McDermott International Inc

Latest McDermott International Inc News and Updates

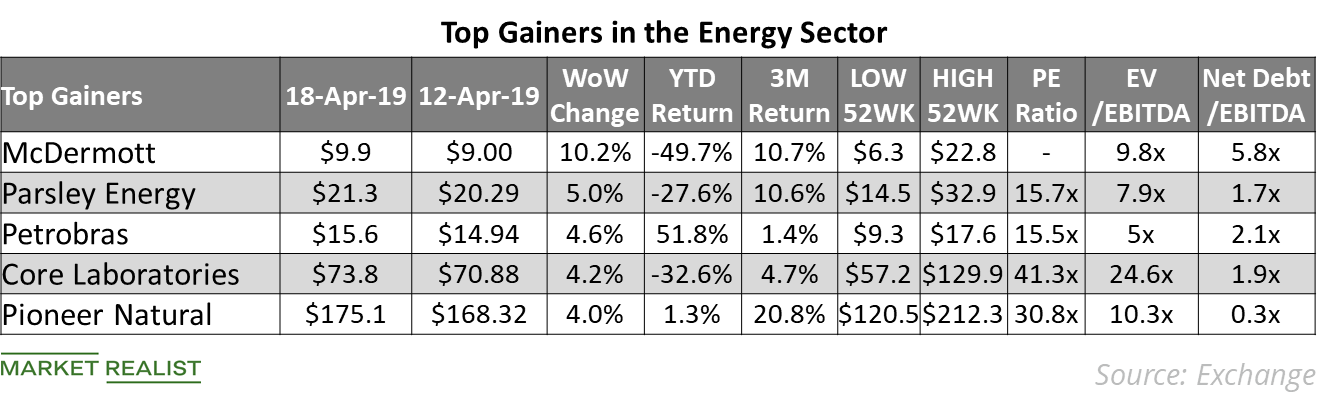

Top Energy Gains Last Week

On April 16, McDermott International announced that it will release its first-quarter earnings results on April 29.

