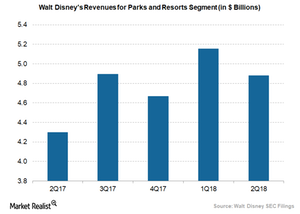

How Theme Parks Are Fueling Disney’s Revenue

Disney has been generating substantial revenues from its theme parks, which have remained the driving force of the company’s top line growth.

Why Disney Is Investing in Theme Parks

In fiscal 2Q18, Disney’s Parks and Resorts segment reported revenues of $4.9 billion.

Why Six Flags’ guest spending per capita improved

Six Flags’ per capita guest spending increased $2.79, or 7%, to $42.97 in 2014, primarily due to improved admissions pricing and new offerings in the parks.

Ticket pricing pushes Six Flags’ admissions revenue up

Six Flags’ (SIX) admissions revenue per capita increased by 9% in 2014, primarily driven by pricing improvements on multi- and single-use ticket offerings.