Genesee & Wyoming Inc.

Latest Genesee & Wyoming Inc. News and Updates

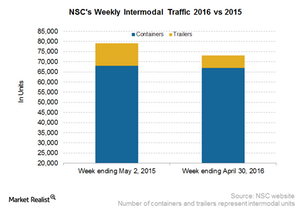

Norfolk Southern’s Intermodal Slump Equitable with Rival CSX

Norfolk Southern’s (NSC) total intermodal traffic for the week ended April 30, 2016, declined by 7.6%, at nearly 73,000 containers and trailers. This compares with 79,000-plus units in the corresponding week of 2015.

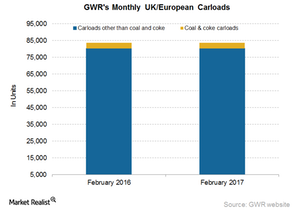

Analyzing GWR’s European Carloads in February 2017

Genesee & Wyoming’s (GWR) European carloads remained unchanged YoY (year-over-year) in February 2017.

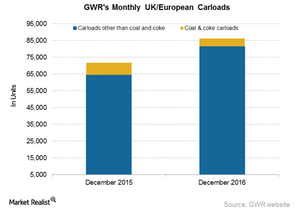

Why Did GWR’s European Carloads Rise in December?

GWR’s European carloads rose 20.3% YoY in December 2016. In the same period of 2015, GWR hauled ~72,000 railcars, as compared to ~86,000 in December 2016.

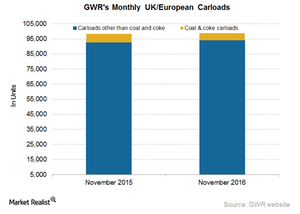

Why Genesee & Wyoming’s European Carloads Rose in November

Genesee & Wyoming’s (GWR) European carloads rose marginally 0.60% in November 2016. In the same period last year, GWR hauled 99,000 railcars.

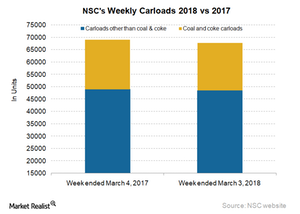

How Norfolk Southern’s Shipments Trended in Week 9

In the week ended March 3, 2018, Norfolk Southern saw a ~2% fall in carload traffic. It hauled ~67,700 carloads in the week.

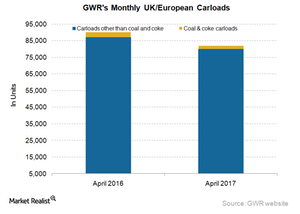

Reviewing GWR’s European Carloads in April 2017

Genesee & Wyoming’s (GWR) European carloads fell 9.1% YoY (year-over-year) in April 2017. GWR’s other-than-coal carloads fell 8.2% on a YoY basis in April 2017.

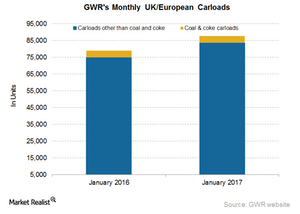

Inside GWR’s European Carload Rise in January

Genesee & Wyoming’s (GWR) European carloads rose 11.2% YoY in January 2017.

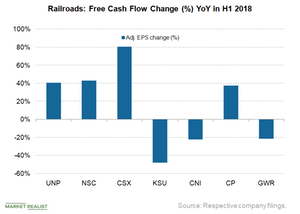

How Railroads’ Free Cash Flow Stacks Up

Free cash flow (or FCF) is an important metric in the railroad (FXR) industry.

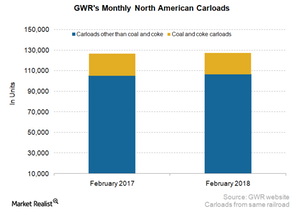

How GWR’s North American Carloads Trended in February

In February 2018, Genesee & Wyoming’s (GWR) North American carloads expanded 0.3% YoY (year-over-year) on a reported basis.

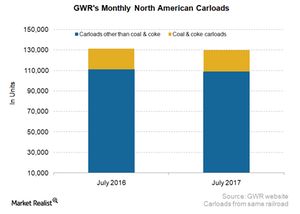

How Genesee and Wyoming’s Volumes Trended in July 2017

In July 2017, Genesee and Wyoming recorded a slight decline in its North American traffic YoY (year-over-year).

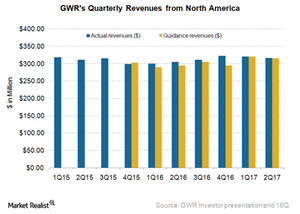

Genesee & Wyoming’s North American Revenues in 2Q17

In 2Q17, GWR’s North American revenues were $315.7 million, a 3.6% rise from $304.6 million in the same quarter last year.

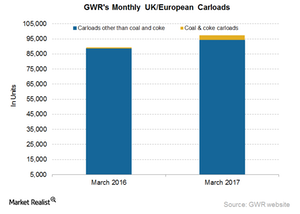

Analyzing Genesee & Wyoming’s European Carloads in March 2017

Genesee & Wyoming’s (GWR) European carloads rose to 9.0% YoY (year-over-year) in March 2017.

Assessing Canadian National through Porter’s Five Forces

In this part, we’ll do a Porter’s Five Forces check for Canadian National (CNI). The threat of new entrants is relatively low for CNI. The railroad industry is extensively capital intensive, with maintenance capital spending accounting for the highest share.