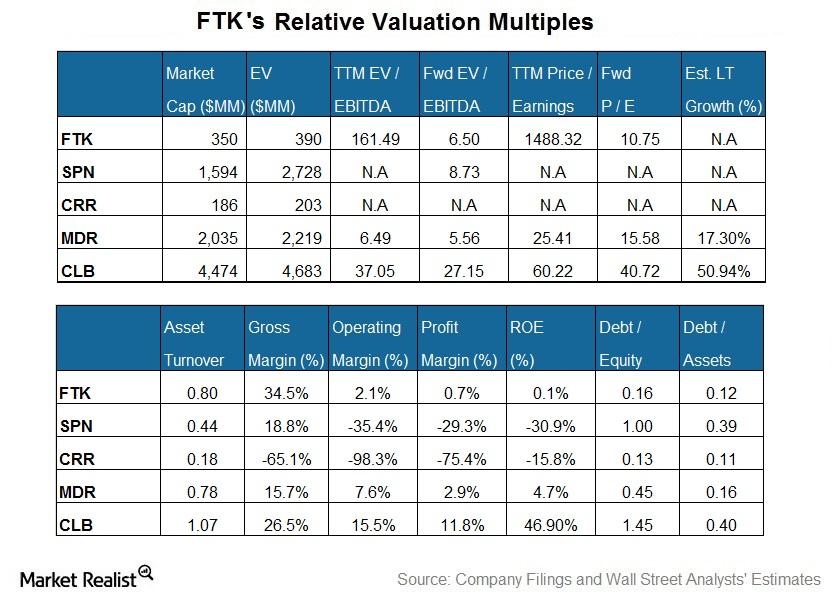

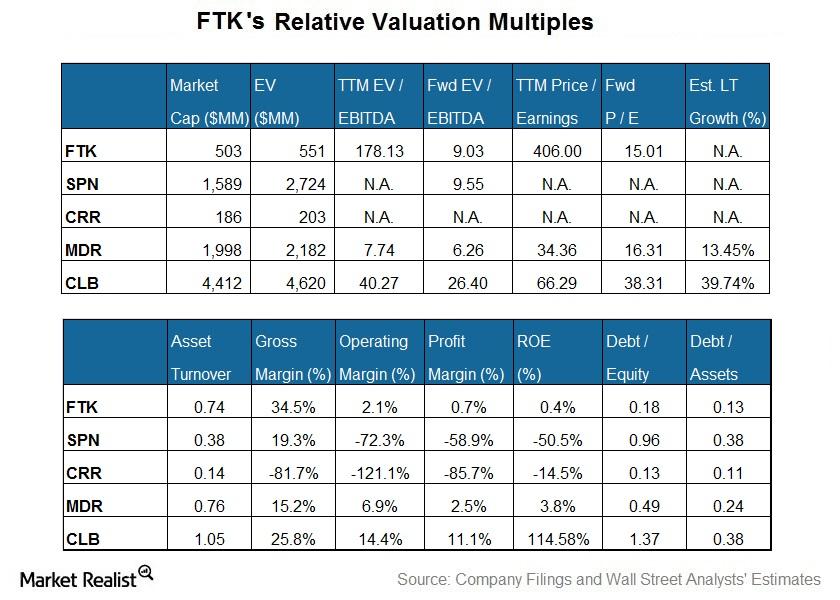

Flotek Industries’ Current Valuation versus Its Peers

Sell-side analysts expect Flotek’s adjusted EBITDA to rise sharper in the next four quarters compared to its peers.

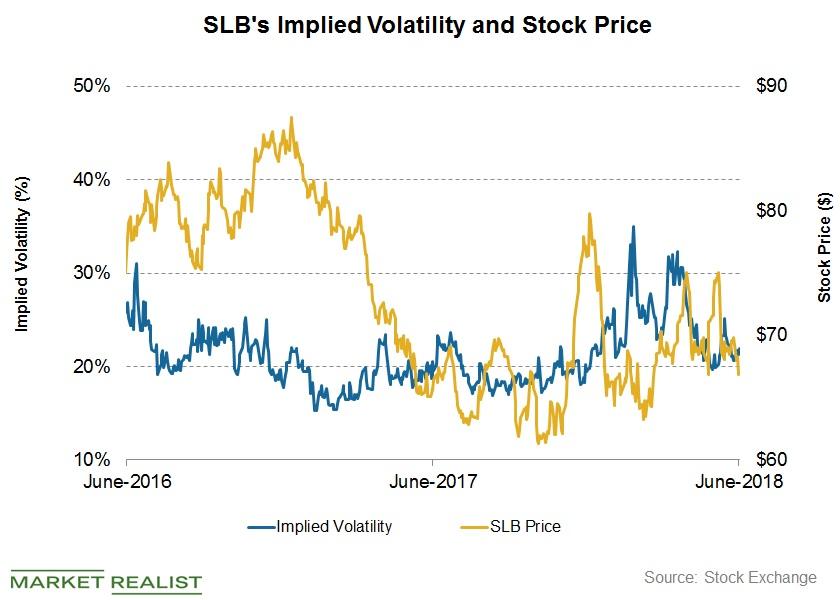

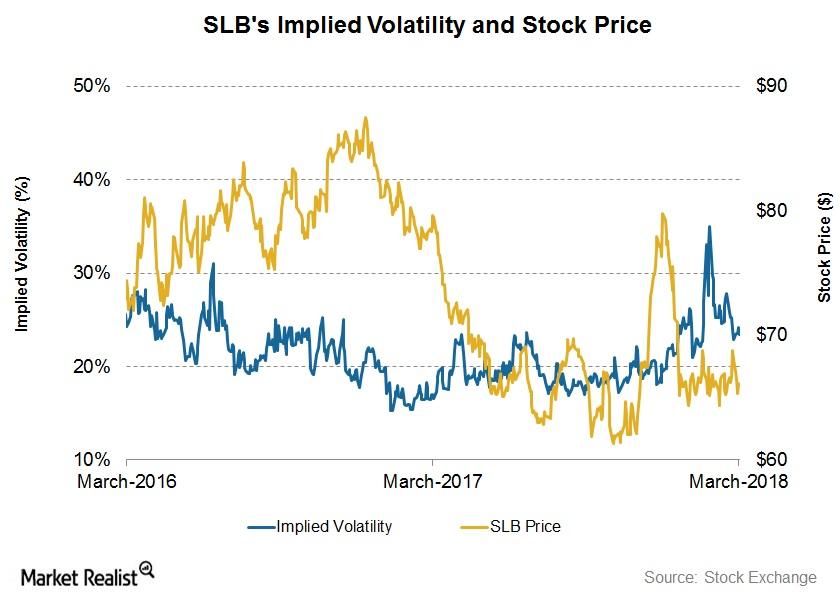

Schlumberger’s Stock Price Forecast this Week

Schlumberger’s (SLB) first-quarter financial results were released on April 20. Between April 20 and June 15, Schlumberger’s implied volatility fell from 24.1% to 22%.

