Royal Bank of Scotland Group (The) PLC

Latest Royal Bank of Scotland Group (The) PLC News and Updates

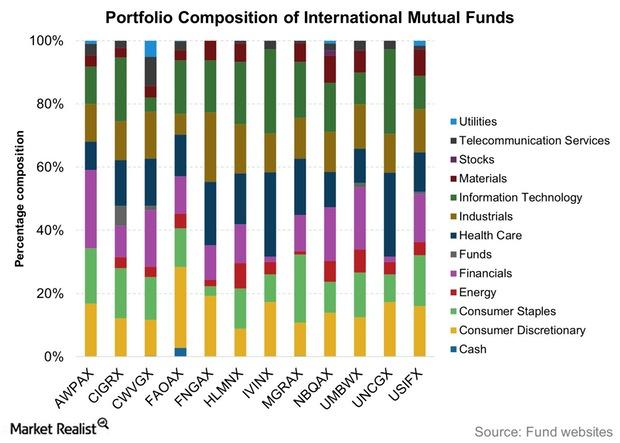

Is It Time to Invest in International Funds?

2016 has mostly been about macro trends, thus presenting a different set of challenges for active fund managers who mostly focus on companies rather than economic and sector trends.

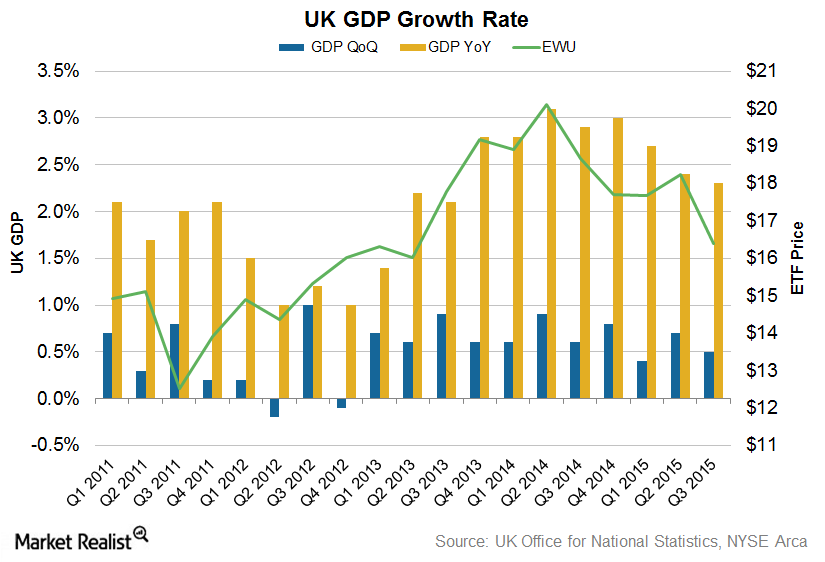

Rise in Household Spending Provided Respite for UK Economic Growth

With household spending gathering pace, it could be an important growth driver for the United Kingdom’s economic growth.

Why Are Deutsche Bank Investors So Concerned About AT1 Coupons?

Shares of Deutsche Bank (DB) have fallen nearly 10% in the last three trading sessions. Efforts to reassure investors about its ability to pay coupons on its AT1 bonds were in vain.

