ServiceNow Inc

Latest ServiceNow Inc News and Updates

ServiceNow CEO Bill McDermott: This Downturn Is “Not a Crisis”

What’s Bill McDermott’s net worth? Learn about the ServiceNow CEO and SAP SE veteran, who said that the current economic downturn is “not a crisis.”

What’s Oracle’s Value Proposition in the US Software Space?

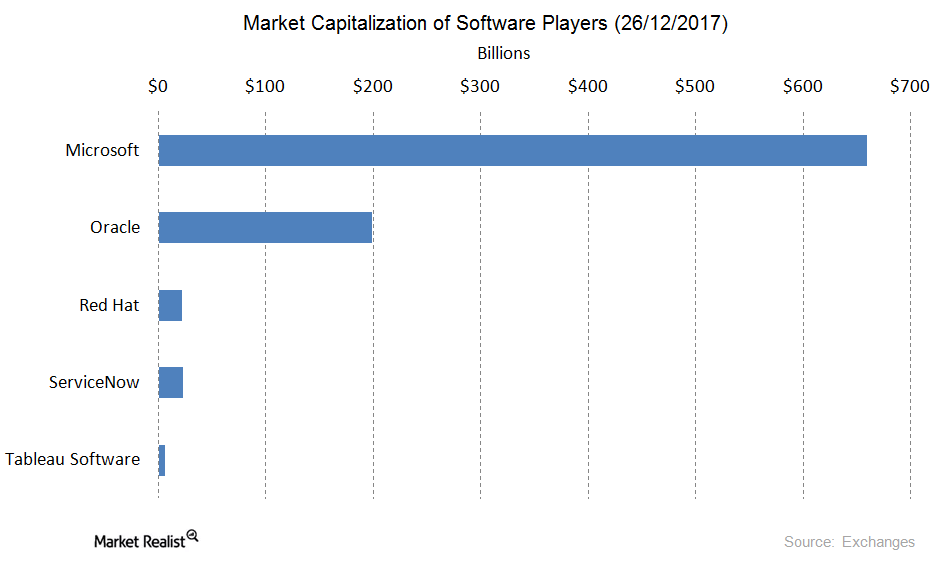

As of December 26, 2017, Microsoft (MSFT), with a market cap exceeding $650 billion, continued to be the largest software player. Oracle came in second.

Adobe, Workday, and ServiceNow Fall Due to Downgrades

Adobe (ADBE), Workday (WDAY), and ServiceNow shares have lost significant market value in early-market trading today. Adobe stock has fallen close to 4%.

Tech Stocks: Are They Attractive after Recent Pullback?

Tech stocks led the sell-off. Investors have been concerned about a slowdown in tech spending after NetApp’s preliminary guidance on August 2.

How Do Analysts View ServiceNow Stock?

Of the 34 analysts tracking ServiceNow (NOW), 30 have recommended “buys,” four have recommended “holds,” and none have recommended “sells” on the stock. Analysts have a 12-month average target price of $287.29 on the stock.