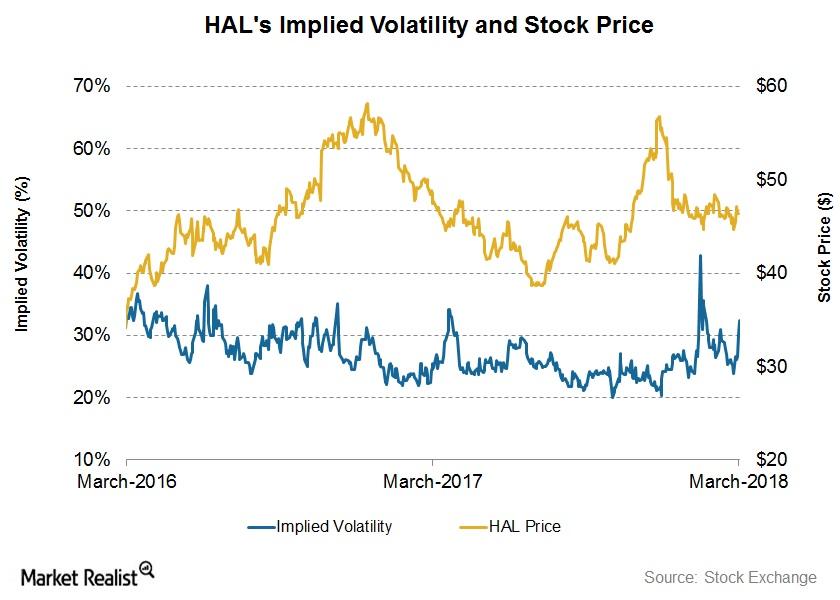

Halliburton’s Next 7-Day Stock Price Forecast

Halliburton stock will likely close between $48.52 and $44.36 in the next seven days—based on its implied volatility.

What’s Schlumberger’s 7-Day Stock Price Forecast?

On January 19, 2018, Schlumberger’s (SLB) 4Q17 financial results were released.

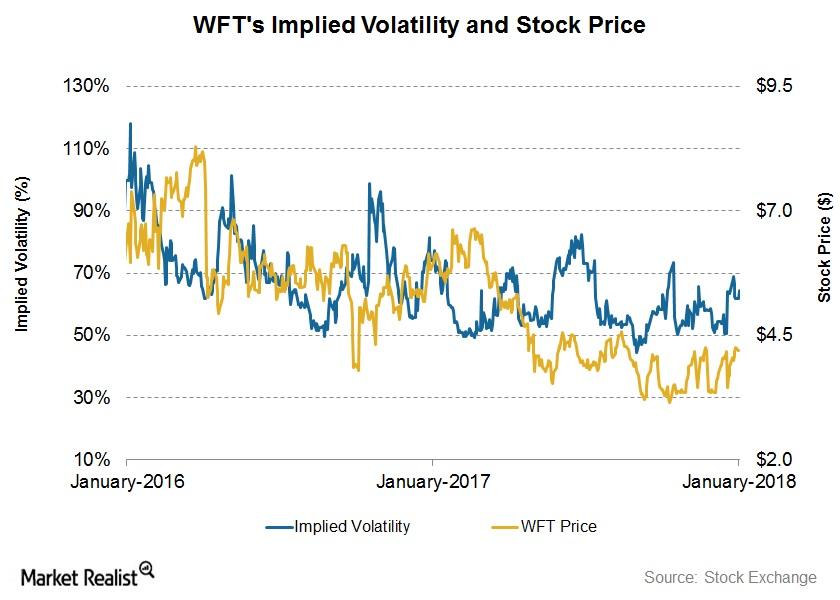

Weatherford’s Stock Price Forecast

On January 16, Weatherford International’s (WFT) implied volatility (or IV) was ~64%. Its 3Q17 earnings were announced on November 1, 2017. Since then, its implied volatility has increased from 54% to the current level.

