These 5 REIT Stocks May Make a Difference in Your Portfolio

The best REIT stocks to buy in 2022 include a rare Warren Buffett pick in the sector. We'll discuss five REIT stocks investors should consider in 2022.

Aug. 16 2022, Published 8:32 a.m. ET

About 83 percent of financial advisers recommend REITs to their clients, according to a Chatham Partners study. With the majority of financial advisers supporting real estate investment, it means that it may be worth having exposure to REIT stocks in your portfolio. What are the best REIT stocks for investors in 2022?

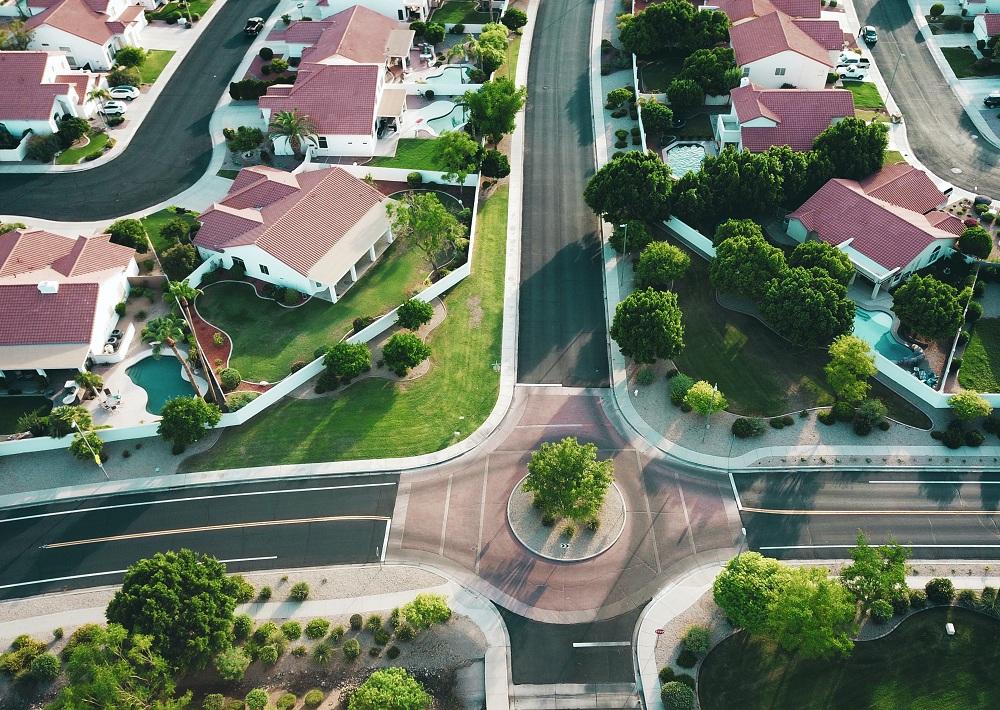

A REIT is a company that owns income-generating real-estate property. These could be residential units, office buildings, farmlands, or factory spaces. They make money from rent and lease contracts.

Are REITs a good investment?

It would require a huge amount of money to purchase a residential apartment or office block that you can rent out and collect payments. While the rich can afford to purchase rent-generating properties in their name, ordinary people would be left out. The REIT structure is meant to make it easy for any investor to get exposure to the real-estate sector. With a brokerage account and a little money, you can invest in a REIT stock.

REITs are required by the law to distribute at least 90 percent of their profit to investors. As a result, REIT stocks usually pay dividends, which you can reinvest in the stock or withdraw to pay your bills.

Many REIT companies own properties in a diverse range of real-estate categories from farmland to retail spaces to residential blocks. As a result, investing in REIT stocks can be a smart way to diversify your portfolio.

Does Warren Buffett invest in REITs?

Many investors hold Warren Buffett in high regard because of his successful track record in investing. As a result, you may be interested in finding out what Buffett thinks about REIT stocks before you invest in this space.

Buffett’s Berkshire Hathaway owns REIT stock STORE Capital (STOR). Berkshire has a more than 5 percent stake in the company and it has held on to that investment for a few years since opening the position.

What are the best REITs for investors in 2022?

The real-estate sector is wide and investors have a variety of REIT stocks to choose from. These are some of the REIT stocks you may want to consider adding to your portfolio in 2022:

STORE Capital (STOR) – Warren Buffett’s favorite REIT provides retail spaces. It specializes in single-tenant properties. In addition to consistently paying dividends, the company has been boosting its dividend amounts in recent years. Currently, STOR stock offers a dividend yield of more than 5 percent.

Extra Space Storage (EXR) – The company provides self-storage spaces and it’s one of the largest providers in the category. The stock offers a dividend yield of about 2.6 percent.

Mid-America Apartment Communities (MAA) – The company rents out residential apartments. It has hundreds of apartment communities across more than a dozen states. MAA stock offers a dividend yield of about 2.4 percent.

Farmland Partners (FPI) – It holds thousands of acres of farmland that are used to grow various crops, including wheat, cotton, and soybeans. The company makes money from leasing out its farms.

SBA Communications (SBAC) – The company owns and operates mobile network infrastructure. It’s in the same category as American Tower (AMT) and Crown Castle International (CCI). The company stands to benefit from the shift to 5G networks.

Finally, the best REIT stocks to buy if you’re investing for income are those that have a track record of steady dividends. You may also want to get exposure to stocks in categories that are expected to continue to grow.