Voyager Digital (VYGVF) Stock Might Rise More in 2021

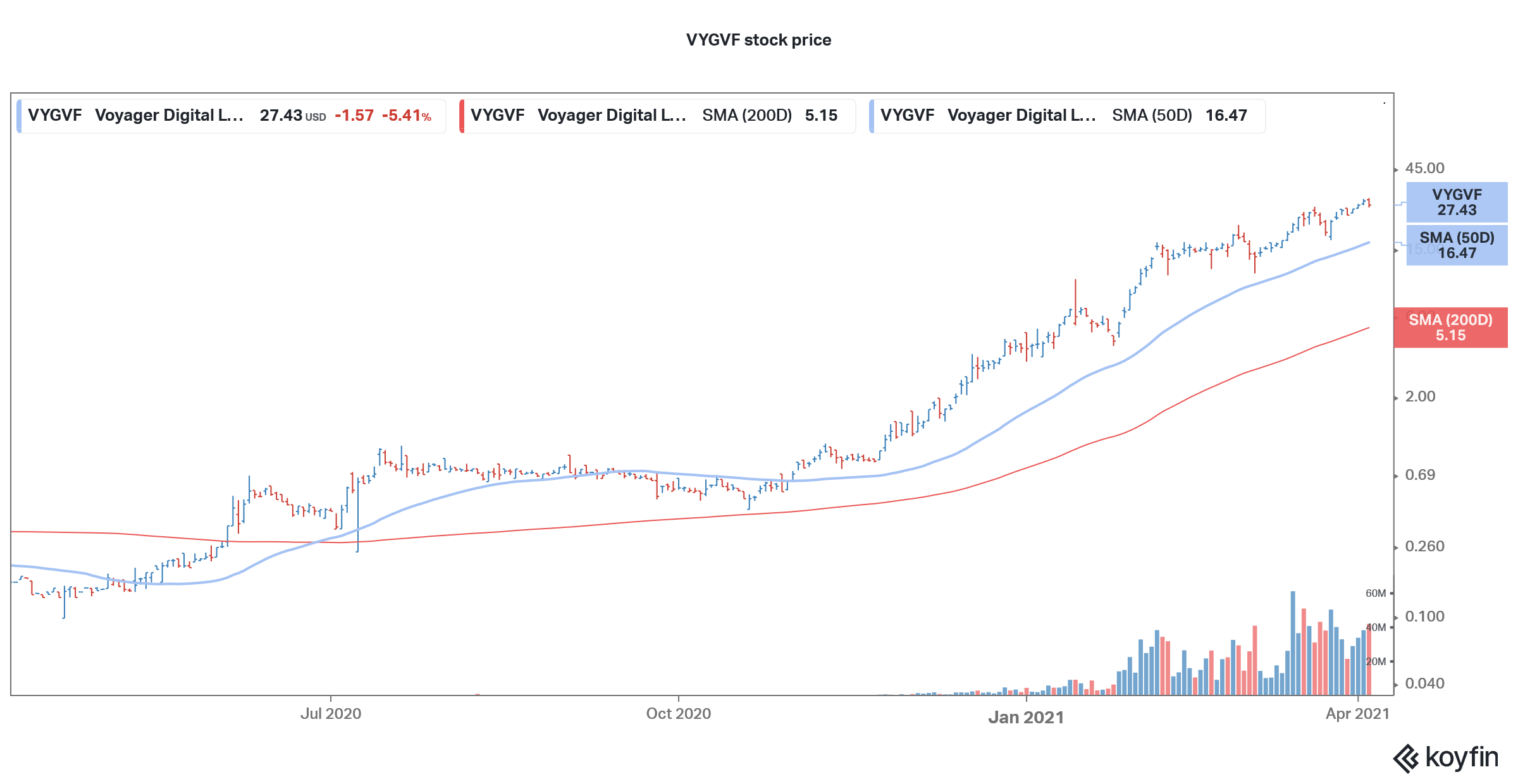

So far, Voyager Digital stock is up 603 percent in 2021. What’s the forecast for VYGVF stock in 2021 and will it rise more?

April 7 2021, Published 10:03 a.m. ET

So far, Voyager Digital stock is up 603 percent in 2021. The stock made its 52-week high of $30.20 on April 6 but closed down 5.4 percent at $27.43. What’s the forecast for VYGVF stock in 2021 and will it rise more?

The last year has been phenomenal for cryptocurrencies. Prominent companies like Square and Tesla have embraced and invested in bitcoins. There has been increased adoption and acceptance of cryptocurrencies as an alternative asset class. Since bitcoin prices have surged over the last year, investors have piled up the stocks of other cryptocurrency plays.

Voyager Digital is a cryptocurrency broker.