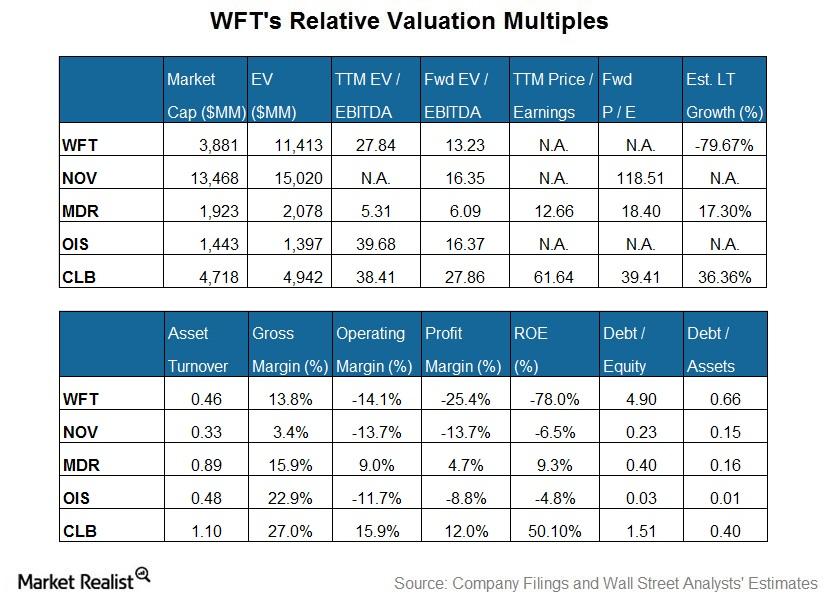

Weatherford International’s Valuation Compared to Its Peers

Weatherford International’s (WFT) EV (enterprise value) when scaled by a trailing 12-month adjusted EBITDA is close to the peer average in our group.

