Fidelity China Region

Latest Fidelity China Region News and Updates

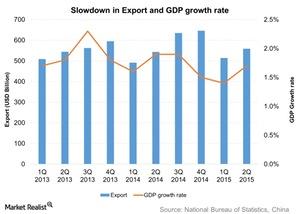

Analyzing China’s Leading Economic Index

China’s Leading Economic Index currently indicates that the country’s economy is facing a downturn. Its LEI remained unchanged at 98.71 points in July 2015.

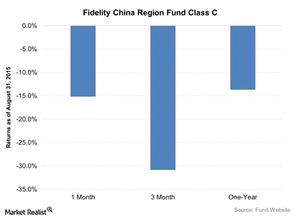

How Did the Fidelity China Region Fund Class C Perform in August?

The Fidelity China Region Fund Class C (FHKCX) aims to achieve long-term capital growth.

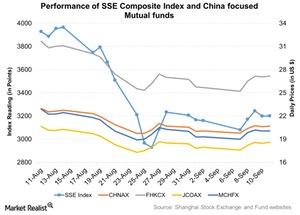

Turbulence in China’s Stock Market

Due to recent stock market turbulence in China’s stock market, the SSE (Shanghai Stock Exchange) Composite Index was down 22.7% month-over-month and ended at 3,200.23 points on September 11.

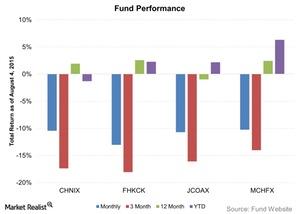

How Have China-Focused Mutual Funds Performed?

In the one-month period ended August 4, 2015, each of the four funds we’re covering in this series posted negative returns due to the stock market crash that spread from the end of June until July.