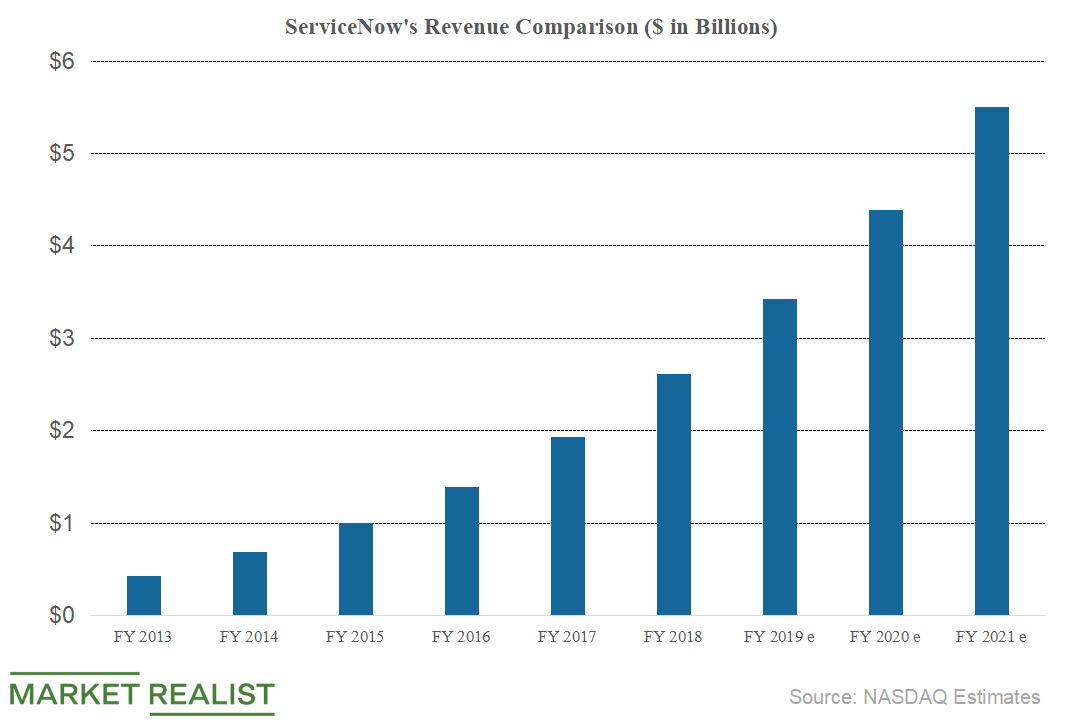

What to Expect from ServiceNow’s Revenue and Earnings Growth

ServiceNow (NOW) is banking on companies’ digital transformation to drive sales.

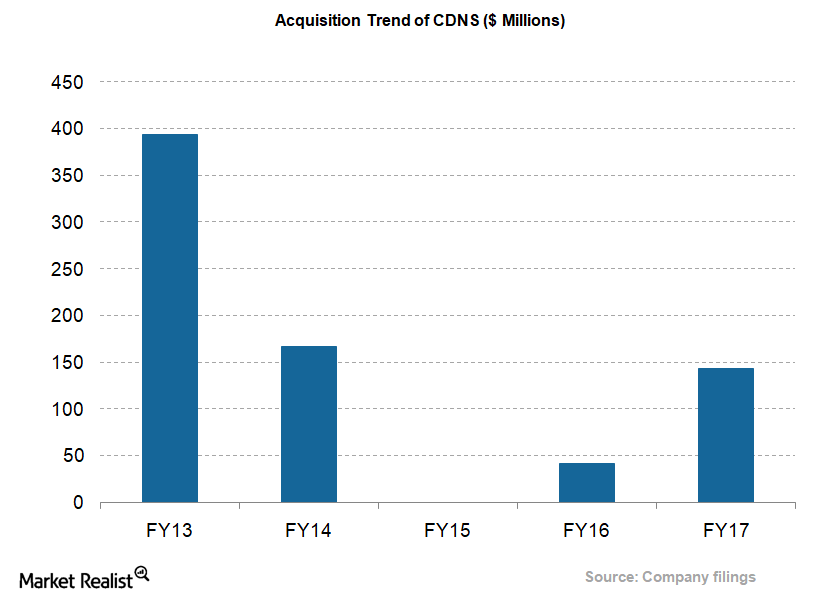

Cadence’s Acquisition Spree to Bolster Product Growth

Cadence Design Systems (CDNS) continues to enhance its product portfolio by way of new acquisitions. In the last five years, the company has completed eight acquisitions.

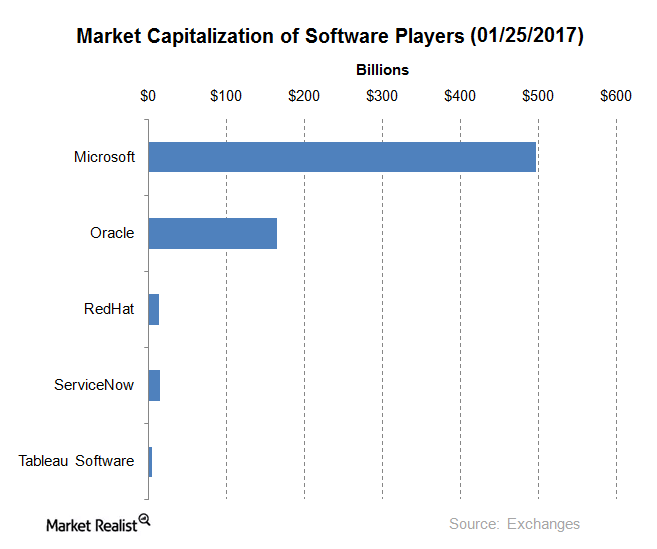

What Is Microsoft’s Value Proposition in the US Software Space?

