iShares J.P. Morgan EM Local Currency Bond ETF

Latest iShares J.P. Morgan EM Local Currency Bond ETF News and Updates

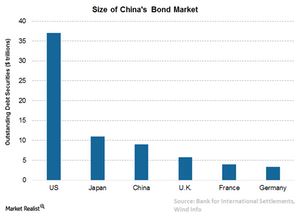

Inclusion of Chinese Onshore Bonds in Global Indexes

In March 2017, Citi’s fixed income indexes decided to include onshore Chinese bonds (EMB) (PCY) in its three government bond indexes.

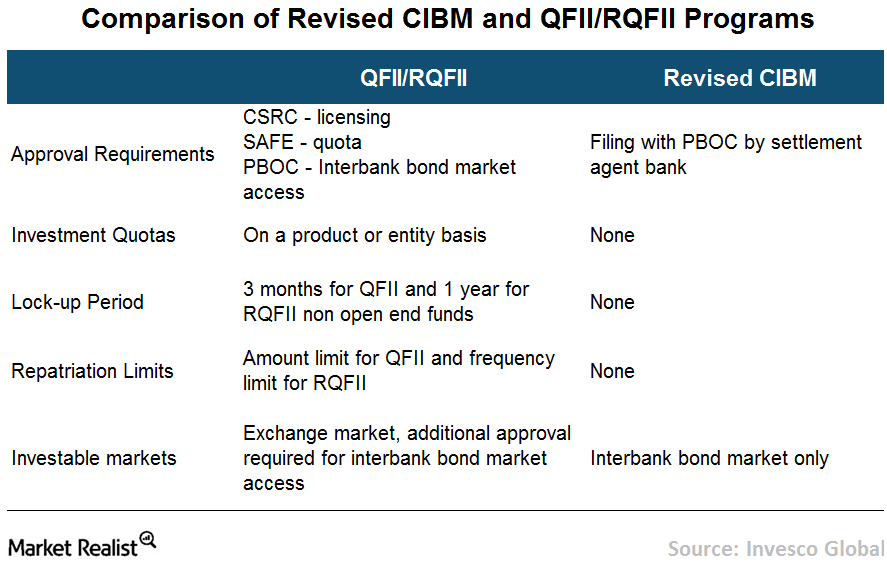

China’s Baby Steps to Open Its Onshore Bond Market

The opening of China’s onshore bond market (EMB) (PCY) was a gradual process that included a number of cautious measures.

Improving Economies Make Strong Case for EM Local Debt

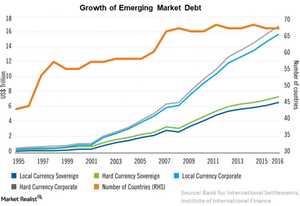

As the emerging market local debt assets (EBND) (ELD) continue to evolve and expand, investors are increasingly looking for opportunities in the space to enhance returns.

What’s Driving Emerging Markets Local Currency Debt?

During the past two decades, EM (emerging markets) local debt has evolved to become the largest and most liquid debt market within the emerging market bond space.

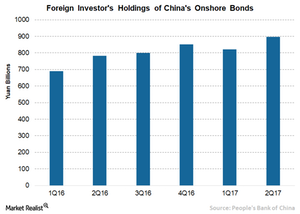

Could China Attract Higher Inflows after Bond Market Reforms?

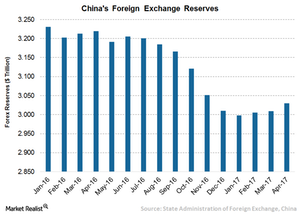

The yuan remains a focus of attention of the international community and a key risk for China’s macroeconomic stability in recent years.

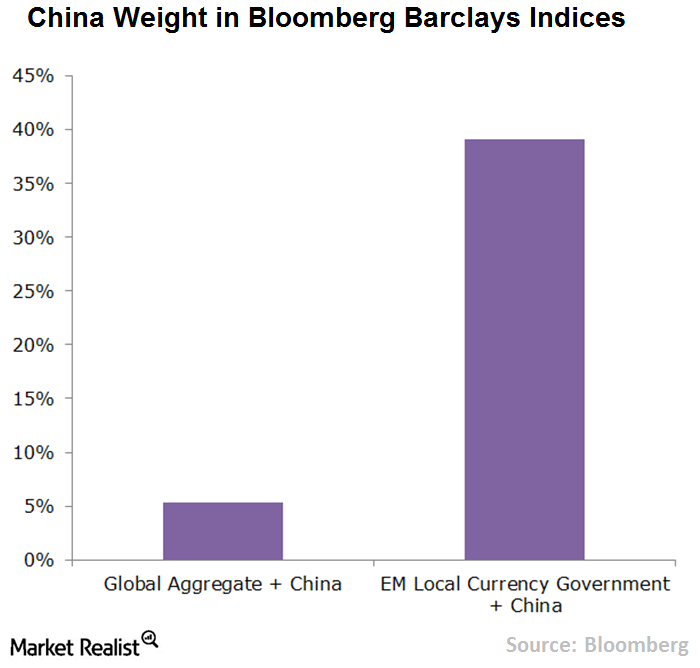

What Difference Does Index Inclusion Make?

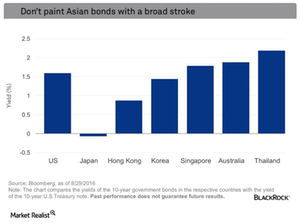

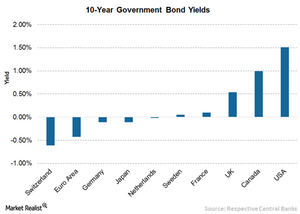

Government bond yields in China are higher than its Asian counterparts such as South Korea and Singapore and much higher than major developed markets.

