Panasonic Corporation

Latest Panasonic Corporation News and Updates

How to Buy Panasonic Stock and Get in on the Action

If Panasonic has ended up on your buy list, you will need to know where to find the stock. Here's how to invest in Panasonic stock and what to expect in 2021..

Panasonic Stock Looks Like a Good Buy Amid EV Shift

In the last year, Panasonic stock has risen 22 percent. Is the stock a buy or sell at this price? How's the company's outlook and what can investors expect?

Dover Refrigeration & Food Equipment: Keeping It Cool

The Dover Refrigeration & Food Equipment unit is a major provider of refrigerated display cases and kitchen equipment such as cookers, mixers, braising pans, and packaging and processing solutions for the meat and poultry business.

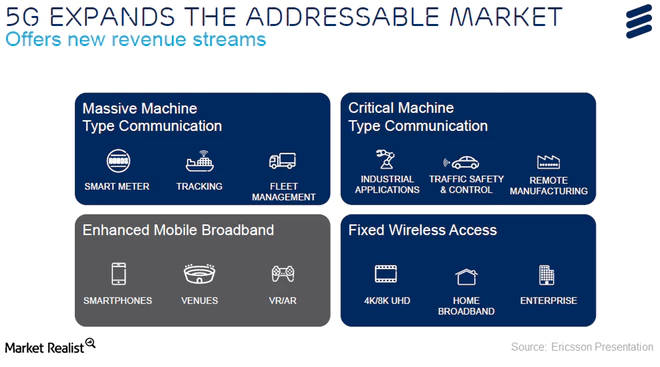

What Are Ericsson’s Target Segments to Drive Future Revenue?

Ericsson (ERIC) believes the global telecommunications industry is a key driver of economic growth and innovation.

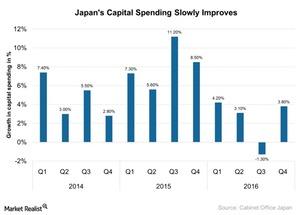

How Does Capital Spending Affect Japan’s Economic Growth?

The Japanese economy (JPN) continued its trend of moderate recovery in 2016 and could move at the same pace in 2017.

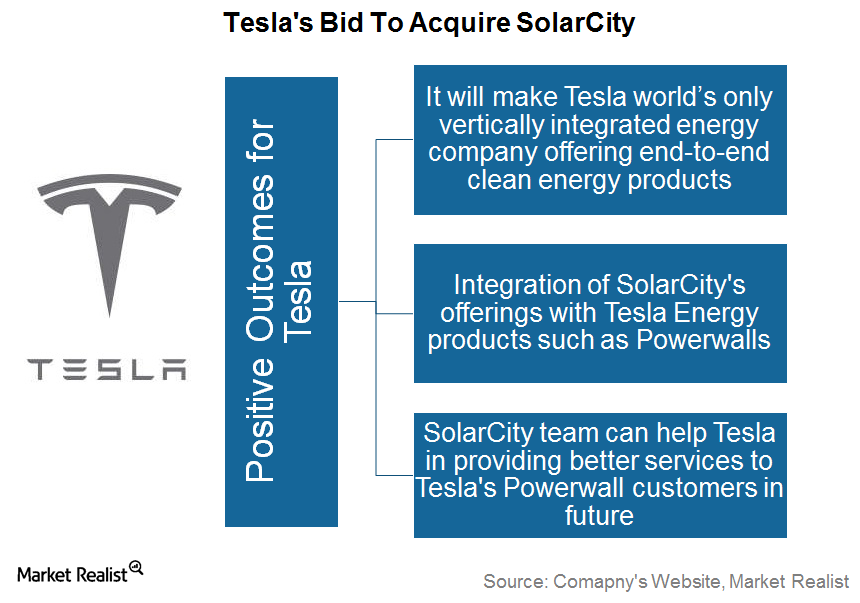

Why Tesla’s SolarCity Acquisition Could Pay Off

According to Tesla’s (TSLA) SolarCity acquisition proposal, it’s ready to pay $26.50 to $28.50 per share for SolarCity.