Best Credit Cards With No Foreign Transaction Fees If You're Traveling Abroad

Several credit cards won’t charge you foreign transaction fees, but not all of them are a good option for you to take with you on your travels.

Nov. 4 2022, Published 8:32 a.m. ET

You’re packing your bags for a trip to Europe and wondering how you’ll pay for things when you get there. Although it's wise to have a little cash in Euros in your pocket, you can get by using a credit card.

If you’re traveling to a larger city like Paris, Lisbon, or Madrid, you’ll find that credit cards are accepted almost everywhere. However, you should be careful with what credit card you use. You want to use a card that doesn’t charge foreign transaction fees.

Foreign transaction fees charged by many credit card companies usually range between 1 percent and 3 percent of your transaction. So, if you spend $50 at a restaurant in Rome, your credit card could charge you up to an extra $1.50 to use it. After traveling for a week, those fees can add up. What are the best travel credit cards with no foreign transaction fees? Keep reading to find out.

What are the best credit cards with no foreign transaction fees?

Several credit cards out there won’t charge you foreign transaction fees, but not all of them are a good option for you to take with you on your travels. For example, both Discover and American Express have cards that don’t charge fees for foreign transactions, but both aren’t widely accepted outside of the U.S., so they probably aren't good options.

When considering the best credit cards with no foreign transaction fees, you should look at cards that have the following:

No annual fee

0 percent APR for 12 or more months

Cashback or travel points for each purchase

Welcome offers of bonus cash back or travel points

Here are our picks:

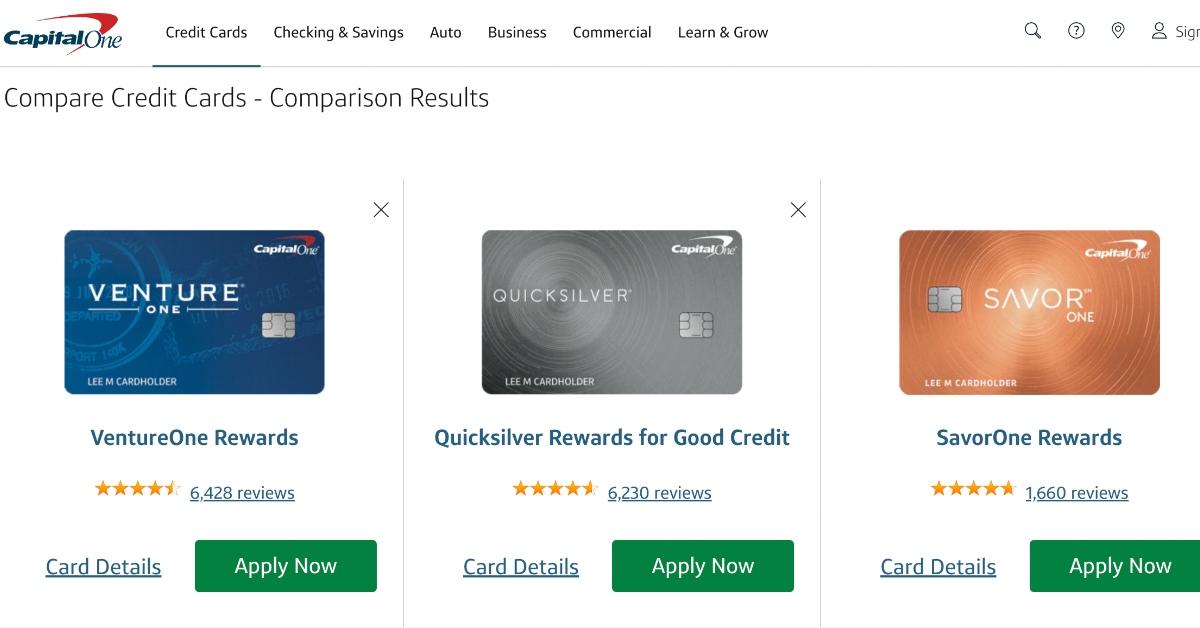

Capital One

Capital One is probably the best credit card company to take with you on your travels. It offers several cards that don’t charge foreign transaction fees and have no annual fees, intro 0 percent APR, and give you cash back or points for all your transactions. The best Capital One cards with we found are:

Savor One – gives you 3 percent cash back on everyday purchases like groceries, dining, entertainment, and streaming services, plus 1 percent on all other purchases. You can also earn a one-time $200 bonus when you spend $500 within the first three months.

Venture One – gives you unlimited 1.25 miles per dollar you spend on most purchases plus 5 miles per dollar on hotels and rental cars booked through Capital One Travel. You’ll also earn 20,000 bonus miles when you spend $500 within the first three months.

Quicksilver Cash Rewards – earn unlimited 1.5 percent cash back on every purchase and a one-time $200 bonus when you spend $500 within the first three months.

Wells Fargo Autograph card

With the Wells Fargo Autograph card, you can earn 3 points for every dollar you spend on travel expenses like airfare, hotels, and car rentals, as well as other expenses like gas stations, restaurants, your cell phone bill, and streaming services like Netflix and Hulu. You’ll also get one point on all other purchases and 30,000 points after you spend $1,500 within the first three months. This card has an introductory 0 percent APR for 12 months and no annual fee.

Bank of America Travel Rewards

The VISA-backed Bank of America Travel Rewards credit card gives you 1.5 travel points for every dollar you spend. So, while traveling on vacation, you can earn points for your next adventure. This card has no annual fee and offers 0 percent APR for 18 months. You’ll also get 25,000 bonus points once you spend $1,000 within the first 90 days after opening your account.

Whatever credit card you end up choosing, happy and safe travels!