If the Federal Tax Withheld Box Is Left Blank on Your W-2, This Is Why

You may have noticed that he federal tax withheld box (Box 2) is blank on your W-2 form. Here's what that means.

Feb. 2 2022, Published 7:31 a.m. ET

Your W-2 is a document completed by your employer outlining the information to be used when filing your taxes. There are several boxes on a W-2, all of which mean something different. If the federal tax withheld box (Box 2) is left blank on your W-2 form, it means you had no federal income tax taken out of your paychecks.

Below, you’ll find a few reasons your employer may not have taken out federal income tax from your paychecks for the year.

Understanding your paychecks and the reason no federal tax was withheld

When you receive a paycheck, it’s usually for a smaller amount than what you actually earned. This is because your employer applies certain deductions. Social Security and Medicare tax are two deductions that reduce the amount you receive each pay period. You’ll find the total amount of Social Security and Medicare tax withheld from your paycheck in Box 4 and 5 on your W-2.

Currently, employees are subject to a 6.2 percent Social Security tax and a 1.45 percent Medicare tax. Another deduction that's applied to each of your paychecks is federal tax.

The amount of federal tax withheld from each of your checks depends on the state you live in and how much you make. If your employer doesn't take any federal tax out of your paychecks, it's likely for one of the following reasons.

Your federal tax withheld box may be blank if you claimed “exempt” from withholding on your Form W-4

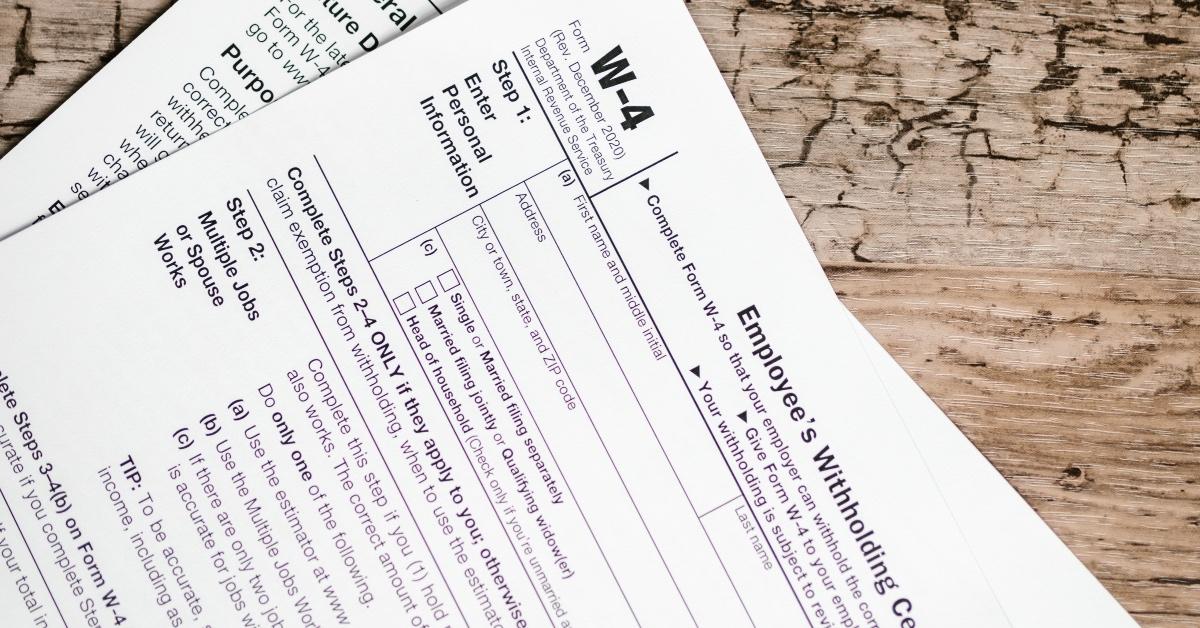

A Form W-4 is a tax document you fill at the time of hiring, though it can usually be modified at any point during the year. Form W-4, also called an Employee’s Withholding Certificate, allows you to adjust the amount of federal tax you want withheld from your paychecks. The more you request to be withheld, the larger your paycheck will be.

If you claim “exempt” on your W-4, no federal income tax will be withheld from your paycheck. This will result in your federal tax withheld box (Box 2) being left blank on your W-2. Now, if you claimed deductions in Step 4(b) when filling out your Form W-4, this could also result in you having no federal tax withheld from your paycheck. It all depends on how much of a deduction you claimed on your W-4.

If you claimed deductions or selected “exempt” on your Form W-4 and no federal tax was withheld from your paychecks, you might owe taxes to the IRS when you file your taxes.

If you’re an independent contractor, your federal tax withheld box will be blank on your tax forms

Independent contractors or self-employed individuals generally don’t receive a W-2, but a 1099-MISC or 1099-NEC instead. Whereas these look similar to a W-2, they're only issued to those who perform work for others but aren't technically employed by them.

If Box 4 on your 1099-MISC or 1099-NEC was left blank, don’t panic, as this is customary for self-employed or independent contractors. Basically, this means that the person or company that paid you didn’t withhold any tax from your paychecks.

The good news is that you were able to take home your exact earnings. The bad news, however, is that you may be required to pay taxes on the income you earned for the year when tax time comes.

If your employer made a mistake while filling out your W-2, the federal tax withheld box may be left blank

If Box 2 is left blank on your W-2 and you didn’t amend Form W-4 so that less tax would be taken out of your paycheck, notify your employer. There's a chance your employer made a mistake when filling out your W-2, and if that's the case, you’ll want to get it corrected right away to avoid a large tax bill.