Warner Music Stock Is Rising Amid PSTH-Universal Music Merger News

Warner Music (WMG) stock was trading higher in the pre-market on June 4. Why is the stock rising and should you buy it now?

June 4 2021, Published 9:15 a.m. ET

Warner Music (WMG) stock was trading higher in the pre-market on June 4 even though stock futures point to a flat opening for the markets. Why is Warner Music stock rising and should you buy it now?

Warner Music went public in 2020 and priced the IPO at $25 per share. The IPO pricing range was $23–$26. Overall, 2020 was a red-hot year for the U.S. IPO market and most companies priced the IPOs above the expected range.

Warner Music stock has delivered good returns since the IPO.

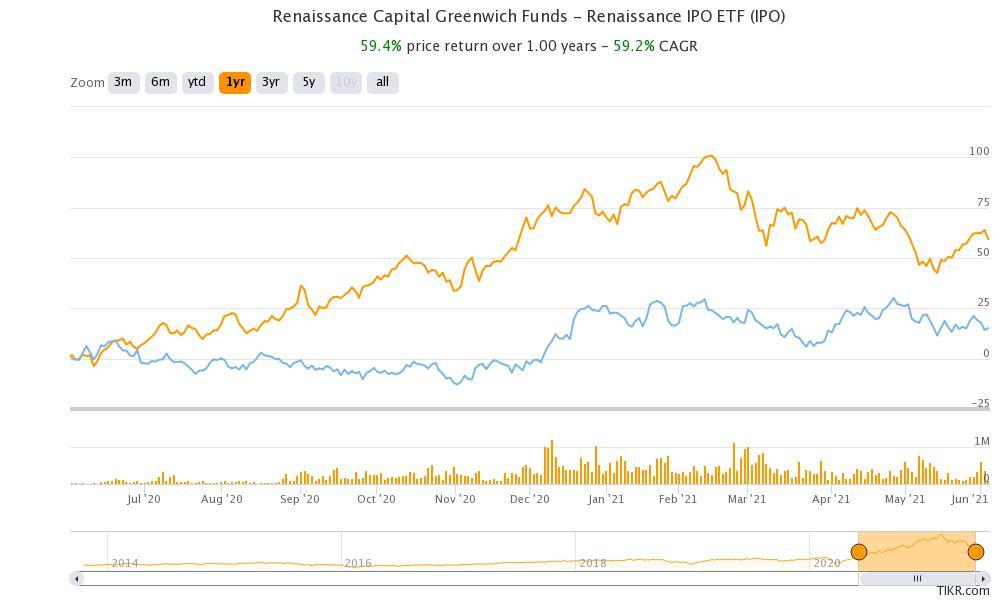

Warner Music stock rose over 20 percent on its listing and closed at $30.12. The stock hit a 52-week high of $39.61. Currently, the stock is down 12.4 percent from the 52-week highs. However, it's up over 38 percent from the IPO price. While the absolute returns might look good, the stock has underperformed the Renaissance IPO ETF, which is up 59 percent over the last year.

Warner Music stock versus Renaissance IPO ETF

Music stocks haven't been popular with the markets since Warner Music listed. If 2020 was the year of growth and tech stocks, value and cyclical stocks are outperforming in 2021. Unlike the high-flying IPOs in 2020 which have gone through a boom-bust cycle, WMG stock has been a steady performer.

WMG stock forecast

According to the estimates from CNN Business, WMG stock has a median target price of $41.50, which is a premium of 19.6 percent. Its lowest target price of $34 is a discount of 2 percent, while the highest target price of $48 is a premium of 38 percent.

Analysts have mixed ratings on WMG stock. It has seven buy and eight hold ratings. One analyst has rated the stock as a “sell.”

Why is Warner Music stock rising?

While Warner Music has been a steady stock, it's up sharply in the pre-market on June 4. I don’t see any particular news about the stock per se. However, there's a piece of related news that Bill Ackman’s Pershing Square Tontine Holdings (PSTH) is in talks to take Universal Music public.

The transaction values Universal Music at a 2020 EV-to-sales multiple of 4.6x. Warner Music Group is valued at an LTM EV-to-sales multiple of 4.45x. Over the last year, we’ve seen a rerating on stocks whenever a new company in the industry decides to go public.

Recently, there was a spike in Churchill Capital IV (CCIV) stock—the SPAC that’s taking Lucid Motors public. The spike wasn’t due to any company-specific news but rumors that Rivian plans to go public.

Also, since we live in a relative world, a lot of companies going public have benchmarked their valuation versus their listed peers. For example, Lucid Motors compared its valuation to that of Tesla Motors while announcing the merger with CCIV.

Overall, the rise in WMG stock on June 4 appears to be due to the news of the PSTH-Universal Music merger. There aren’t a lot of pure-play music companies. Companies like Sony also have other businesses which make comparisons with WMH and PSTH difficult.

Will WMH stock rise more?

If the PSTH-Universal Music merger goes through, we could have a listed peer for WMH. The stocks could trade in tandem. From a standalone valuation perspective, WMH trades at an NTM PE multiple of 38.6x. The company has a strong cash flow generation capacity and the NTM price-to-cash flow multiple is 21.9x.

WMH stock looks reasonably priced and could rise more. The listing of Universal Music, if it were to happen, will also provide an impetus to the stock.