Helix Energy Solutions Group Inc

Latest Helix Energy Solutions Group Inc News and Updates

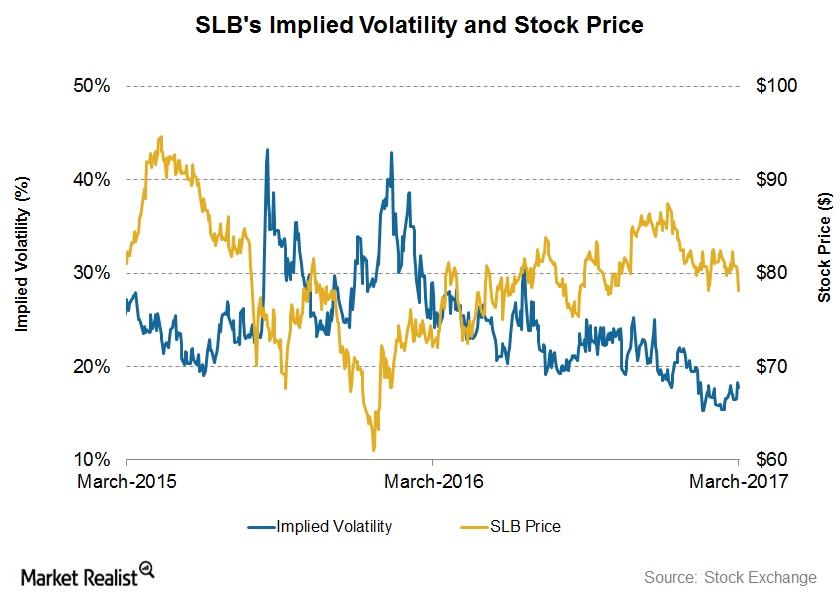

Schlumberger by Implication: Reading Implied Volatility

On March 10, 2017, Schlumberger’s (SLB) implied volatility was 17.7%, having fallen from 19% since its 4Q16 financial results were announced on January 20.

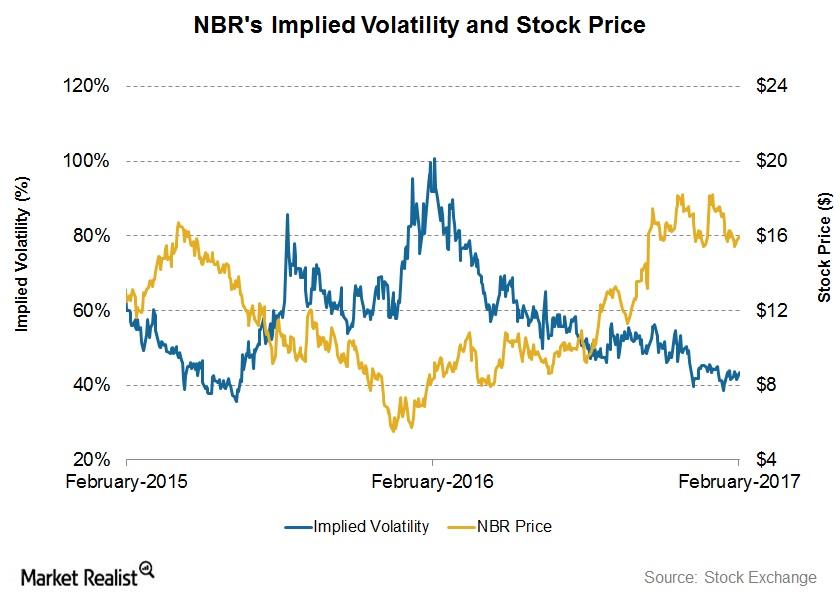

What Nabors Industries’ Implied Volatility Suggests

On February 13, 2017, Nabors Industries (NBR) had an implied volatility of 43%.

