GMBL Stock Looks Like a Good Bet for Long-Term Investors

Esports Entertainment (GMBL) is up 150 percent YTD. Why is GMBL stock rising and is it a good stock for investors to buy now?

April 9 2021, Published 9:47 a.m. ET

Esports Entertainment (GMBL) stock rose 3.5 percent on April 8 and was trading higher in pre-market on April 9. The stock is up 150 percent YTD even though it has fallen almost 35 percent from the 52-week highs. Why is GMBL stock rising and is it a good stock to buy now?

Esports Entertainment is an online gambling company that focuses on esports wagering and gaming for adults. The company is focusing on organic and inorganic growth. It has acquired Esports Gaming League, which will help fuel its growth.

Why GMBL stock is rising.

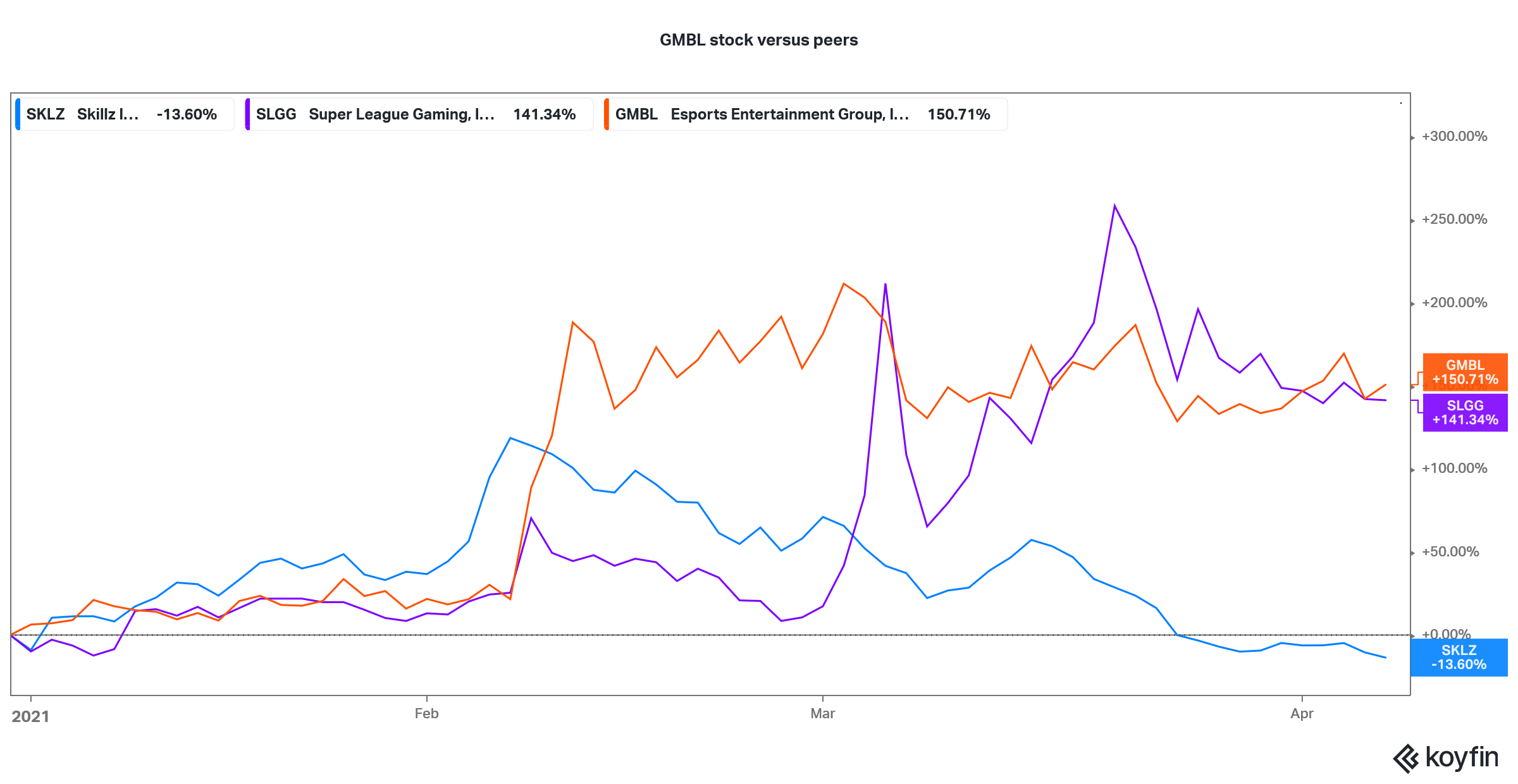

There has been a broad uptrend in esports gaming stocks. Super League Gaming (SLGG) is also up 141 percent YTD. However, Skillz (SKLZ) is down 13.6 percent. GMBL capitalized on the rise in its stock price to raise more cash by issuing shares. Many companies have adopted this strategy and raised cash to fund their growth.

GMBL stock YTD returns versus peers

Esports Entertainment's major acquisitions

GMBL completed the acquisition of Esports Gaming League and online casino operator Lucky Dino Casino in 2021. In 2020, it acquired online sports betting company Argyll Entertainment. The company expects to complete the merger with ggCircuit and Helix eSports early in the second quarter of 2021.

Is GMBL a good stock to buy?

In February, while proving the business update, GMBL raised its revenue guidance for fiscal 2021 to $18 million from the previous guidance of $13 million. The company also raised its fiscal 2022 revenue guidance to $70 million, which is significantly higher than its previous guidance of $42 million. GMBL expects to become EBITDA positive in fiscal 2022.