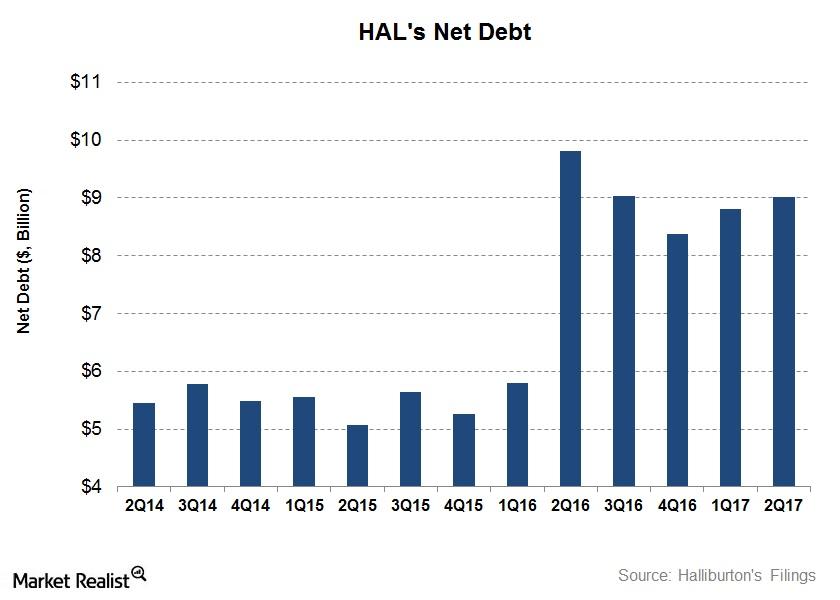

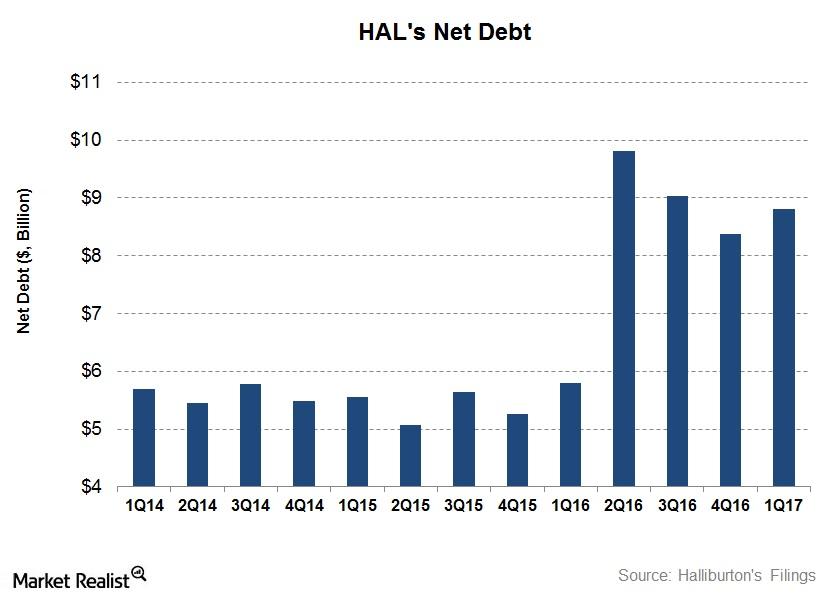

Understanding Halliburton’s Net Debt after 2Q17

In 2Q17, Halliburton’s (HAL) total debt fell 14% from 2Q16, while its cash and marketable securities fell 31%.

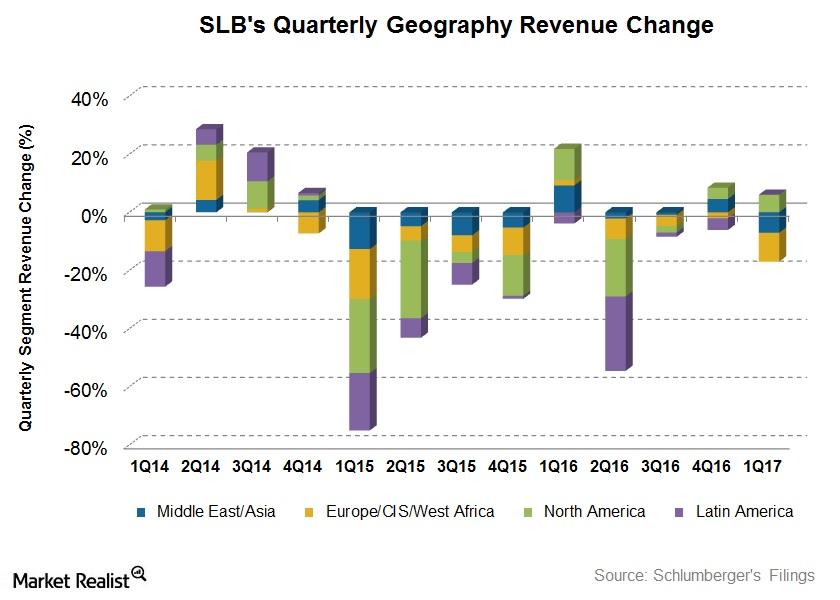

What Drove Schlumberger in 1Q17

Schlumberger’s 1Q17 revenue by geography From 4Q16 to 1Q17, Schlumberger (SLB) witnessed 6% revenue growth in North America, while it saw a steep revenue decline of ~10% in the Europe/CIS[1.Commonwealth of Independent States]/West Africa region. Schlumberger’s revenue from Latin America was resilient in 1Q17, remaining unchanged from 4Q16. Schlumberger accounts for 6.5% of the ProShares […]

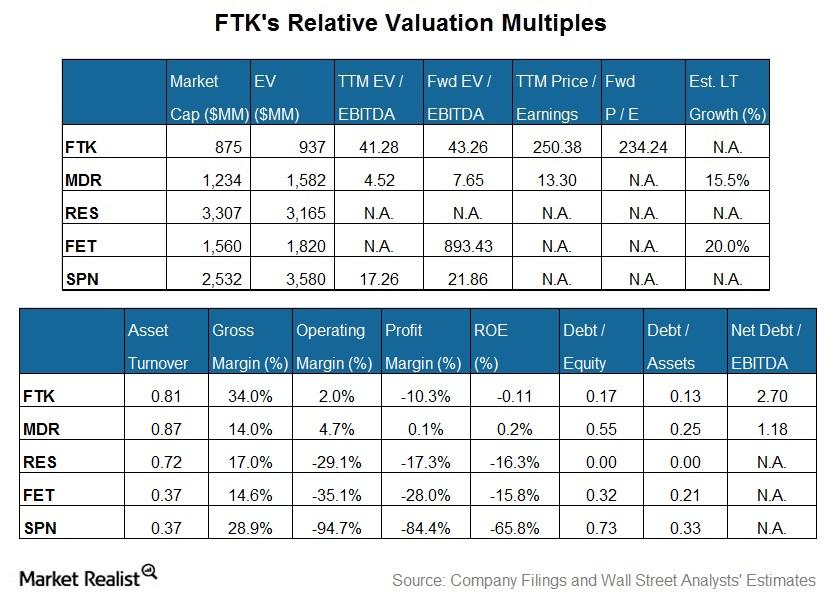

Weighing Flotek’s Current Valuation against Peers

Sell-side analysts expect FTK’s adjusted EBITDA to rise more sharply over the next four quarters than those of its peers.