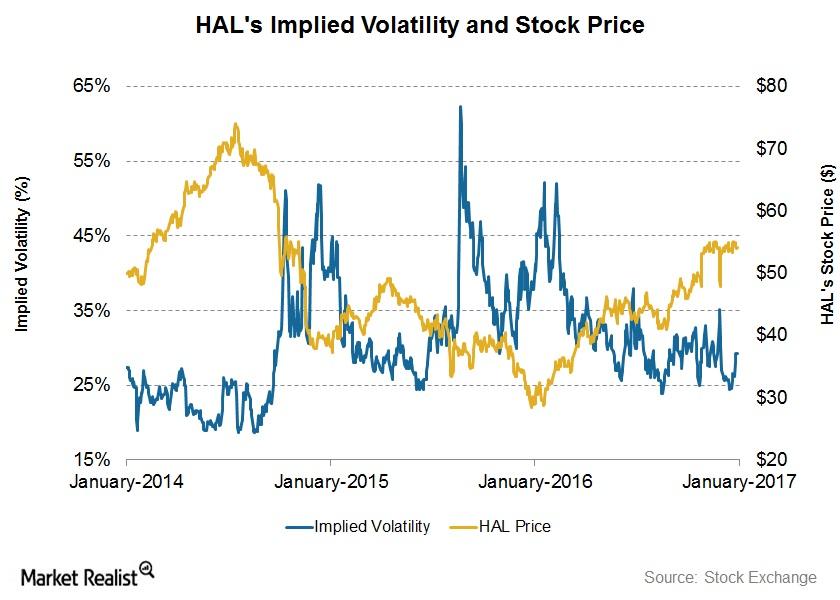

What Does Halliburton’s Implied Volatility Indicate?

On January 3, 2017, Halliburton (HAL) had implied volatility of ~29%. Since HAL’s 3Q16 financial results were announced on October 19, 2016, its implied volatility has remained nearly unchanged.

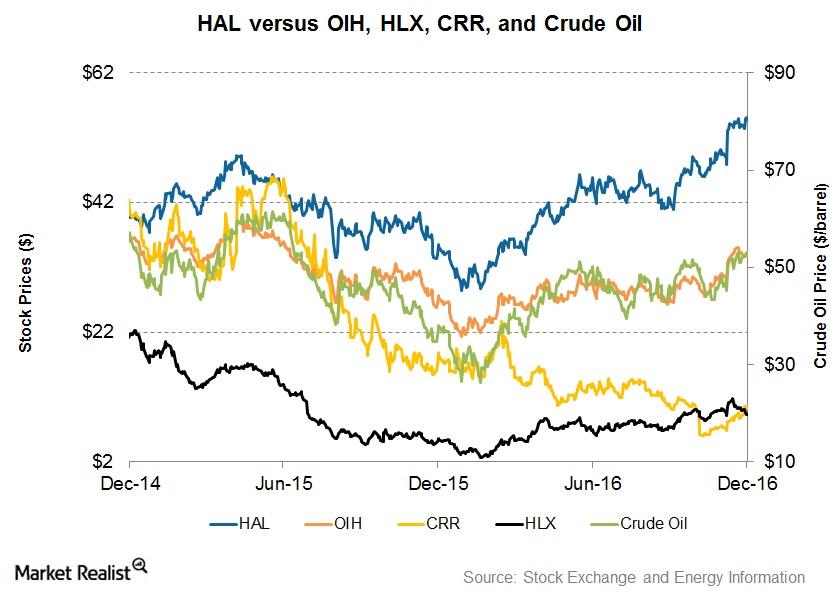

Analyzing Halliburton’s Stock Price Returns

From December 2014 to December 2016, Halliburton’s (HAL) stock price reached the highest level in December 2016. It troughed at ~$28 in January 2016.

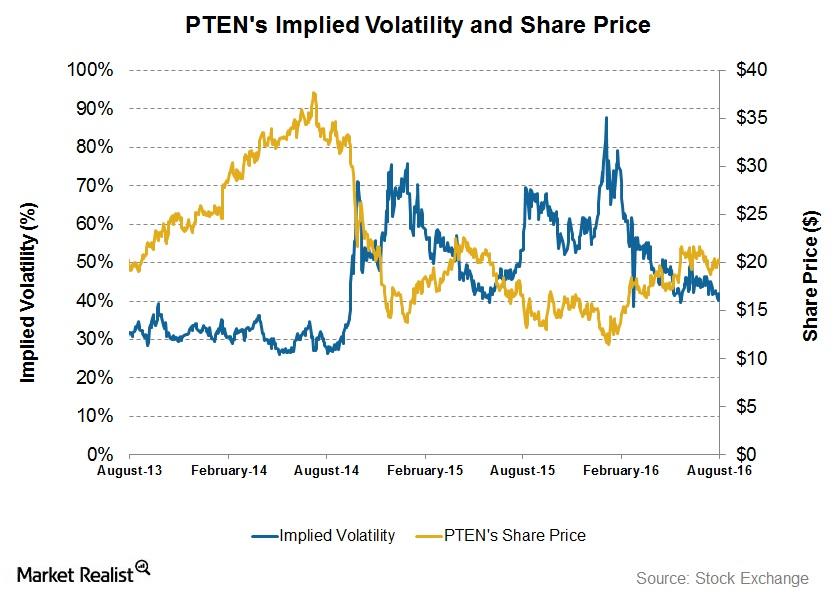

How Volatile Is Patterson-UTI Energy after 2Q16?

On August 19, Patterson-UTI Energy had an implied volatility of ~40%. Since its 2Q16 results were announced, its implied volatility has fallen from ~45%.