WisdomTree U.S. SmallCap Earnings Fund

Latest WisdomTree U.S. SmallCap Earnings Fund News and Updates

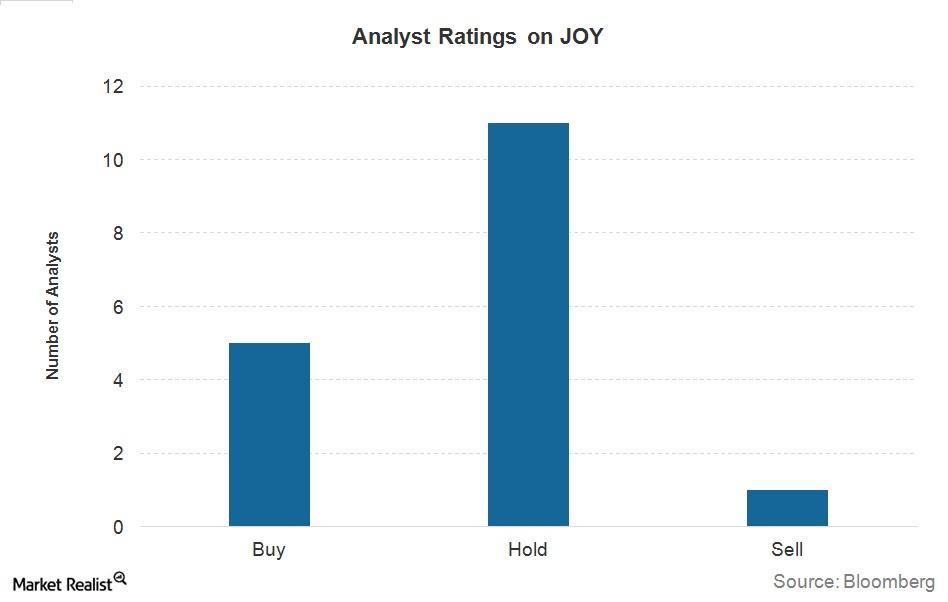

The Word on the Street: What Analysts Are Recommending for Joy Global Now

Of the 17 analysts surveyed by Bloomberg, only five issued “buy” recommendations for Joy Global, while 11 issued “holds,” and one issued a “sell.”

What Is the Market Outlook for Underground Mining Equipment?

The global underground mining industry is expected to grow at a compound annual growth rate of approximately 7% from 2015 to 2019.

A Quick Look at Joy Global’s History and Operations

Joy Global operates in two business segments, namely its Underground Mining Machinery and Surface Mining Equipment segments.