Deckers Outdoor Corp

Latest Deckers Outdoor Corp News and Updates

Susquehanna Rates Deckers Outdoor as ‘Neutral’

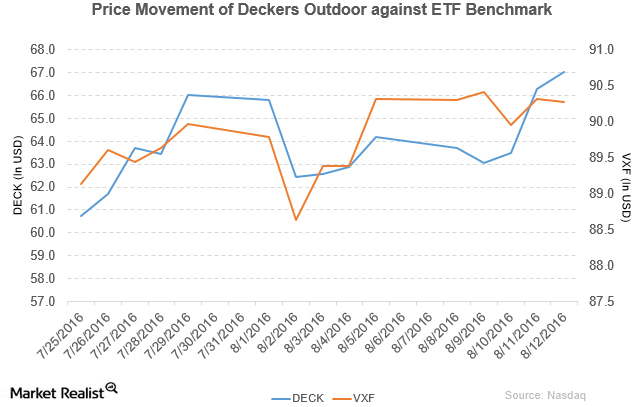

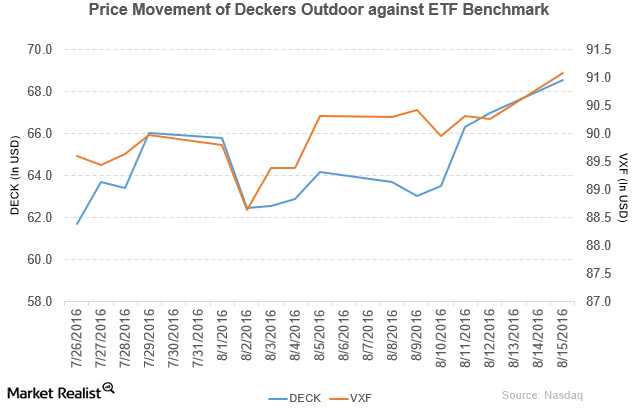

Deckers Outdoor (DECK) has a market cap of $2.1 billion. It rose by 1.1% to close at $67.01 per share on August 12, 2016.

How Does Skechers Manage Its Inventory and Distribution?

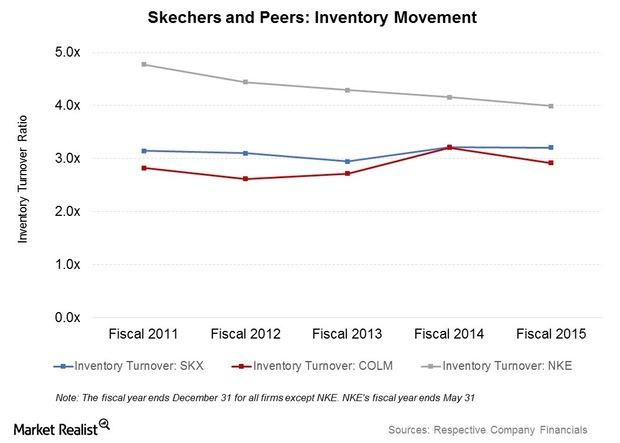

In recent years, Skechers has reported improved working capital metrics. The company’s inventory turnover (or ITR) rose from 2.9x in 2013 to 3.2x in 2015.

Buckingham Research Upgrades Deckers Outdoor to a ‘Buy’

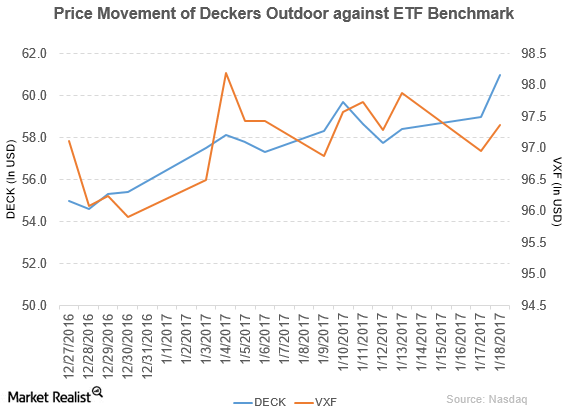

Deckers Outdoor (DECK) reported fiscal 2Q17 net sales of $485.9 million, a fall of 0.21% from the net sales of $486.9 million in fiscal 2Q16.

