The Paysafe IPO Is Here—Will It Sink in a Saturated SPAC Pool?

Fintech continues to gain steam, and Paysafe is a part of it, SPAC in tow. What an investors expect? Will the Paysafe IPO sink or swim?

March 30 2021, Published 2:41 p.m. ET

Global payments revenue is in the trillions, and Paysafe—a local acceptance payment solution company—is part of the movement. With one billion transactions processed across the globe, the company has reached it official SPAC merger date with Foley Trasimene Acquisition II Corp.

Is Paysafe (NYSE:PSFE) diving into an overly saturated arena or did Foley garner enough momentum in the lead-up to the reverse merger?

Paysafe could be a remnant of a potential SPAC bubble.

Despite the fact that Paysafe is backed by Blackstone and is expanding into the cryptocurrency market—both signs of potential—some wonder if the sheer volume of recent SPACs could be enough to squander the brand. However, Paysafe's monetary reality is a sturdy one that has only gotten stronger in recent months. The company hit a billion in revenue back in 2016 and has continued to grow.

Investors are showing interest in Paysafe already.

Starting for preferred investors at $15 per share on March 30, retail investors will soon be able to access the ticker on the NYSE. However, PSFE shares will surely fluctuate in value in the short term. One analyst valued the stock at as much as $23.53 using a PayPal stock comparison in addition to other computations. That's a 57 percent growth from the initial offering.

It isn't a surprise that there's a buzz surrounding the Paysafe IPO. The company has been on the cutting edge of fintech for the past 25 years. Headquartered in the Isle of Man (an island situated in the Irish Sea), the company is spearheaded by CEO Philip McHugh and maintains a multinational reach.

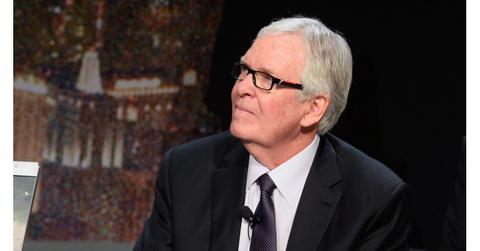

Bill Foley is excited for the Paysafe deal closure.

Meanwhile, Bill Foley heads the acquisition corporation that merged with Paysafe. Foley, who also owns the professional ice hockey team Vegas Golden Knights and chairs Fidelity National Financial, really believes in Paysafe's reach.

In a CNBC interview, Foley spoke with Jim Cramer about his SPAC's deal with Paysafe. Foley told Cramer, "We basically searched 300 different companies, identified roughly 10–15 that we were really interested in, and Paysafe was right at the top of the list."

Because Blackstone backs Paysafe, Foley had to make deals with it as well, which makes this a merger with numerous touchpoints. He says that he prioritized companies that were sizable enough to match up with the SPAC's existing capitalization.

"Paysafe in particular is ubiquitous. It's just everywhere in terms of the gaming world, digital wallets, e-cash solutions," said Foley.

In all, Foley's deal with Paysafe is a logical move. There's a looming reality of the overabundant SPAC market, but Paysafe's reach and success puts both the company and its reverse acquirer in a solid position, especially in an arena of unproven startups.

When will Paysafe IPO stock become available?

PSFE shares will soon be available beyond the preferred and institutional market. However, the prices might be unpredictable for the near term. It's common practice to place a stop-loss order for any new IPO shares to help you avoid buying the peak.