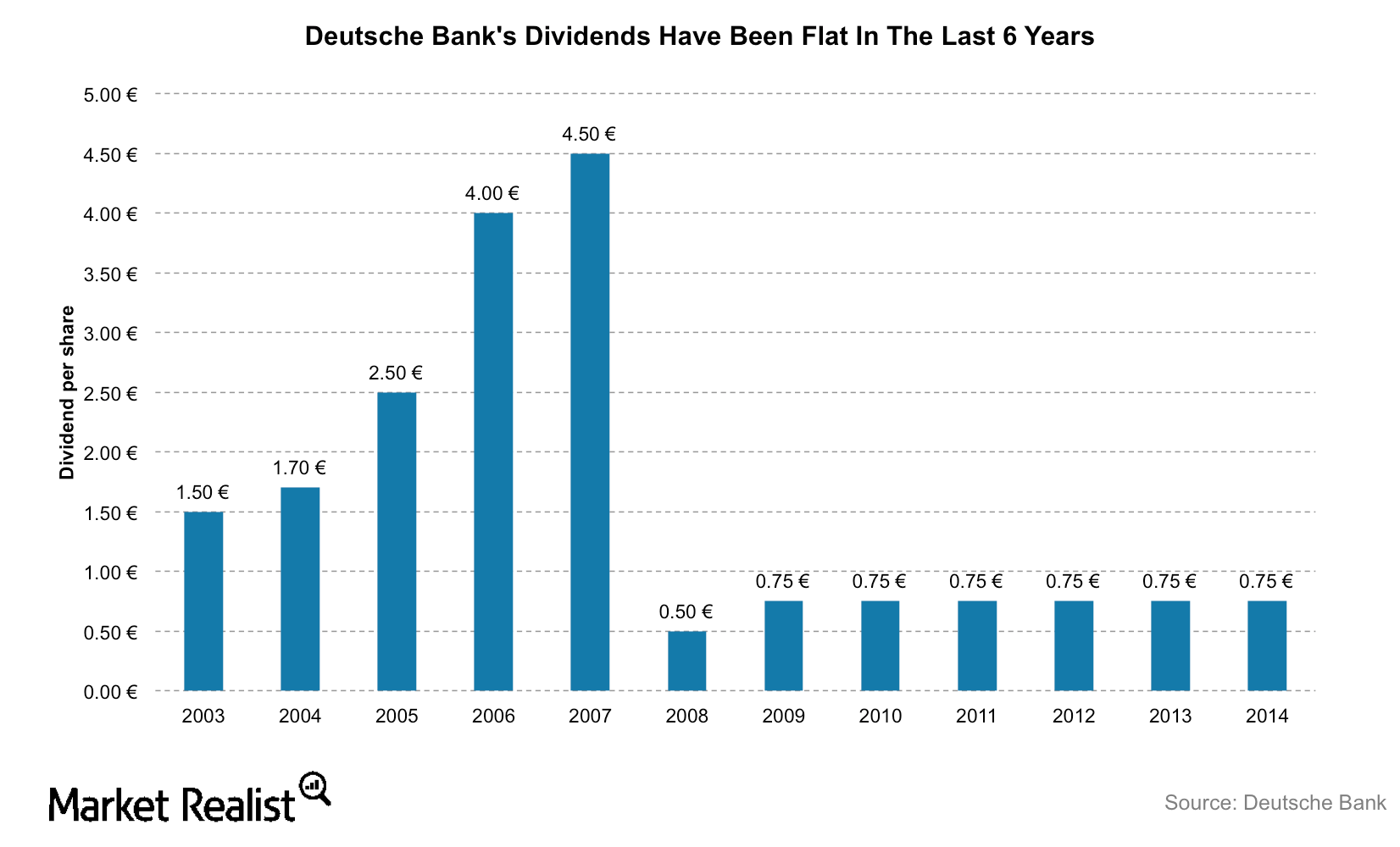

Why Deutsche Bank Scrapped Dividends in 2016

Germany-based Deutsche Bank (DB) announced plans to cut dividend payments for 2015 and 2016 as part of its plans to strengthen the bank’s capital.

