All Crypto Is Down in 2022, More Downside Likely in the Near Term

Almost all the cryptos including Bitcoin have crashed in 2022. Why is all crypto down and is the worst yet to come? Here's what investors can expect.

May 10 2022, Published 8:20 a.m. ET

Cryptocurrencies are quite volatile and drawdowns of 50 percent from the peaks aren't uncommon, at least for the smaller cryptos. However, over the last six months, the total crypto market cap has plunged by more than half.

The total crypto market cap exceeded $3 trillion in November 2021 but has now fallen below $1.5 trillion. Bitcoin has also lost over 50 percent from its peaks and is at the lowest price level in almost a year. Most of the cryptos have crashed in 2022. Why is all crypto down and is the worst yet to come?

Why is all crypto down?

There has been a sell-off in risk assets. No matter how much crypto bulls would portray digital assets as an alternate asset, they have time and again shown that they have a high correlation with stocks.

As investors would recall, crypto plunged in the first quarter of 2020 amid the broader market sell-off. As stocks started to recover from their March 2020 lows, so did cryptos.

There's a strong correlation among cryptos.

Just like stocks, there's a strong correlation in the price action of cryptos as well. The broader market sentiments play a big role in the price movement in cryptocurrencies. When the market sentiments are poor, like they are in May 2022, the entire crypto market plunges. Similarly, when the sentiments are positive, we see a rally in most cryptocurrencies.

Why have cryptos been falling in 2022?

There has been selling pressure in growth companies, speculative names, as well as cryptos amid the Federal Reserve’s monetary policy tightening. The Fed has made it clear that bringing down inflation is its key priority. The easy money party that markets got accustomed to over the last two years is now ending.

The easy money was fueling the rise in many speculative assets. Now with the driving force behind the rally fizzling away, cryptos have seen a selling spree. Also, central banks and governments globally have been looking to crack down on cryptos in one form or the other. Even in the U.S., President Joe Biden has issued a White Paper calling upon different federal agencies to study digital assets.

Investor interest in cryptos has also been falling.

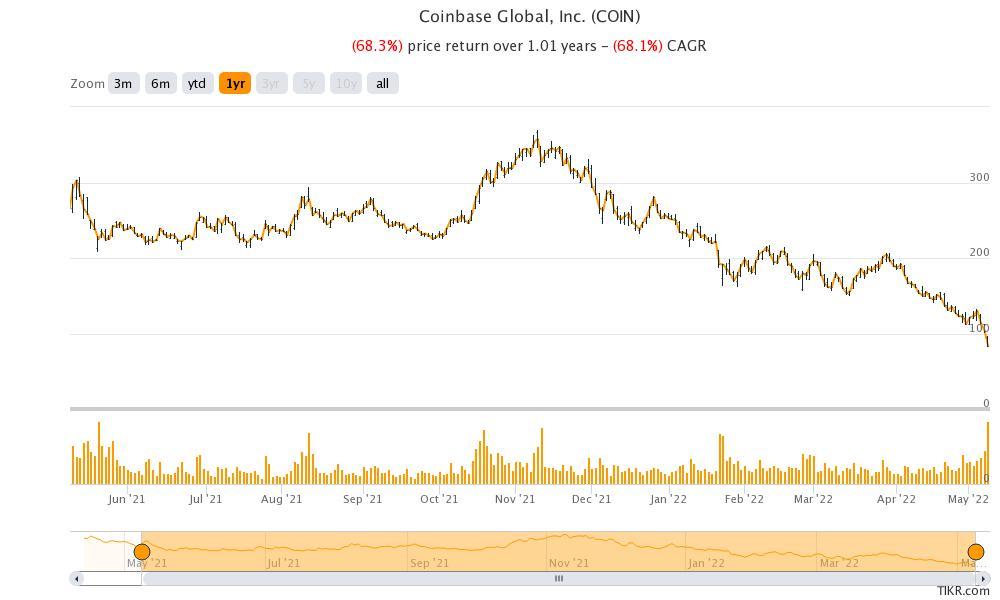

Investor interest in cryptos has also been falling, which is reflected in lower trading volumes. Robinhood reported a sharp fall in its cryptocurrency trading volumes in the first quarter of 2022. Coinbase has also been battling lower volumes. Coinbase stock has fallen to an all-time low, which is a reflection of the broader pessimism towards digital assets.

Cryptocurrencies might continue to remain under pressure.

Looking at the current macro factors, cryptocurrencies might continue to remain under pressure. Crypto bulls saw massive money printing by central banks as a key bullish driver for the market. Now, with central banks globally looking to unwind their accommodative monetary policy, one of the key bullish theses for cryptos is withering away.

As interest rates continue to rise globally, we could see further downside in risk assets, especially cryptos. The market still doesn't seem to have bottomed out and investors should brace for more pain in the near term.