Jefferies Downgrades Steven Madden to ‘Hold’

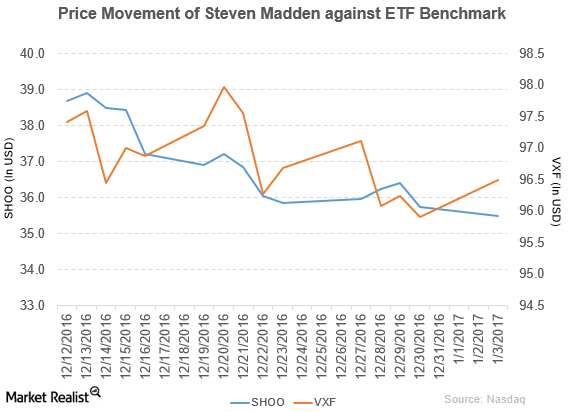

On January 3, 2017, Jefferies downgraded Steven Madden’s rating from “buy” to “hold” and set the stock’s price target at $37.00 per share.

Stifel Upgrades Deckers Outdoor to a ‘Buy’

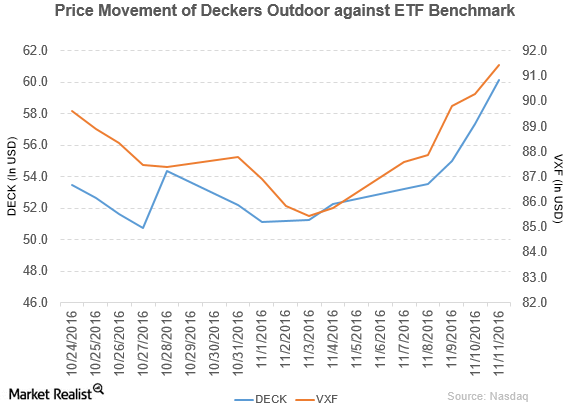

Price movement Deckers Outdoor (DECK) has a market cap of $1.9 billion. It rose 4.9% to close at $60.17 per share on November 11, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 15.2%, 5.7%, and 27.5%, respectively, on the same day. DECK is trading 11.7% above its 20-day moving average, 3.8% […]

Why Susquehanna Downgraded Deckers Outdoor to ‘Negative’

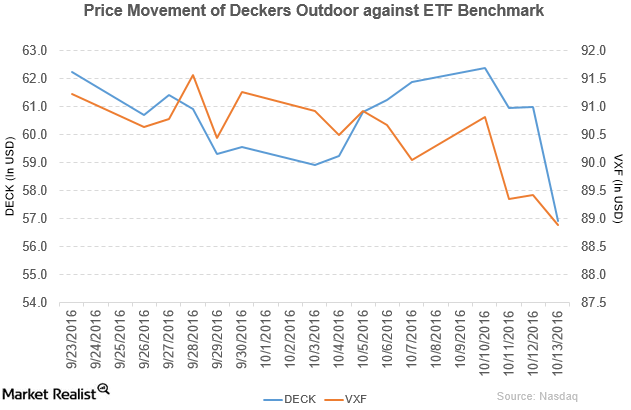

Deckers Outdoor (DECK) has a market cap of $1.8 billion. It fell 6.7% to close at $56.92 per share on October 13, 2016.

Telsey Advisory Upgrades Deckers Outdoor to ‘Outperform’

Deckers Outdoor rose by 2.3% and closed at $68.55 per share on August 15. Its weekly, monthly, and YTD price movements were 7.6%, 10.2%, and 45.2%.

