Fiserv Inc

Latest Fiserv Inc News and Updates

What Are Leon Cooperman’s Top Holdings?

In Q3 2020, billionaire investor Leon Cooperman’s top five holdings were Fiserv, Mr. Cooper Group, Alphabet, Cigna, and Trinity Industries.

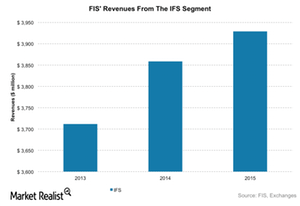

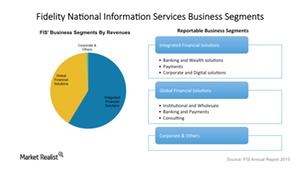

Inside FIS’s Integrated Financial Solutions Segment

FIS’s Integrated Financial Solutions segment caters to North American banks and is the largest contributor to the company’s total revenues (~60%).

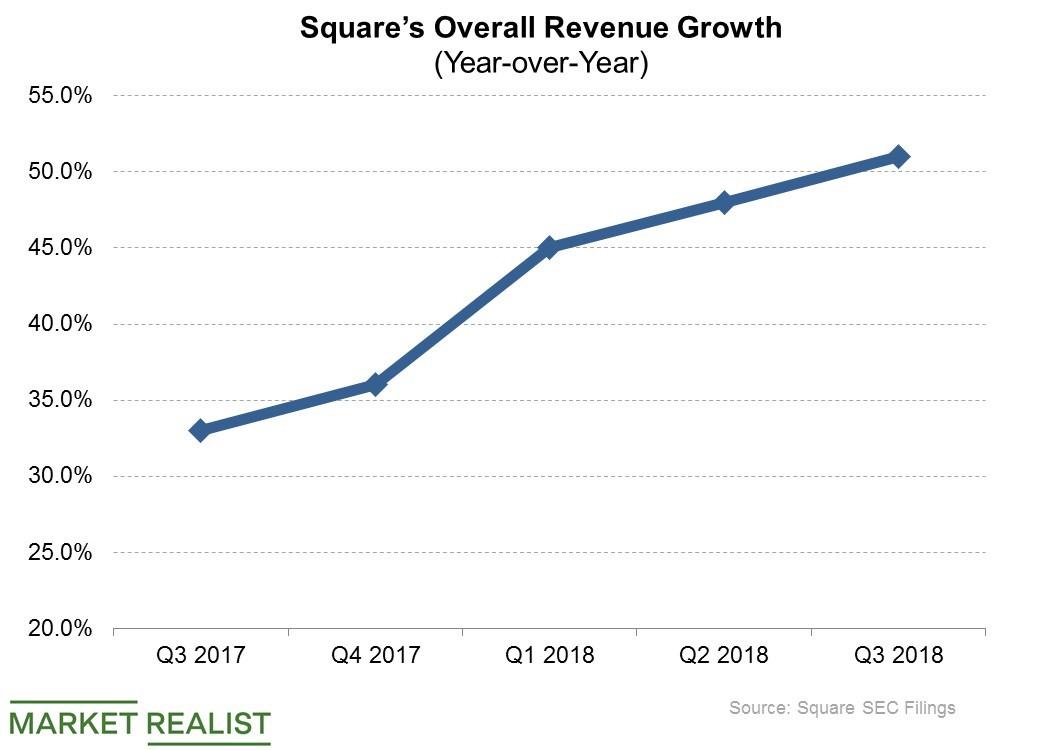

Could Square Survive a Fiserv–First Data Tie-Up?

Fiserv (FISV) and First Data (FDC) have agreed to join forces in a $22 billion merger that is set to create a stronger competitor for Square (SQ) in payment processing.

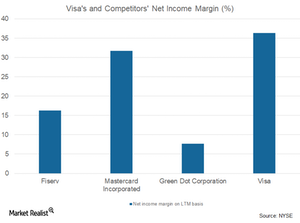

Inside Visa’s Operating Expenses

Visa (V) saw a rise of 13% in total operating expenses on a YoY (year-over-year) basis in fiscal 1Q18. It incurred $1.5 billion in expenses in fiscal 1Q18 compared to $1.4 billion a year earlier.

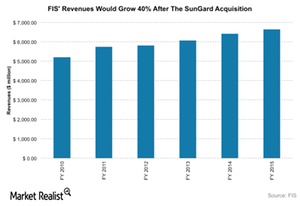

What the SunGard Acquisition Could Bring for FIS

In August 2015, FIS acquired SunGard for $9.1 billion, its largest acquisition to date. SunGard is expected to expand FIS’s top line by nearly 50%.

How Are FIS’s Business Strategies Driving Growth?

FIS plans to build stronger client relationships through multidimensional offerings. Its SunGard acquisition should also help expand client relationships.

Inside FIS’s Operating Model

In 2015, FIS reorganized and began reporting its results under three segments. But after the SunGard acquisition, another restructuring process is underway.

Introducing Fidelity National Information Services

Headquartered in Florida, Fidelity National Information Services is a big hitter in software solutions and innovations in the financial services industry.