Banco Bradesco S.A.

Latest Banco Bradesco S.A. News and Updates

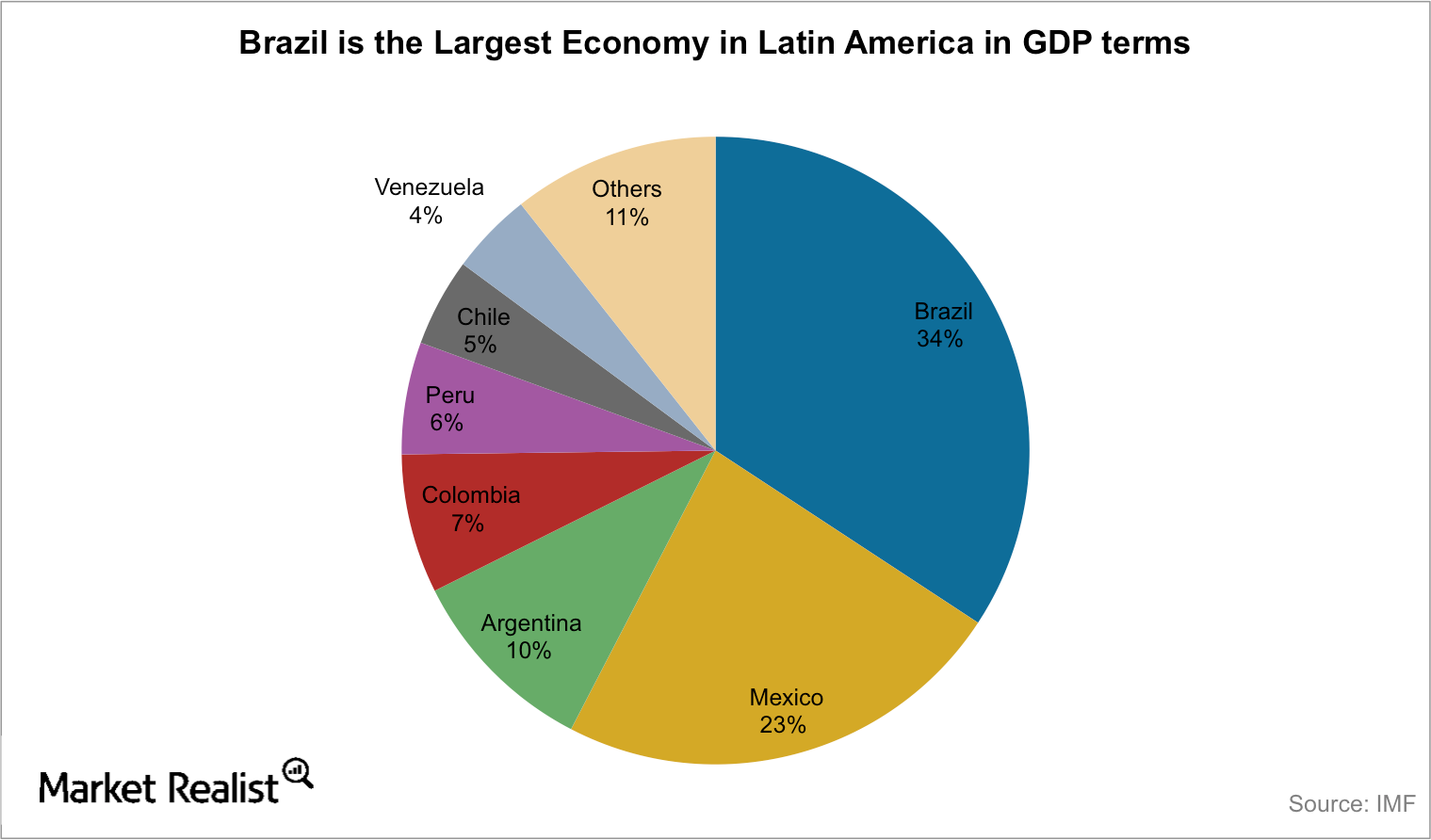

Why Latin American Economies May Be in Trouble

Worsening economic conditions in Brazil and Venezuela hit economic growth in Latin America in the first quarter of 2015.

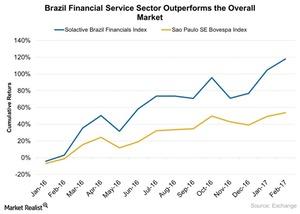

Why the Service Sector’s Contribution to Brazil Is Important

The service sector is the main contributor to Brazil’s GDP and job creation, but it’s currently suffering from structural weakness and poor international performance.

