Can Reddit Traders Take XELA to the Moon Next After AMC and GME?

Exela Technologies stock has been on an uptrend. What’s the forecast for XELA stock as Reddit traders fancy yet another short squeeze?

July 28 2021, Published 8:41 a.m. ET

Exela Technologies (XELA) stock has been on an uptrend. The stock rose 6.5 percent on July 27 and was trading higher in premarkets on July 28. The stock is popular on Reddit and other social media groups and traders are betting on a short squeeze. What’s the forecast for XELA stock and is it a good buy? Can Reddit traders take it to the moon next after GameStop (GME) and AMC Entertainment (GME)?

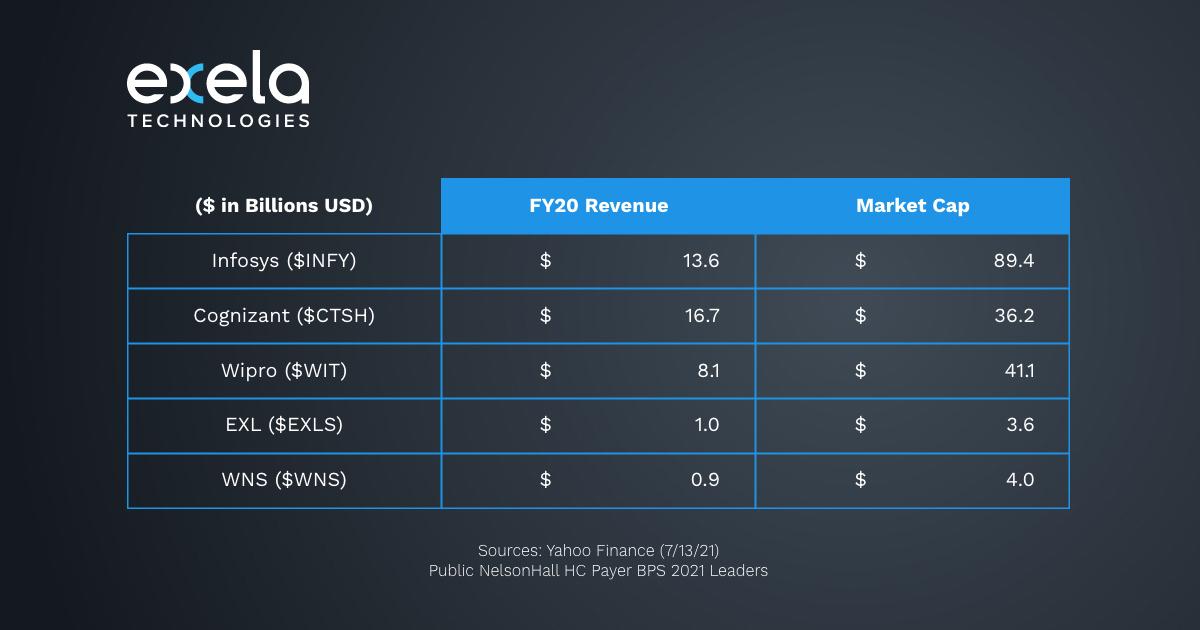

Exela is a business process automation company and has 4,000 customers spread across 50 countries. The company has an impressive clientele and 60 percent of Fortune 100 companies are its clients.

XELA stock latest news

On July 27, Exela announced record second-quarter new users for its DrySign and Digital Mailroom offerings. Like many other meme stocks, XELA has also been on a capital-raising spree.

After completing the $100 million at-the-market stock sale, it announced another $150 million offer. In its most recent update, the company said that it has issued $85 million worth of shares as part of the offer. The company intends to use the proceeds mainly for deleveraging and to invest in its growth pursuits.

XELA stock forecast

Only one analyst is covering XELA stock. The analyst has a $4 target price on the company, which implies an upside potential of over 53 percent. Previously, I noted that XELA stock’s risk-reward dynamics don't look favorable. The stock has since plunged. The massive fall in XELA stock combined with optimistic business updates makes it a penny stock worth looking at.

Exela stock Reddit

XELA stock is a popular name on Reddit and there's a subreddit with almost 2,900 members to discuss the stock. However, it isn't as popular on WallStreetBets. A post on r/Xelastock talked about XELA rising to $100 and termed it as the next AMC. While the $100 target price might seem like a tall ask, the stock does seem to be in an uptrend.

XELA stock short squeeze

According to Fintel, XELA had a FINRA short volume ratio of 54.5 percent on July 27, which was significantly higher than the previous days. Many retail traders are fancying their chances of a short squeeze in the stock. A high short volume combined with positive updates from the company make XELA a prime short squeeze candidate.

Is XELA stock a good investment?

XELA is expected to report revenues of $1.32 billion in 2021 and $1.42 billion in 2022. The company is expected to post an adjusted EBITDA of $220 million and $317 million, respectively, in 2021 and 2022. The stock trades at an NTM EV-to-sales multiple of $1.31x and NTM EV-to-EBITDA of 7.24x.

The valuations would appear cheap but they are low for two reasons. First, the company’s sales fell in 2019 and 2020. Second, Exela has a huge debt pile, which is pulling down its multiples.

Meanwhile, the company is trying to reduce the debt levels through stock issuances. While it would certainly lead to dilution, it would also help the company bring down the debt, which isn't at sustainable levels. Deleveraging and the expected turnaround in organic business could drive XELA stock higher. The company’s upcoming earnings release might also help buoy sentiments.