Krispy Kreme Doughnuts Inc

Latest Krispy Kreme Doughnuts Inc News and Updates

Kentucky Residents Will Be Able to Get Krispy Kreme Doughnuts at McDonald's

Starting on March 21, 2023, many Kentucky residents will be able to get a Krispy Kreme doughnut to go with their McDonald’s coffee.

Who Owns Krispy Kreme and Can You Invest in the Doughnut Company?

Krispy Kreme is among the most popular doughnut companies in the U.S. Who owns Krispy Kreme and can you also invest in the company?

After a Successful IPO, Is Krispy Kreme (DNUT) Overvalued?

Krispy Kreme (DNUT) stock rose 23 percent on its first day of trading. What’s Krispy Kreme's stock forecast, and how high could it go?

Krispy Kreme Accounting Scandal Explained, DNUT to Go Public Again

Krispy Kreme is going public—again. An accounting scandal contributed to the company's near-demise just a few years after the first IPO.

Opportunities and risks that Dunkin’ Brands investors must know

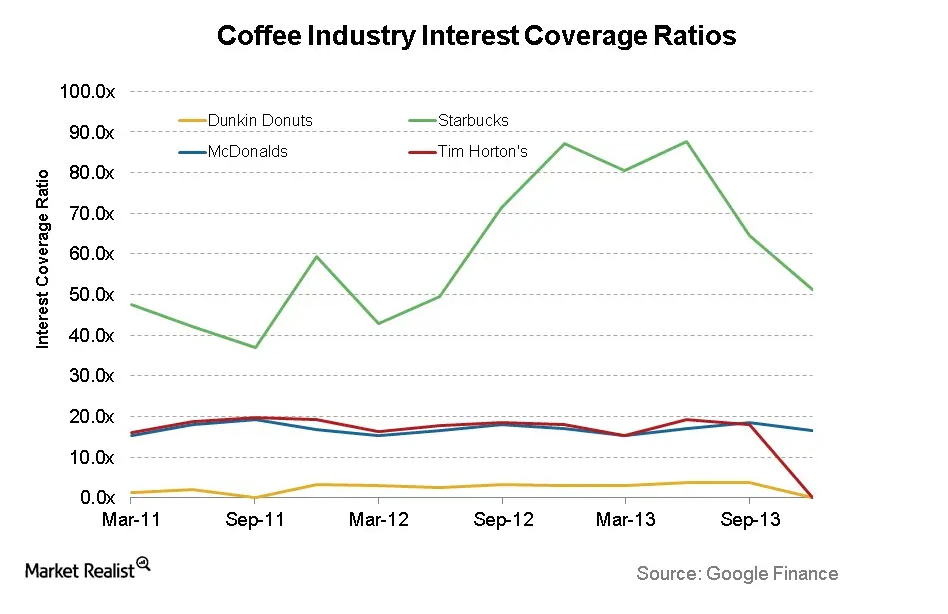

It’s no big secret that Dunkin’ Donuts has the highest relative leverage in the industry. Leverage comes with a number of risks— a substantial risk is the interest paid on debt.Consumer Why Dunkin’ Brands is a unique player in a maturing industry

Dunkin’ Donuts’ main competitor on the coffee sales front is Starbucks, which sells coffee from its company-owned fleet of retail locations.

The Starbucks Market Mystique

Starbucks stock began its ascent in late September 2014. Prices increased even more after the first-quarter 2015 earnings were released on January 22, 2015.

How Dunkin Donuts Is Embracing Technology

Dunikin’ is embracing technology with a phone app that allows you to search Dunkin’ Donuts locations, see nutritional information, and gift Dunkin’ treats.

A Business Overview Of Starbucks Corporation

Starbucks Corporation (SBUX) is a limited-service café. It operates more than 20,000 restaurants across 65 countries around the world. It employs more than 191,000 people.Consumer An industry advantage: Dunkin’ Brands’ operating costs are dieting

Dunkin’ Brands has a very low capital requirement relative to the rest of the coffee retail industry. This is due to its business model, centered around establishing franchises across the world.Consumer Must-know: Dunkin’ Brands is innovating the supply chain

Dunkin’ Brands Group doesn’t typically supply products to its franchises. Revenues derive from royalty fees as opposed to product distribution.