Rolls-Royce Is a Good Value Stock to Buy and Bet on Turnaround

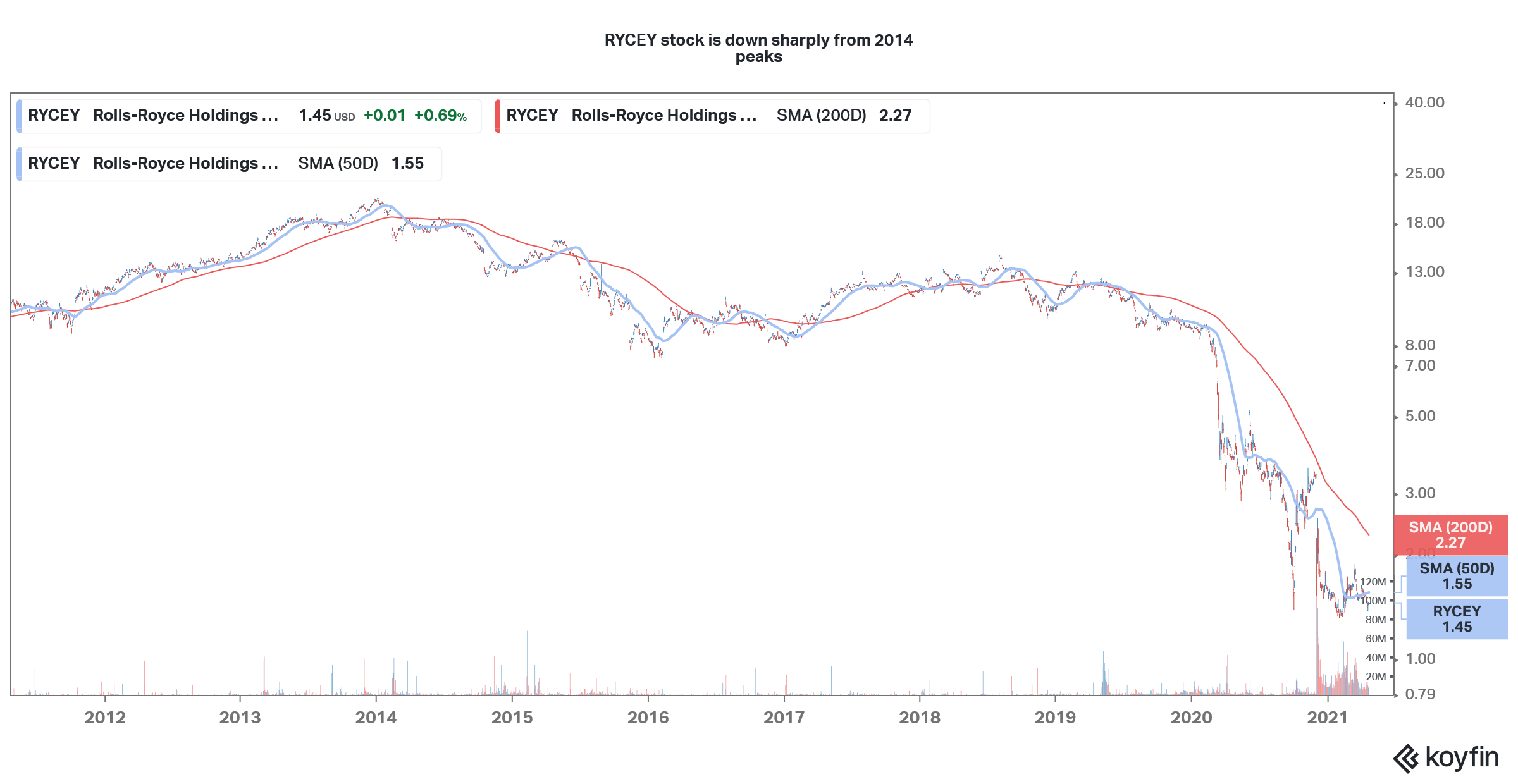

Rolls-Royce stock has been sliding after peaking in 2014. However, RYCEY could see better days and looks like a good turnaround value stock to buy.

April 26 2021, Updated 8:52 a.m. ET

So far, Rolls-Royce (RYCEY) stock is down 8.9 percent in 2021. The stock’s woes haven't ended even though many other beaten-down industrial names have recovered. However, RYCEY stock looks like a good value stock to buy now and bet on the turnaround.

To be sure, RYCEY’s woes didn't start in 2020. The stock has been falling since it peaked in 2014. The stock trades at only about 7 percent of what it used to trade in 2014. The stock fell sharply in 2019 and 2020 and is now down YTD in 2021 as well.

RYCEY stock outlook

To gauge the outlook for RYCEY stock, we’ll have to look at the forecast for its business segments. Rolls-Royce has three main business segments. Civil Aviation, its largest segment, accounted for 41 percent of the revenues in 2020. Unfortunately, the segment has also been impacted the most by the COVID-19 pandemic.

Defense, the company’s second-largest segment, accounted for 29 percent of its 2020 revenues. Power Systems is Rolls-Royce’s third-largest segment. For Rolls-Royce, 22 percent of its 2020 revenues came from the third segment.

Rolls-Royce will sell ITP Aero.

ITP Aero accounted for 6 percent of RYCEY's 2020 revenues. RYCEY has put the business on the block for sale and is expected to garner around $1.8 billion from the asset. However, the sale would have to be approved by the Spanish government. Reports suggest that the government might block the sale if the conditions aren't met.