Susquehanna Rates Steve Madden as ‘Positive’

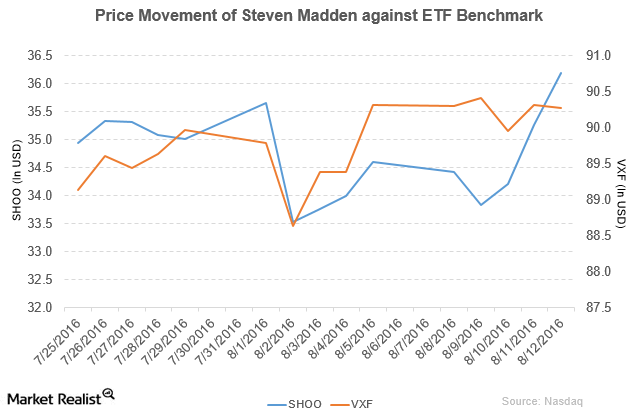

Steve Madden (SHOO) has a market cap of $2.2 billion. It rose by 2.6% to close at $36.20 per share on August 12, 2016.

A Look at Steven Madden’s Financial Footprint in 2Q16

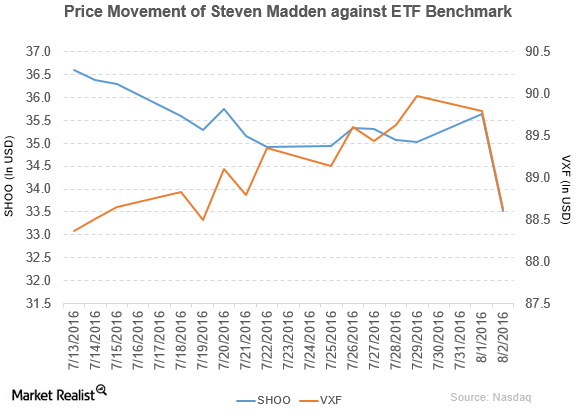

Steven Madden (SHOO) has a market cap of $2.1 billion. It fell by 6.0% to close at $33.52 per share on August 2, 2016.

Buckingham Research Downgrades Steven Madden to ‘Neutral’

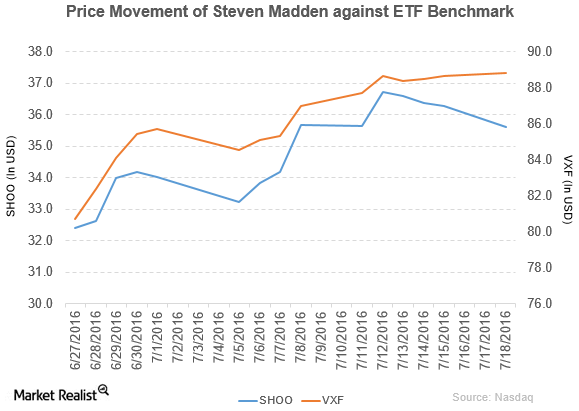

Steven Madden (SHOO) has a market cap of $2.2 billion. It fell by 1.9% to close at $35.60 per share on July 18, 2016.

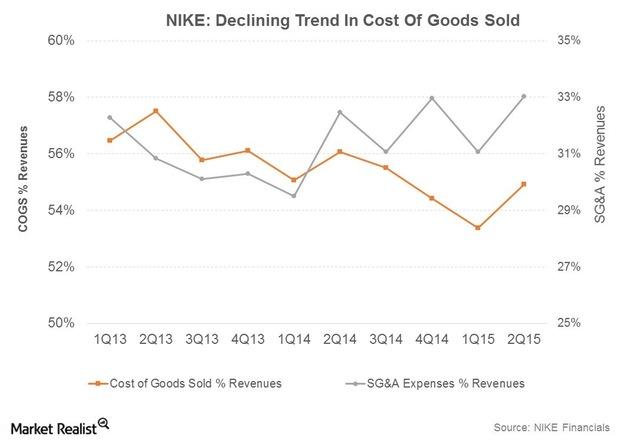

Reasons for NIKE’s Rising Profitability

NIKE is working to improve its profitability, as its margins trail industry peers such as Lululemon Athletica (LULU) and VF Corporation (VFC).