How Higher Inflows to China Could Impact Other Emerging Markets

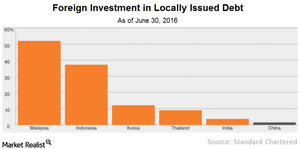

With the onset of reforms, foreign holdings in China’s onshore bond (EMB) (PCY) market is gradually increasing.

China’s Onshore Bond Market Reforms

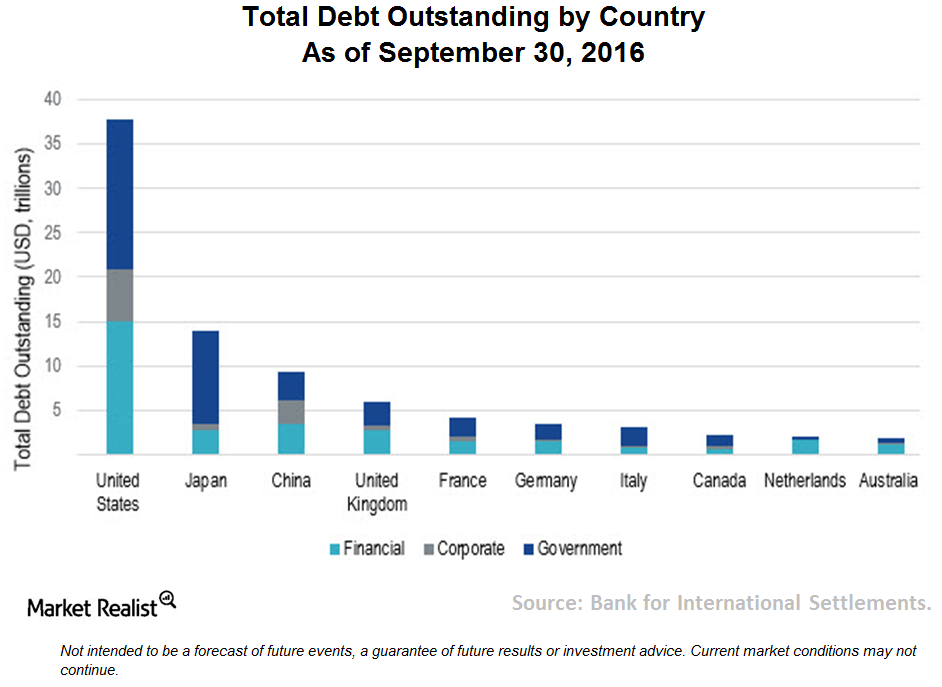

China’s onshore bond market (EMB), consisting of locally denominated and issued bonds, is larger than the offshore bond market.

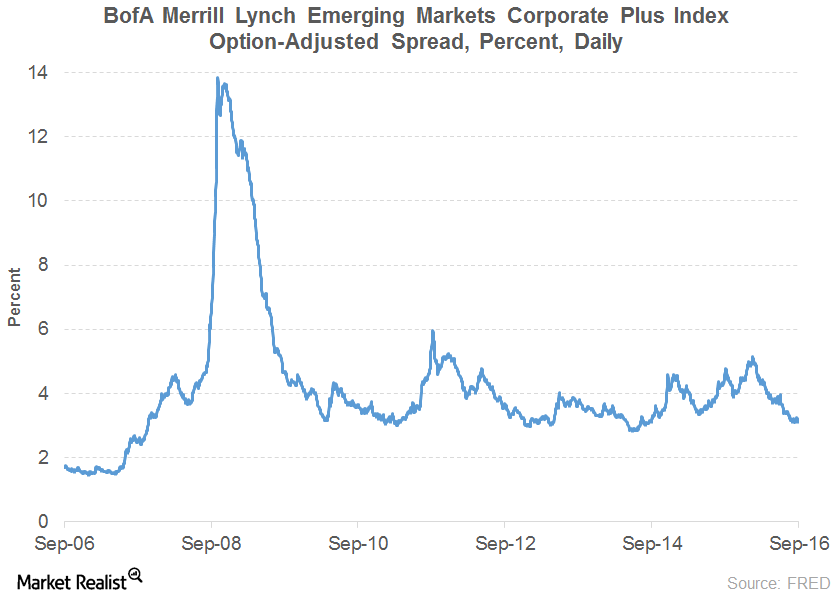

The Rally in Emerging Market Debt

Emerging markets’ nonfinancial corporate debt breached the $26 trillion mark in the first half of 2016.

Diminishing Opportunities in Asia: What You Need to Know

The balance of countries in Asia present more interesting opportunities. To better focus our discussion, I’ll concentrate on investment grade markets.

Regulatory Hurdles Affecting Chinese and Indian Bond Markets

As the intensifying search for yield goes international, Matt examines and shares his thoughts on the different Asian bond markets.

Why Does Emerging Market Debt Still Look Attractive?

Emerging market debt (EMB) offers plenty of opportunities to investors. Markets are expected to continue their outperformance for the next few quarters.

What Are the Threats for Emerging Markets?

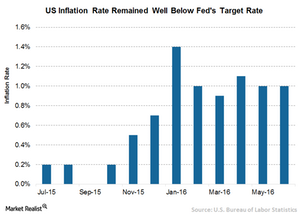

The major threat to emerging markets is tightening in the US. While the Fed will likely leave rates unchanged in September, a hike is possible in December.