After the acquisition of Lucky Dino, GMBL expects its monthly cash burn to fall to $0.6 million from the current run rate of $0.9 million. Also, the company has enough cash to bridge its cash burn, while also spending on growth through acquisitions.

From a valuation perspective, GMBL stock is valued at 4.6x its forecasted fiscal 2022 revenues. The multiples don’t seem that high considering the fact that the company expects its revenues to almost triple between fiscal 2021 and fiscal 2022.

If you are a growth investor, GMBL looks like a good stock to buy. Meanwhile, it would also be prudent to look at peer valuation to get a better idea about whether GMBL stock is undervalued.

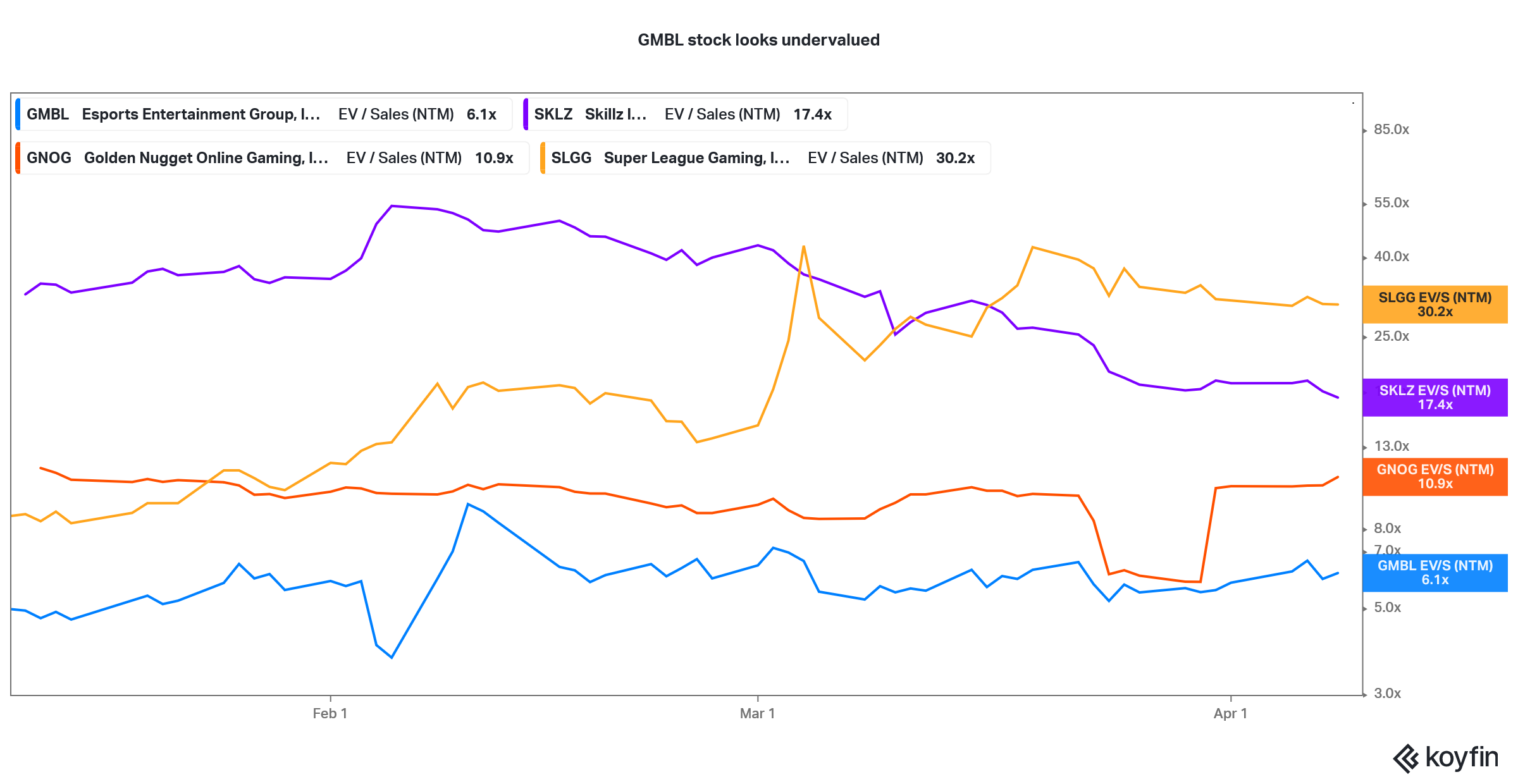

GMBL stock's valuation compared to its peers

GMBL stock trades at an NTM EV-to-sales multiple of 6.1x. In comparison, Super League Gaming, Golden Nugget, and Skillz trade at an NTM EV-to-sales multiple of 30.2x, 10.9x, and 17.4x, respectively.

Looking at the growth outlook, analysts expect Skillz’s revenues to rise 60 percent in 2021, while Golden Nugget’s revenues are expected to rise about 50 percent in the year. Both of these companies are growing their revenues at a slower pace than GMBL. However, they attract a higher valuation. GMBL stock looks undervalued compared to its peers based on the growth outlook and valuation multiples.

GMBL stock looks undervalued

GMBL target price

According to the estimates compiled by CNN Business, GMBL has a median target price of $20, which is a premium of 25.6 percent over the current prices. The stock’s highest target price is $30. All four of the analysts covering the stock have a buy or equivalent rating.

To sum it up, Esports Entertainment stock looks worth your money and worth betting on at these prices. It could be a good and relatively undervalued play on the fast-growing online gambling market.