There Isn’t Much to Keep Paysafe (PSFE) Stock Down for Long, Should Fly Soon.

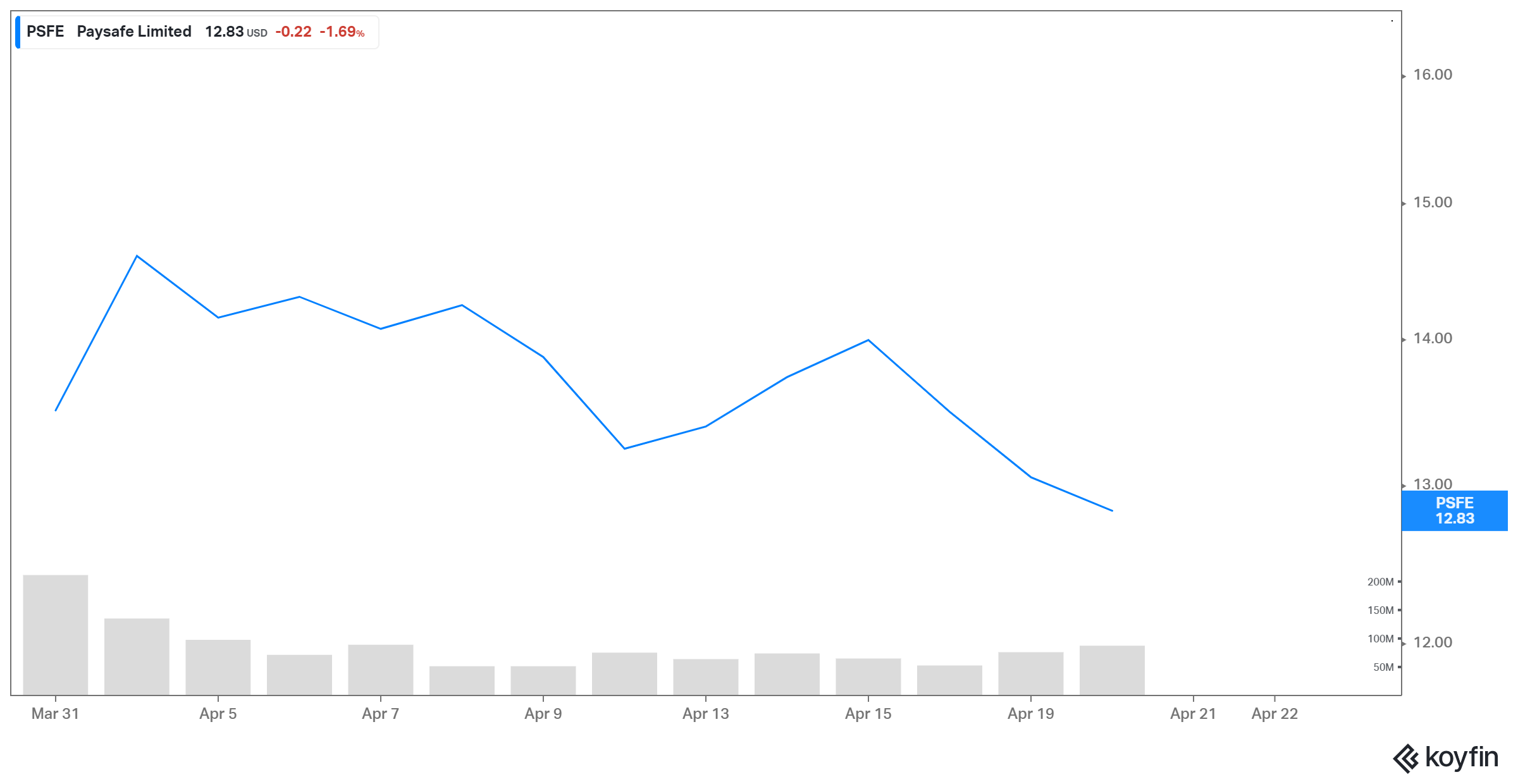

Paysafe’s stock has fallen by nearly 8.3 percent in the last three trading sessions. Why is Paysafe (PSFE) stock dropping and will it recover in 2021?

April 21 2021, Published 10:56 a.m. ET

Backed by Fidelity National Financial chairman William Foley II, Foley Trasimene Acquisition Corp. II (BFT) took Paysafe public in March 2021. The transaction closed on March 30 and the ticker symbol change from "BFT" to "PSFE" became effective on March 31 on NYSE. The stock’s performance has remained mixed since and, lately, the price has been falling. The question is whether (PSFE) will recover in 2021.

Paysafe provides global payment processing and has a huge business that handles $100 billion in payments volume annually. Its brands include Skrill, Neteller, and Paysafecard.

The reasons why Paysafe stock is dropping appear to be macro.

Paysafe’s stock has seen three consecutive down trading sessions and has lost a value of 8.3 percent in this period. There hasn’t been any company-specific news in the recent past. The drop, therefore, has mainly due to do with the macroeconomic considerations. One of the reasons for the fall in stocks, especially growth and SPAC plays, is the investors’ risk-off sentiment amid rising inflation and interest rate concerns.

Moreover, recently, the broader markets saw a sell-off due to rising Covid cases worldwide, which led to concerns regarding the recovery of markets.

PSFE stock price prediction through 2021 requires more analysis.

Currently, only two analysts cover Paysafe stock, according to Market Beat. Both analysts have a buy rating with an average target price of $19, which implies a possible upside of 48 percent for the stock.

Wolfe Research initiated on the stock on April 7. The firm’s analyst, Darrin Peller sees the company’s position as a leading digital wallet provider and “niche” merchant acquirer to help it establish a dominant position in areas such as internet gaming, property management, and cryptocurrency trading.

Will PSFE stock recover?

As the dust settles down and investors reassess their positions, they will come back to quality growth names and Paysafe definitely fits the bill. Most of the recent drop for the company has to do with factors that aren't directly linked with the company's performance. Therefore, a shift in macroeconomic conditions would mean a rekindling of interest for PFSE stock.

Moreover, the fundamentals and the outlook is favoring PSFE stock, which should help it recover. The digital payment market is expected to grow exponentially and PSFE is well-positioned and well-capitalized with an experienced management to take advantage of this trend. Another recent positive for the company has been an upgrade by Moody’s to B1 from B3 with stable outlook.

PSFE seems like a good stock to buy now.

PSFE’s current EV is close to $11 billion, based on its current market capitalization and pro forma net debt. Based on PSFE’s own projections, its EBITDA should be $561 million and $655 million for 2021 and 2022, respectively. These figures imply an EV to EBITDA multiples of 19.6x and 16.8x for 2021 and 2022, respectively.

Its major competitor, Paypal, is trading at an EV-to-NTM EBITDA multiple of 40.6x, according to TIKR, which is much higher than Paysafe. While Paypal’s organic revenue growth should be higher in 2022, Paysafe’s EBITDA margins are expected to be higher at 33 percent compared to 29 percent for PayPal.

Paysafe’s current pullback has rendered its valuation quite attractive compared to most of its payment processing peers. Therefore, it would make sense to bet on this play for an attractive entrance into the fintech space. When Paysafe announces its results for the first time as a public company in May, the market might take that opportunity to re-rate it higher.