Insulet Corp

Latest Insulet Corp News and Updates

Tandem Diabetes Care’s International Expansion Strategy

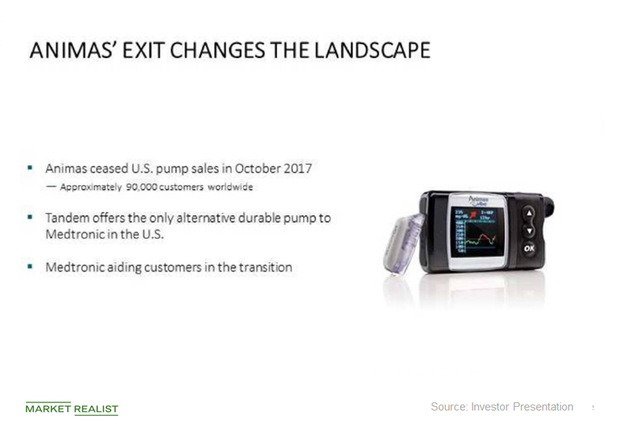

Tandem Diabetes Care (TNDM) is slated to begin its international expansion later this year to capture opportunities arising after Johnson & Johnson’s (JNJ) exit from the insulin pump market, which was announced in October 2017.

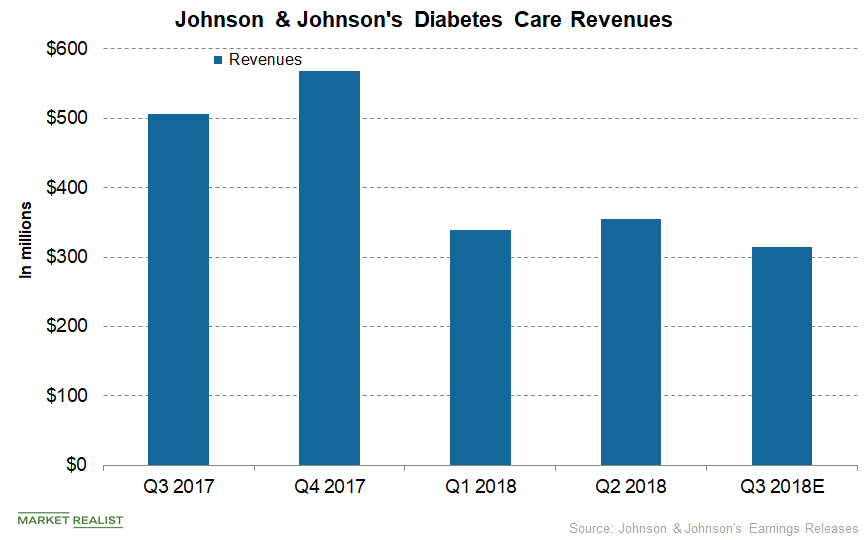

A Look into Johnson & Johnson’s Diabetes Care Business

In the US and international markets, Johnson & Johnson’s Diabetes Care segment generated third-quarter net revenues of $125.0 million and $190.0 million, respectively.

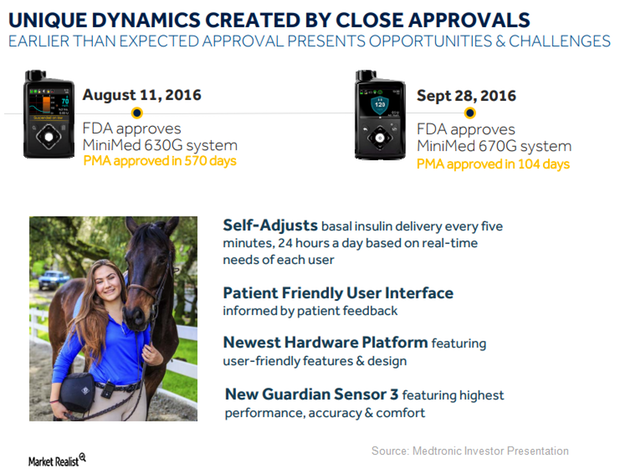

Medtronic Saw Several Challenges during Launch of MiniMed 670G

In fiscal 2H17, Medtronic launched the priority access program to first target those patients who were interested in purchasing MiniMed 670G.

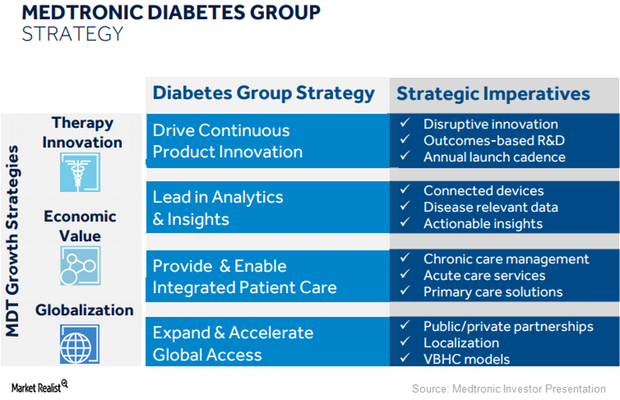

What’s Medtronic’s Long-Term Growth Strategy for Its Diabetes Business?

Medtronic (MDT) expects its diabetes business to witness a temporary sequential drop in revenues in 2Q18 and then return back to growth in the second half of fiscal 2018.