Why Rolls-Royce (RYCEY) Stock Is Falling, Could Recover Soon

Rolls-Royce stock is trading near its 52-week lows. Why is RYCEY stock falling and will it go back up in the second half of 2021?

June 30 2021, Published 8:39 a.m. ET

While there has been a smart recovery in most of the beaten-down cyclical and industrial stocks, and many of them have reached their pre-pandemic highs, Rolls-Royce (RYCEY) stock continues to sag. The stock is trading near its 52-week lows. Why is RYCEY stock falling and will it go up or fall more in the second half of 2021?

So far, Rolls-Royce stock is down 6.7 percent in 2021. The stock is underperforming the S&P 500 as well as the FTSE 100. The stock’s primary listing is on the London Stock Exchange where it trades under the ticker symbol “RR.”

Why Rolls-Royce stock is falling

There are a few reasons why Rolls-Royce stock is falling. First, there are still stringent travel restrictions in Europe and the regulations haven’t eased as much as the travel and tourism industry was hoping. This has led to a fall in European travel stocks including TUI.

While the U.K. has expanded its so-called “green list” for international travelers, it fell short of market expectations. Also, some of the European countries have tightened restrictions on travelers from the U.K. as the country battles the Delta variant of the coronavirus.

Will RYCEY stock recover?

RYCEY stock could recover in the second half of 2021. Multiple triggers could help the stock recover. From an earnings perspective, the company expects to become cash-flow positive in the second half of the year.

Rolls-Royce has taken several cost-saving measures and expects to realize annualized costs savings of 1.3 billion pounds (almost $1.8 billion). The company is also looking to sell ITP Aero and could realize $1.8 billion from the sale, which will help it shore up the balance sheet.

Rolls-Royce operates under three business segments—Civil Aviation, Power Systems, Defence, and ITP Aero. While the Civil Aviation segment has been struggling, the Defence segment has been doing well. The Defence segment reported sequentially higher revenues and profits in 2020.

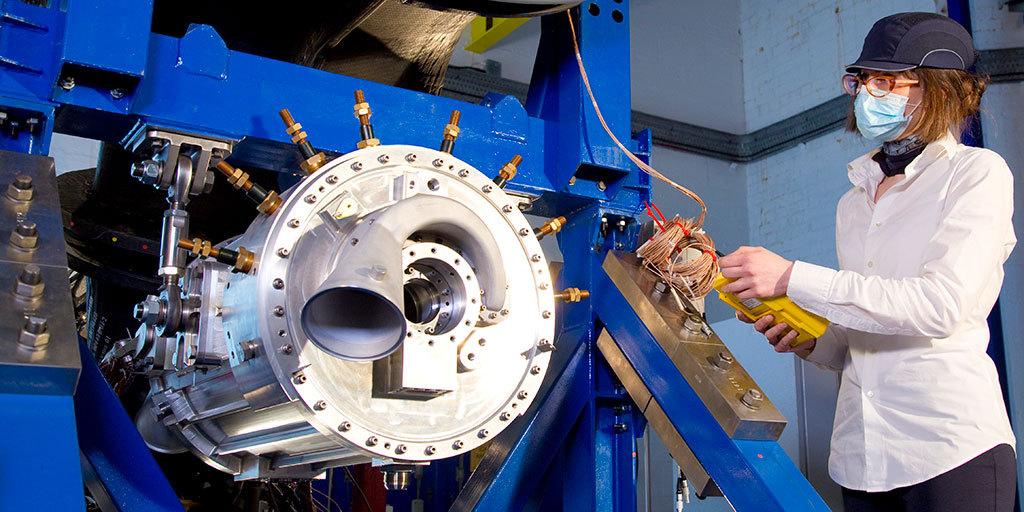

RYCEY has also been working to expand its ambit in the green economy and is testing a hybrid-electric propulsion system for aviation. It has also invested in Berlin-based startup Kowry Energy GmbH, which provides sustainable and decentralized energy systems.

Will Rolls-Royce stock go back up?

The COVID-19 pandemic has dealt a severe blow to Rolls-Royce stock. Its price action is reminiscent of the pain that the company has gone through. However, the stock might have bottomed out and could go up after it starts delivering on the many initiatives that it's taking.

The company’s Defence segment should continue to perform well and the Civil Aviation segment should report incrementally better results as the sector picks up. While airline stocks have recovered in anticipation of the rebound in air travel, Rolls-Royce stock has sagged.

RYCEY stock looks reasonably valued.

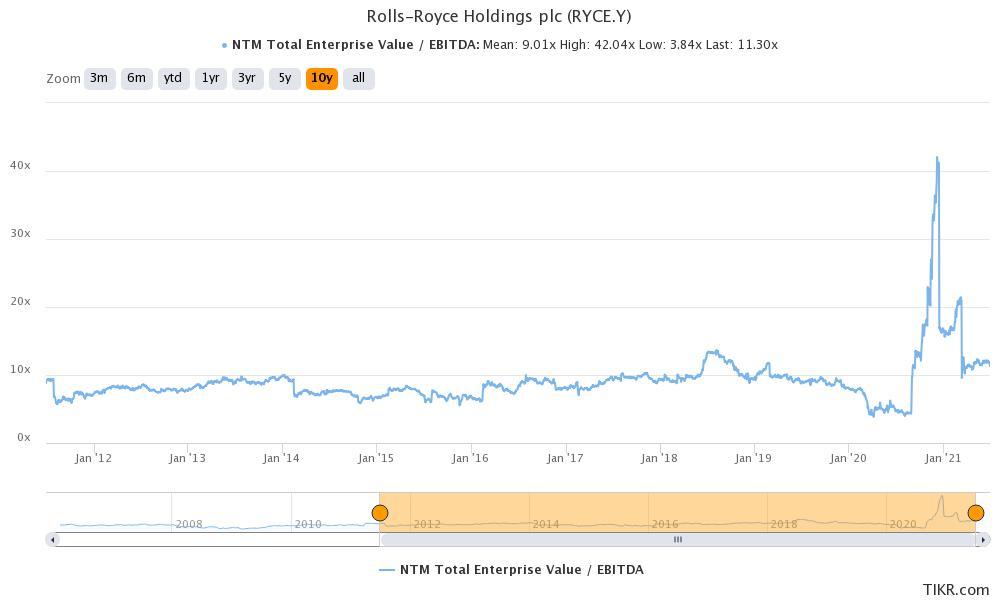

The divergence between aviation stocks and RYCEY might soon reverse and the stock could play a catch-up trade. Looking at the valuations, RYCEY stock trades at an NTM EV-to-EBITDA multiple of 11.3x, which seems reasonable. While the multiple is higher than the 10-year average of 9x, it's because of the depressed near-term earnings.

Rolls-Royce stock valuation

RYCEY stock trades slightly below the 50-day and 100-day SMA (simple moving average). If the stock can break above these, which currently stand at $1.50 and $1.52, respectively, we could see bullishness in the near term.