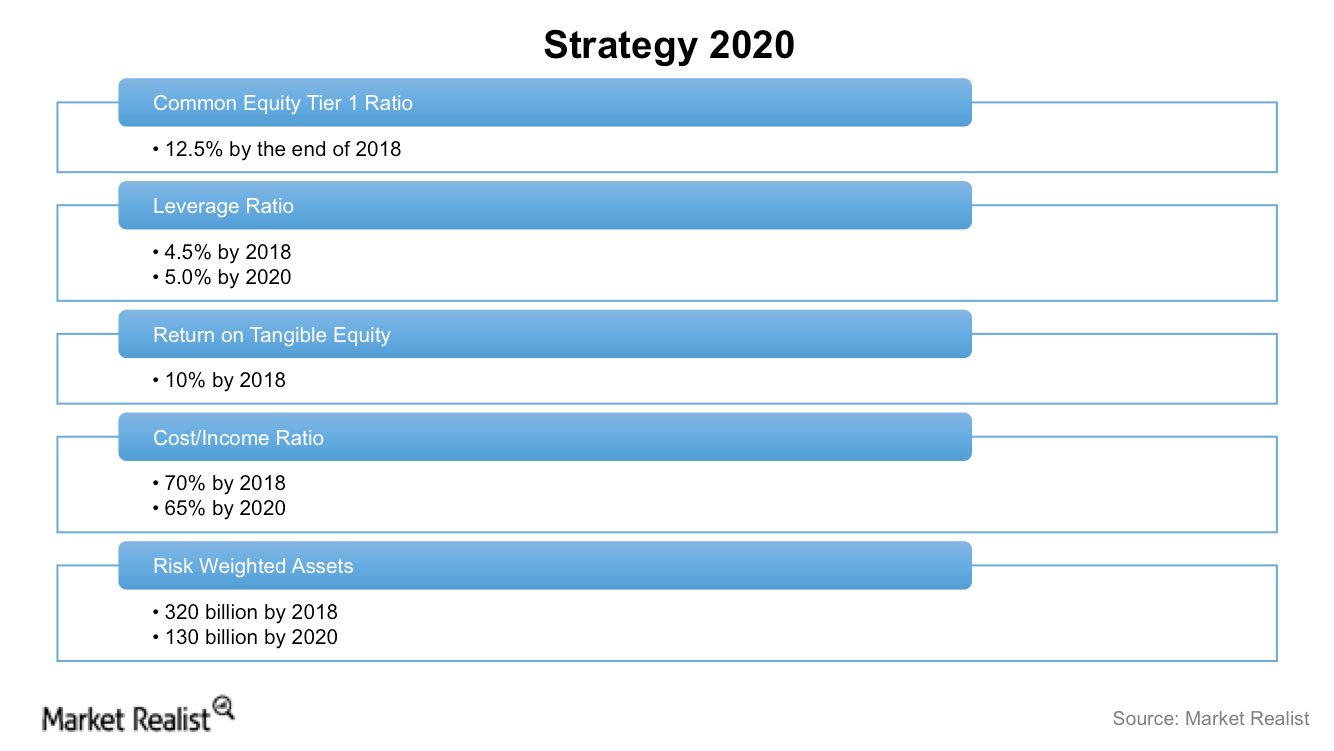

Will Deutsche Bank’s Overhaul Plan Work?

Investors who are concerned about Deutsche Bank’s bankruptcy are looking at CEO John Cryan’s plan to restructure the company’s operations.

