23andMe Is Going Public, IPO Expected in the Second Quarter

23andMe is going public through a merger with Sir Richard Branson's VGAC SPAC in the second quarter of 2021. When is the IPO date?

Feb. 5 2021, Updated 8:37 a.m. ET

As the demand for genetic testing continues to grow, 23andMe plans to join the publicly traded companies in the field. Talks about the company merging with a SPAC led to an official agreement.

23andMe announced that its upcoming IPO that will take place through Sir Richard Branson’s Virgin Galactic Acquisition Corp. (VGAC). It’s a blank-check company that formed specifically to raise capital through an IPO in order to acquire another company. With a combination of stock and cash financing, the deal will give 23andMe an enterprise value of $3.5 billion.

23andMe is a legit company

23andMe aims to provide a better understanding of the human genome, largely through direct-to-consumer DNA testing. Users can send their samples to the company and learn personalized information about their ancestry, traits, and genetic health risk factors.

The company is unique because it has received multiple FDA clearances for health and carrier status reports available over-the-counter.

Some people have legitimate concerns about privacy and data collection. Sometimes, DNA testing companies share data with pharmaceutical companies and law enforcement agencies. 23andMe said that it never uses or shares information without consent.

Optional participation by customers in genetic research has led to genetic insights. For research purposes, all personal data is kept anonymous. Research participation with 23andMe allows you to “join forces with millions of other people contributing to science.”

23andMe versus Ancestry

In the past, at-home DNA tests cost $1,000, but companies like 23andMe and Ancestry have made the process simpler and cheaper. In 2017, 23andMe was the first DNA testing company to get FDA approval for risk screening for diseases including Alzheimer’s and Parkinson’s.

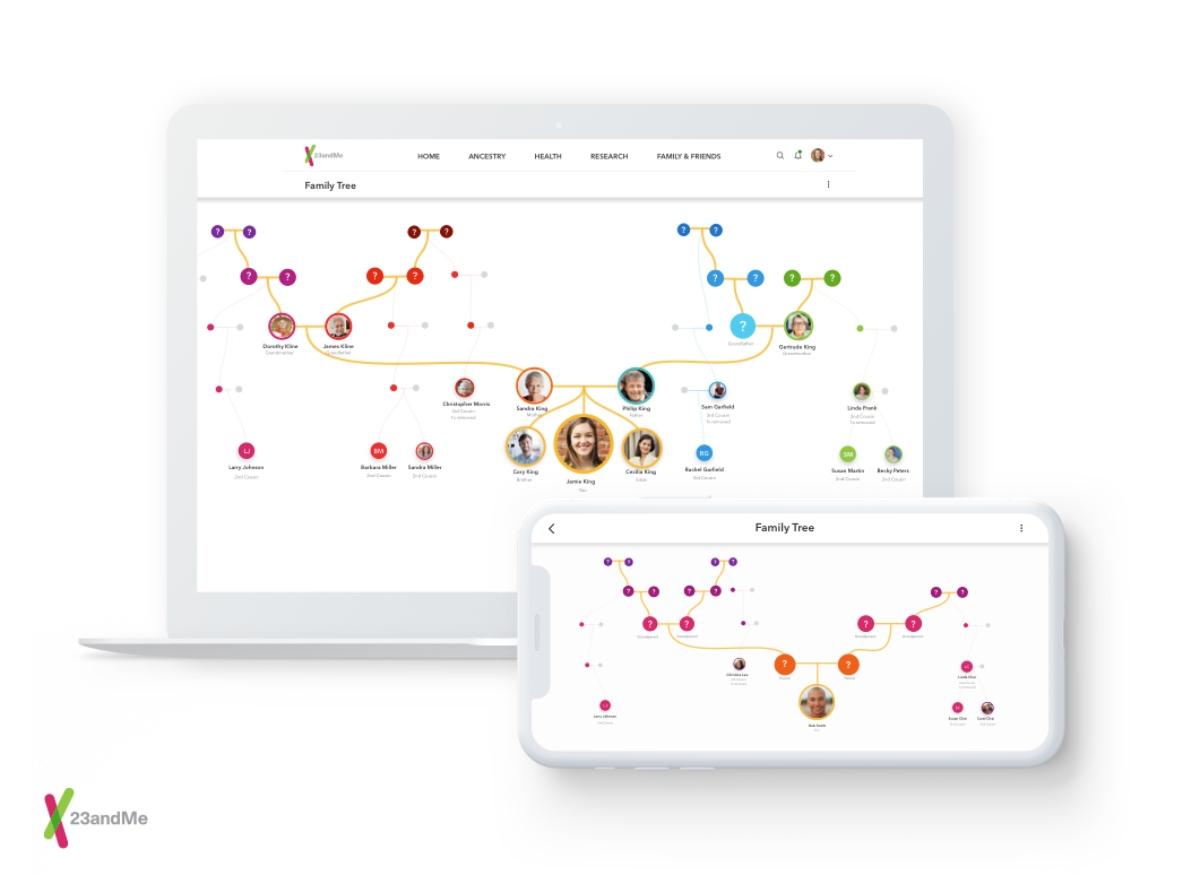

23andMe Family Tree Example

23andMe and Ancestry offer similar genetic testing to discover insights into family history and health indicators. Recently, CNET ranked 23andMe as the best genetic testing option for beginners. CNET said that AncestryDNA offered better integration of genetic analysis with historical research.

When is 23andMe going public?

Sources say to expect the merger to be finalized sometime during the second quarter of 2021. The details of the deal include $25 million apiece contributed to a PIPE investment by both Branson and 23andMe CEO Anne Wojcicki, along with institutional investors.

$509 million in cash in VGAC’s trust will be added to the $250 million from the PIPE priced at $10 per share. The gross proceeds from the transaction will be $759 million.

23andMe and Sir Richard Branson’s SPAC

Billionaire Sir Richard Branson expressed strong support of 23andMe and the coming merger in a press release. He said, “Of the hundreds of companies we reviewed for our SPAC, 23andMe stands head and shoulders above the rest.” He cited the company’s potential to positively impact many more lives in the future.

Wojcicki, the founder and CEO of 23andMe, said that the company wants to help people be more proactive about their health. “Through a genetics-based approach, we fundamentally believe we can change the continuum of healthcare.”

How to buy 23andMe stock

Currently, the SPAC is listed as "VGAC" on the NYSE. After the IPO, retail investors will be able to buy shares of 23andMe through the new ticker symbol "ME."