iShares Intermediate Credit Bond

Latest iShares Intermediate Credit Bond News and Updates

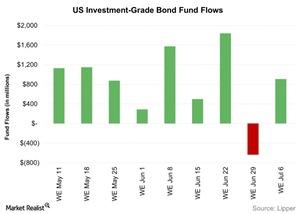

Investment-Grade Bond Funds Saw Inflows Last Week

Flows into investment-grade bond funds were positive last week. Investment-grade bond funds saw net inflows of $907.1 million during the week ending July 6.

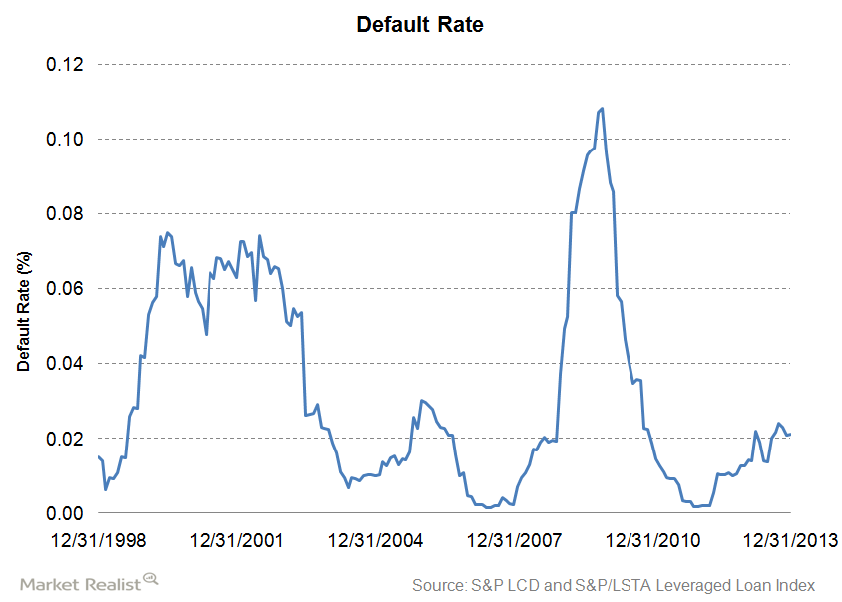

The default rate and its relation to bond and loan prices

Default rate is a key metric of credit risk and is defined as the risk that the counterparty will default on its financial obligations.

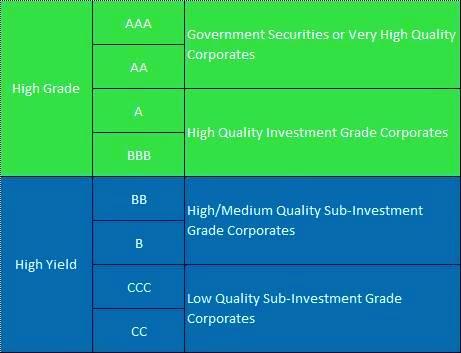

Must know: How credit rating affects default rate and bond price

A lower credit rating means higher risk, and therefore, higher yield as investors look for the premium to take the risk and vice versa.

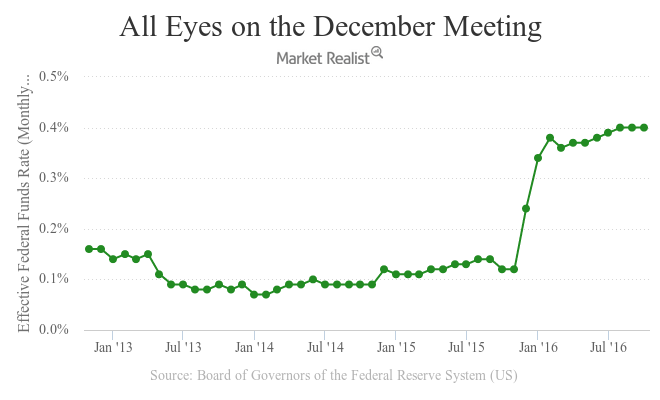

A Pass on a November Hike: It’s Up to December Now

The expected occurred on November 2, 2016, when the FOMC (Federal Open Market Committee) left the federal funds rate unchanged at 0.25%–0.5%.

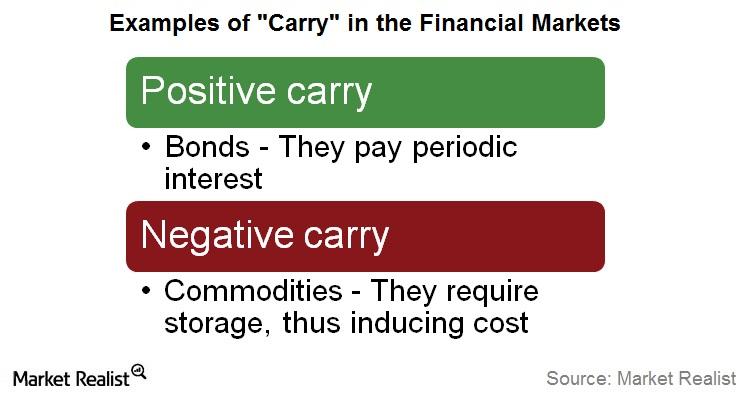

Why Is ‘Carry’ Compressed in Financial Markets?

In his investment outlook for June 2016, Bill Gross asserted that “carry” is compressed in nearly every form. It has more risk than return.

Bill Gross Talks about Compressed ‘Carry’ in Financial Markets

In his latest monthly investment outlook for June 2016, bond market veteran Bill Gross talked about “carry” in financial markets.