Ally Financial Inc

Latest Ally Financial Inc News and Updates

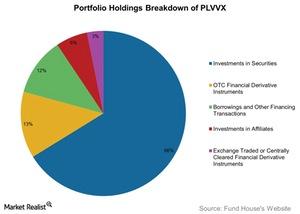

A Detailed Holdings Analysis of PLVVX

PLVVX holds fixed income securities in both long and short positions. The fund also holds derivative forward, future, and swap agreements on government securities, indexes, and currencies.

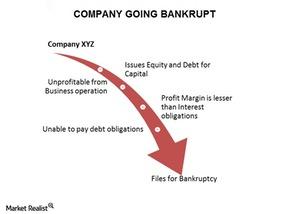

What Is Bankruptcy Investing?

Informed investors can profit from businesses that have filed for bankruptcy. A chapter 11 bankruptcy gives a company a second chance to revive its business.