Family Dollar Stores Inc

Latest Family Dollar Stores Inc News and Updates

Farallon Capital Increases Its Position in Dollar General

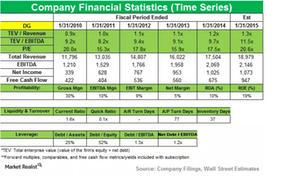

In 2014, Dollar General reported net sales of $18.9 billion, an increase of 8% compared to sales of $17.5 billion in 2013.

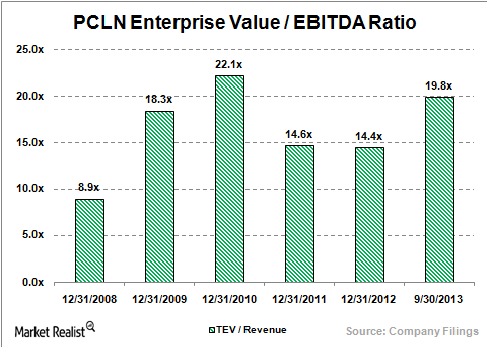

Eton Park Capital opens new positions in FDO, STZ, BID, EQIX, Sells NLSN, PCLN – 13F Flash

In this six-part series, we will go through some of the main positions Eton Park Capital traded this past quarter Eton Park Capital Management is a multi-strategy hedge fund founded in November 2004 by former Goldman Sachs partner Eric Mindich. The firm started new positions in Family Dollar Stores (FDO) , Constellation Brands (STZ), […]

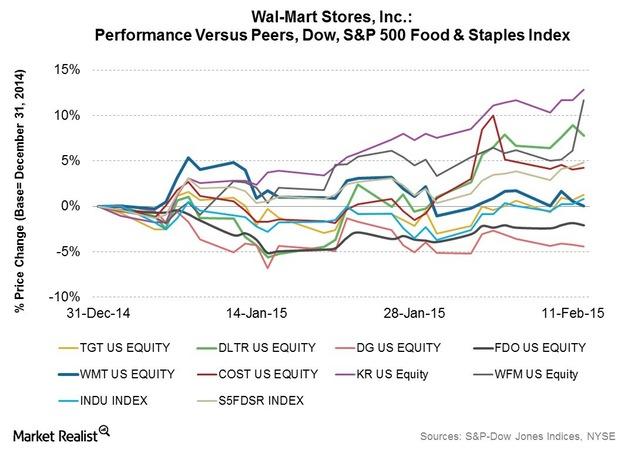

Walmart’s Key Challenges In Its Business Environment

The NLRB filed a complaint last January. It accused Walmart of violating labor laws. The NLRB claims that the retailer acted against workers who joined unions.

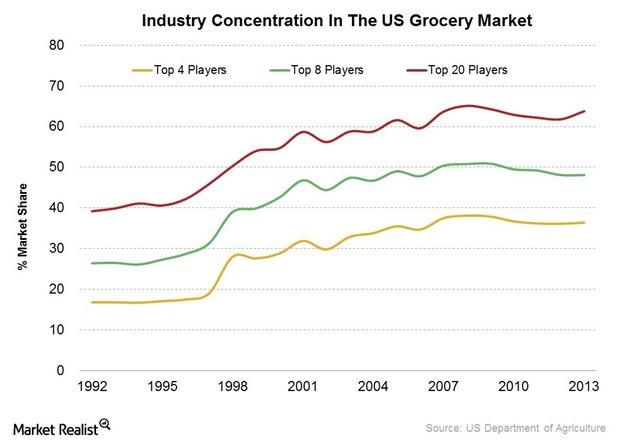

The Wal-Mart Impact on Food Price Deflation

What starts as a competitive strategy for Wal-Mart may also affect the general level of grocery price inflation in the United States.