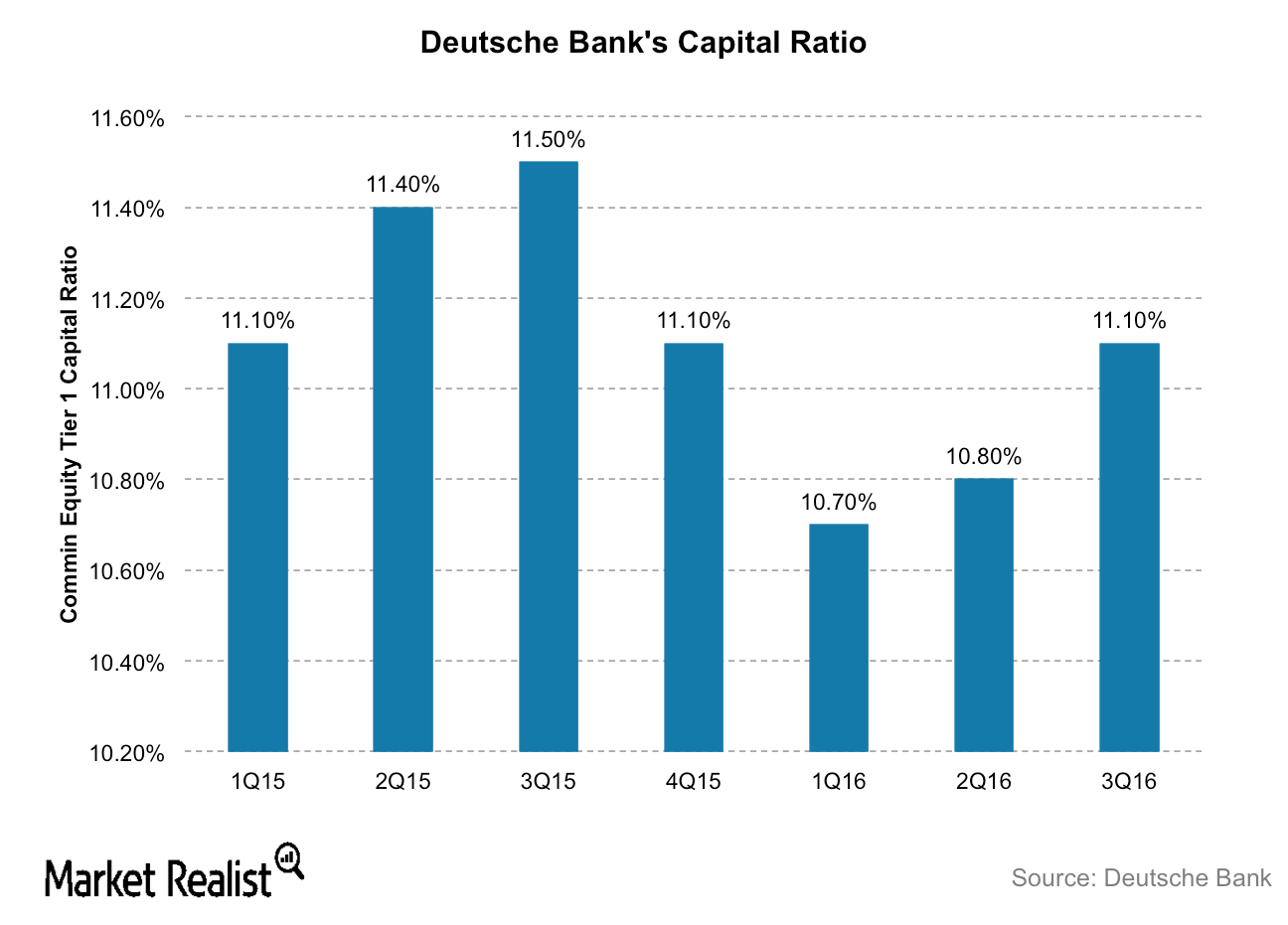

Deutsche Bank: Analyzing Its Capital Levels

Deutsche Bank is proving to be the most dangerous bank to the global economy. It failed the Fed’s 2016 stress tests in June 2016.

Deutsche Bank’s Capital Levels Struggle to Meet Regulatory Requirements

Deutsche Bank’s stock is down nearly 40% in 2016 so far. Capital reserves are important to restore the confidence of regulators and investors.

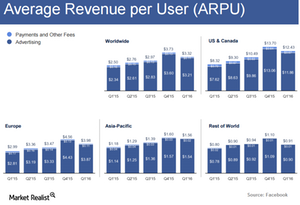

How Is Facebook’s Average Revenue per User Trending?

Average revenue per user (or ARPU) is a key metric for Internet companies, as it helps in analyzing how well a company can monetize its user base.

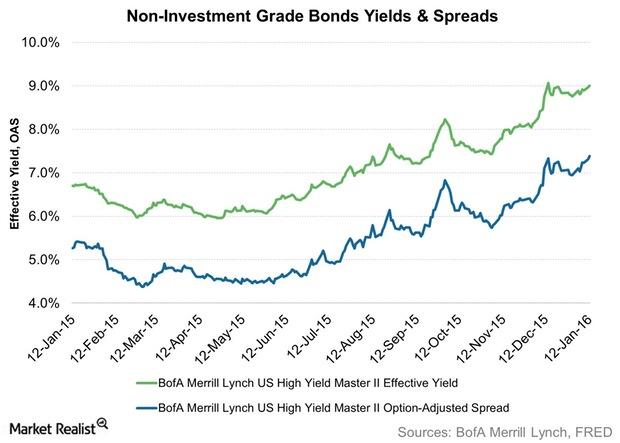

High-Yield Bonds and You in 2016

High-yield bonds, also known as Junk bonds, have an iffy repayment ability, even if they are at the higher end of the junk rating scale.