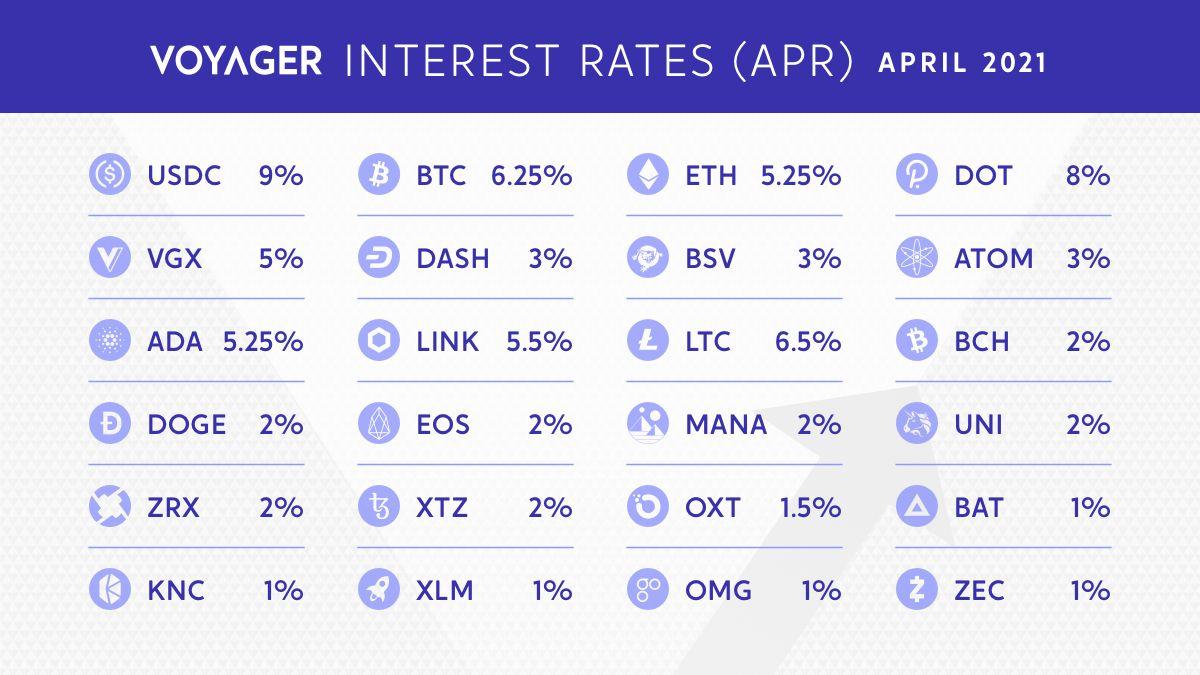

Voyager Digital is a cryptocurrency broker. It lets users buy various digital assets on the platform. Voyager Digital has over 50 digital assets on its platform and offers attractive interest rates on 24 of them. For April, it offers a 9 percent APR on USDC, which is the highest on the platform. Voyager Digital offers 8 percent on Polkadot and 5 percent on its own Voyager Token.

Voyager Digital is a publicly-traded company on the OTC exchange.

Voyager Digital is a publicly traded company that trades on the OTC exchange. While trading volumes can be a concern on the OTC markets, the average trading volumes for VYGVF stock are healthy at 1.5 million.

VYGVF's March business update

On April 6, VYGVF provided its business update for March. Voyager Digital has over 1 million verified users on its platform, while 270,000 of these were funded accounts. In March, its total AUM was above $2.4 billion.

In March, the company reported net deposits of $650 million compared to $400 million in February. Voyager Digital had 95,000 new funded accounts in March compared to 70,000 in February. The new verified accounts also jumped from 190,000 in February to 395,000 in March.

VYGVF stock has a bullish forecast.

Analysts' target price suggests a bullish forecast for VYGVF stock. In March, Stifel Nicolaus boosted the stock’s target price from $30 to $55. The brokerage’s target price implies an upside of more than 100 percent over the current prices. In January, HC Wainwright initiated coverage on the stock with a buy rating.

All three analysts covering the stock have a buy or equivalent rating on the stock. Wall Street seems bullish on VYGVF stock given its exposure to the crypto trading market and its strong growth.

Voyager Digital as a long-term investment

In 2021, a lot of companies have used the rise in their stocks to raise capital by selling shares. Voyager Digital also followed a similar strategy. However, it didn't go for a public issue. Instead, it opted for a private placement of shares at $13.10 per share to raise $100 million.

VYGVF stock price has soared

Voyager Digital would use these funds to invest in its fast-growing business. It has a big market opportunity ahead of itself. The company is also looking at geographical expansion, new product launches, and increased penetration in existing markets and products. Voyager Digital is enhancing its existing infrastructure to cater to the increasing demand.

Interestingly, while growth stocks have been under pressure over the last month amid rising bond yields, we haven’t seen a sell-off in VYGVF stock. In contrast, the stock has been rising to new highs. The stock looks like a good stock to hold for the long term given the strong growth and market opportunity.

Analysts expect the company’s revenues to rise 162 percent YoY to $352 million in fiscal 2022, which would end on June 30, 2022. The company’s current market capitalization is $3.54 billion, which would mean a price-to-sales multiple of around 10x in fiscal 2022. The multiples seem reasonable looking at the explosive growth.