The Civil Aviation segment bore the brunt when aircraft were grounded globally in 2020. Along with the sales of new engines, the segment also generates revenues from servicing aircraft, which is closely tied to flying hours. After the slump in 2020, the outlook for the civil aviation industry is cautiously optimistic.

RYCEY's long-term forecast and turnaround

In 2022, Rolls-Royce expects to generate positive free cash flows of over $1 billion. The forecast is based on the assumption that flying hours recover to more than 80 percent of the 2019 levels and widebody aircraft deliveries of between 200 and 250.

Also, RYCEY has raised considerable cash in 2020 that would help it survive the current slump. It has also managed to extend its debt maturity profile and most of its debt is maturing after 2025.

Rolls-Royce has also structurally lowered its cost base including through headcount reduction. This would mean structurally higher earnings for the company when it recovers from the current slump.

The company expects its Power System segment’s revenues to rise to 2019 levels by 2022 and expects margins to rise to 10 percent that year. The Defense segment also looks well placed as higher defense spending globally, including in the U.S. and Europe, would mean higher revenues for the segment.

Meanwhile, the Civil Aviation segment is a play on the post-pandemic economic recovery. While the COVID-19 pandemic is still far from over considering the spike in India and Brazil, the increasing pace of vaccinations would help address the situation in the medium term.

RYCEY looks like a good value stock to buy now

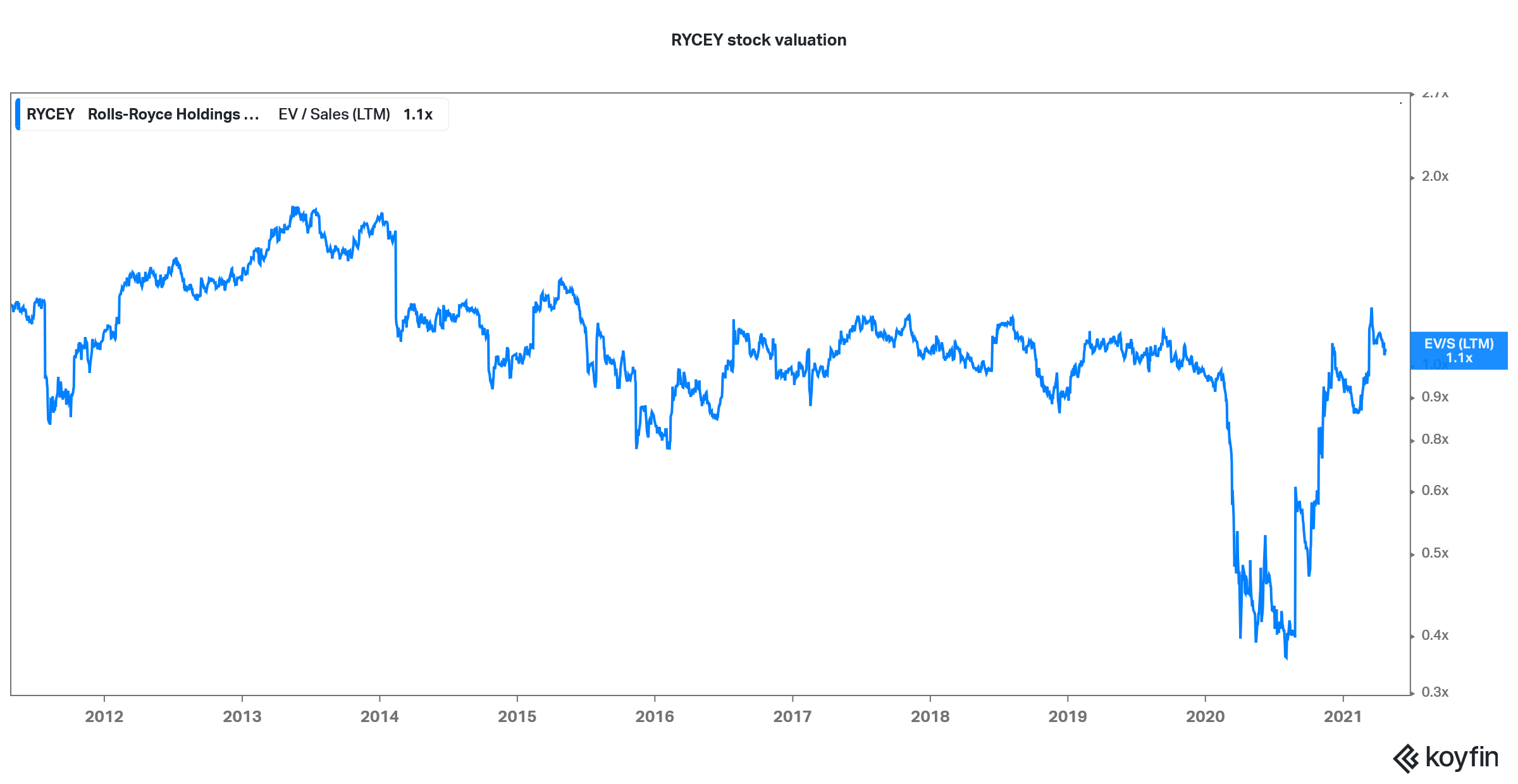

RYCEY stock trades at an NTM EV-to-sales multiple of 1.05x. The multiples look decent enough. Incidentally, while most other beaten-down value and industrial stocks have bounced back including OEMs like Boeing and Airbus, RYCEY hasn’t seen that kind of rerating.

However, the stock looks like a good way to play the recovery in the aviation sector, which should rebound after the conditions recover to a more normalized level. While there are risks of the COVID-19 pandemic stretching more than what the markets are currently envisioning, at the current prices, RYCEY looks like a good value stock to buy now and bet on the turnaround.