What’s Happening to Halliburton’s Net Debt?

In 1Q17, Halliburton’s (HAL) total debt fell 29% compared to a year earlier, while its cash and marketable securities fell 78%.

How Flotek Industries Is Valued versus Peer Stocks

Core Laboratories (CLB) is the largest company by market capitalization among our set of select oilfield services and equipment (or OFS) companies…

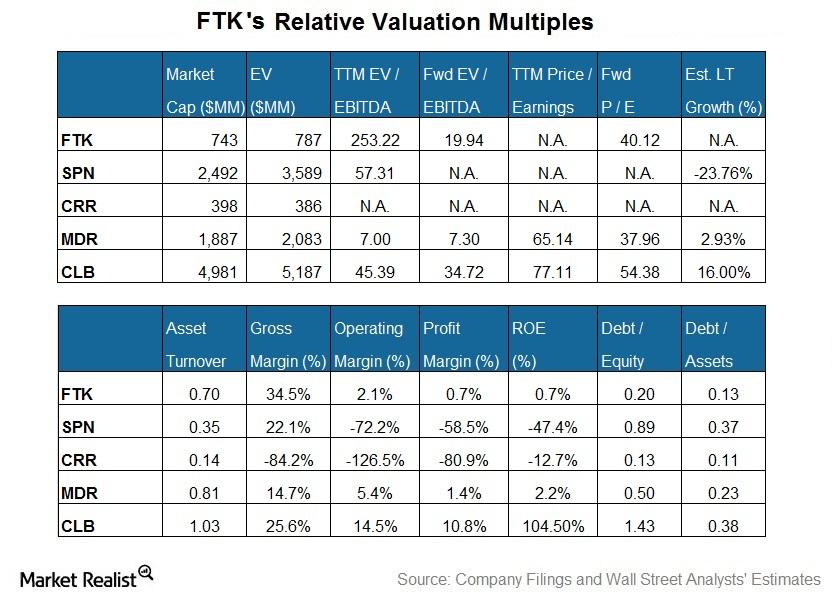

How Is Flotek Industries Currently Valued Compared to Its Peers?

RPC is the largest company by market capitalization among our set of select OFS companies. Flotek Industries is the smallest of the lot.

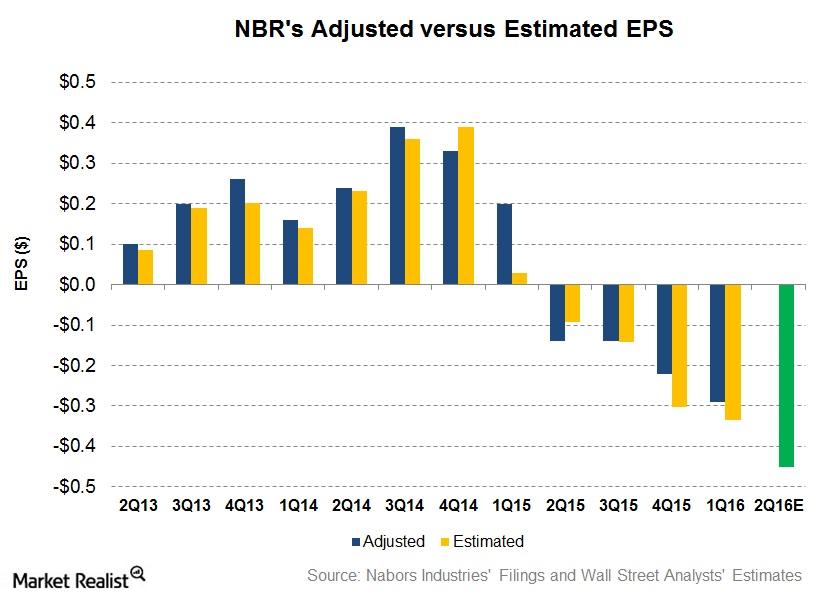

What Do Analysts Expect from Nabors Industries’s 2Q16 Earnings?

In 2Q16, Wall Street analysts expect an adjusted loss per share of $0.45 for Nabors Industries (NBR). NBR will release its 2Q16 financial results on August 2.