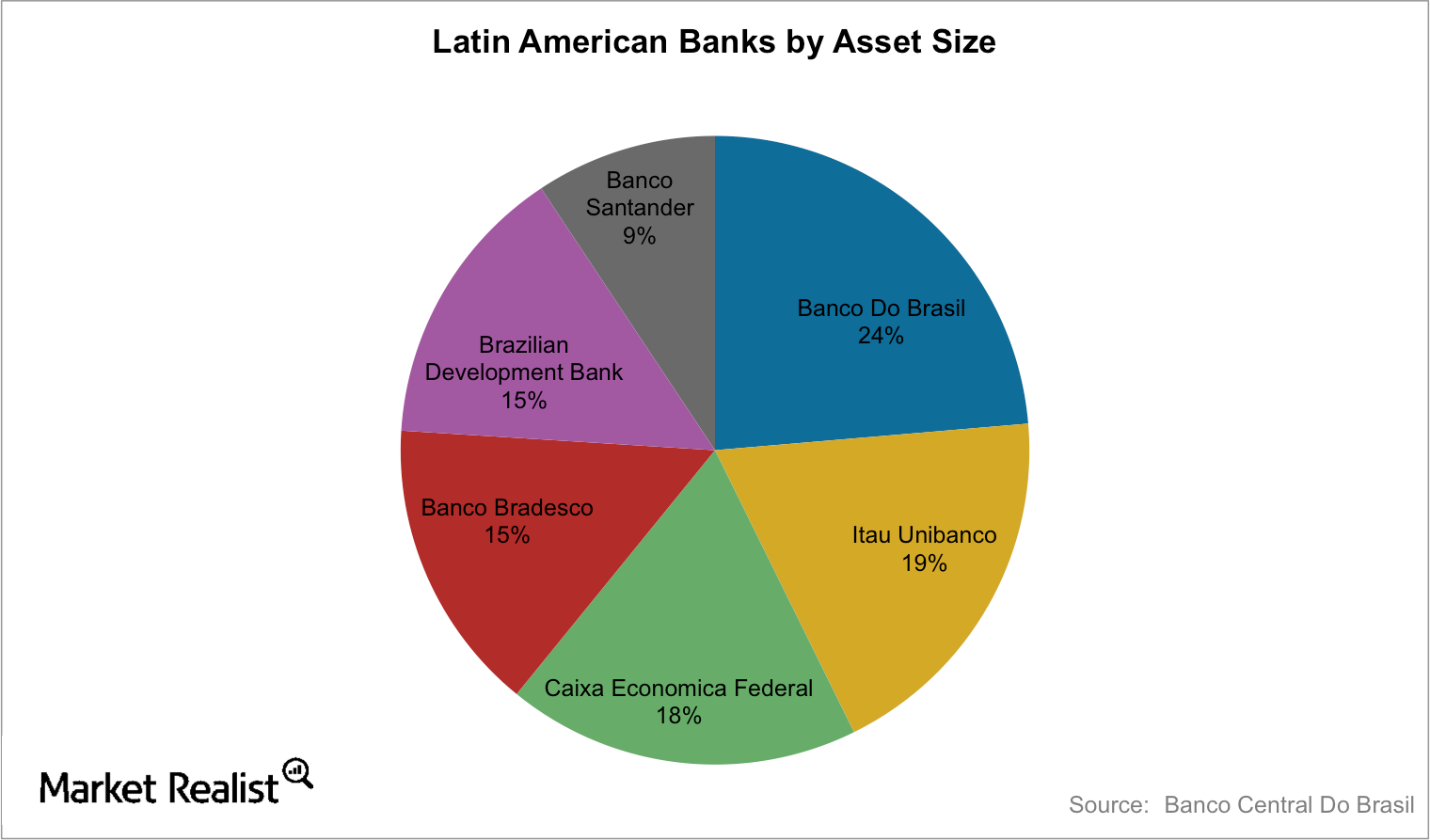

An Introduction to Brazil’s Largest Banks, Latin America’s Biggest

Since the ’80s and ’90s, Latin American banks have stabilized. Today, the largest banks in Latin America are concentrated in two countries: Brazil and Mexico.Consumer A guide to Cantillon Capital Management’s investment strategy

The New York–based Cantillon Capital Management is a hedge fund manager founded in 2003 by William von Mueffling.

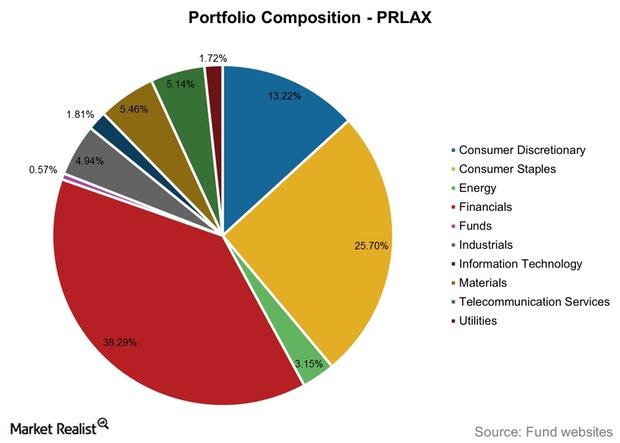

The T. Rowe Price Latin America Fund (PRLAX): Important Facts

The T. Rowe Price Latin America Fund (PRLAX) is offered by T. Rowe Price. The fund seeks long-term growth of capital.

Brazilian Real Nears All-Time Lows in 2015

The Brazilian real has been trading on a weaker note against the US dollar in the last year after depreciating by more than 40% against the US dollar.