As of January 25, 2017, Microsoft continues to be the largest software player by market capitalization on a global scale.

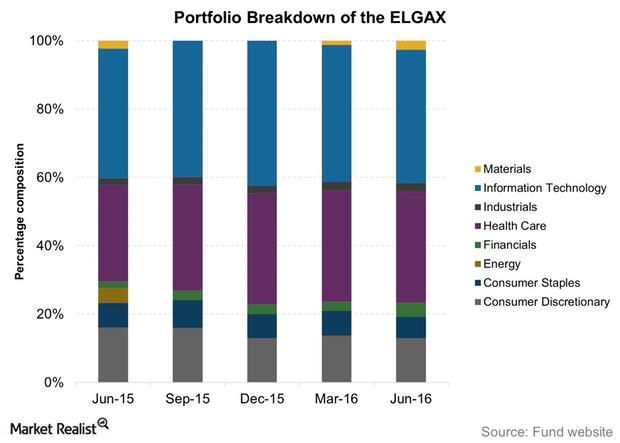

Columbia Select Large Cap Growth Fund: Sector Composition YTD 2016

The Columbia Select Large Cap Growth Fund (ELGAX) invests at least 80% of its assets in common stocks of US-based and foreign companies with market caps in the range of companies in the Russell 1000 Growth Index.

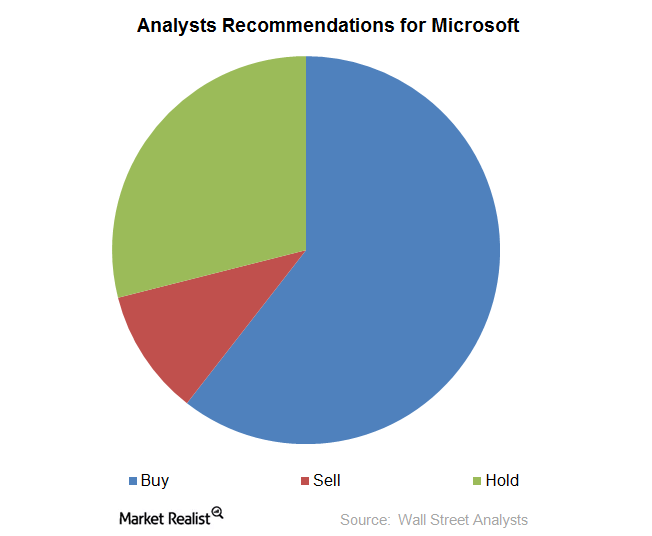

What Are the Analysts’ Recommendations for Microsoft?

Of the 38 analyst recommendations on Microsoft’s stock, 60.5% were “buys” as of April 6. Meanwhile, ~29% of recommendations were “holds.” The remaining ~10.5% of recommendations on the stock were “sells.”

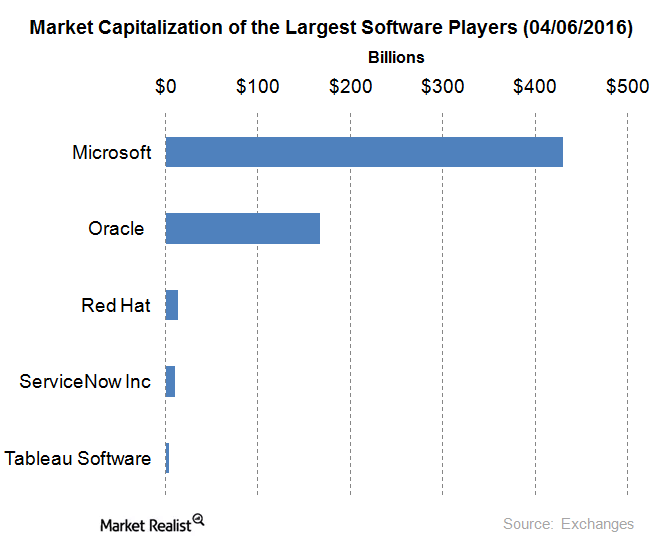

Microsoft’s Value Proposition in the US Software Space

As of April 6, 2016, Microsoft was the largest software player by market capitalization on a global scale. It was followed by Oracle (ORCL).