Edison International

Latest Edison International News and Updates

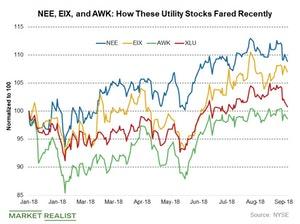

Highest Dividend Growth: Comparing NEE, EIX, and AWK

Utilities have been weak compared to the broader markets this year largely due to the strength in the Treasury yields.Energy & Utilities Must-know: Risks to AES Corporation’s business

Given the nature of its business, AES Corporation (AES) faces risks relating to currency fluctuations, fuel prices, interest rates, and a scattered business model.

A brief overview of Exelon’s power operations

Power generation is a significant segment for Exelon, generating more than 60% of its total revenue. The energy delivery business provides the other 40% of the company’s revenues.

Where PG&E Stock Might Go amid Interest from Mayors

PG&E gained for the sixth straight day amid increased uncertainty. The stock has gained more than 80% during this period and closed at $8 on Tuesday.

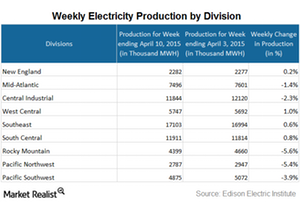

Rocky Mountain Division Sees a Large Drop in Electricity Generation

Out of nine divisions, electricity generation increased in four divisions and decreased in five divisions for the week ending April 10.

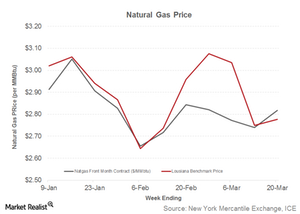

Why A Marginal Rise in Natural Gas Prices Helped Coal

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices rise, coal gains market share.