ON Semiconductor Corp

Latest ON Semiconductor Corp News and Updates

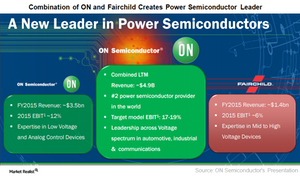

What Revenue Synergies Would a Fairchild-ON Merger Bring?

Looking at revenue synergies, we see that Fairchild’s strong portfolio in the high voltage and medium voltage power semiconductor market complements ON’s low voltage and small-signal market.

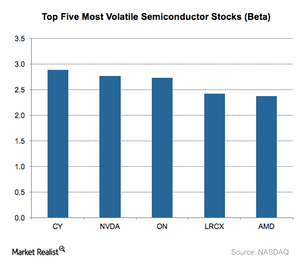

Inside the Top 5 Most Volatile Semiconductor Stocks

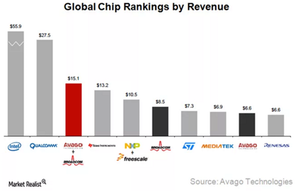

Intel (INTC) is the world’s largest semiconductor company and also the least volatile semiconductor stock, though it has a beta of 1.23.

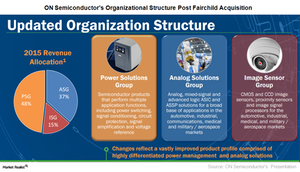

ON Semiconductor’s Revised Organizational Structure

The Power Solutions Group’s revenues rose 34.3% sequentially to $620.3 million in 4Q16. More than $200 million in revenues came from the Fairchild Semiconductor integration.

Synergies from the ON–Fairchild Semiconductor Merger

ON Semiconductor (ON) expects the Fairchild Semiconductor merger to bring in annual cost synergies of $225 million by 2019 compared with just $160 million in 2017.

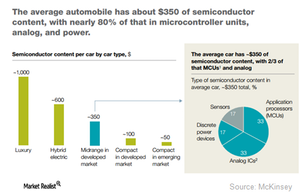

Automotive Segment to Drive Growth in the Semiconductor Market

Automotive semiconductor revenue has grown at a CAGR (compounded annual growth rate) of 8% between 2002 and 2012, according to McKinsey.