VFF Stock Will Likely Continue Its Rally as Marijuana Stocks Soar

Village Farms (VFF) stock is up sharply in 2021. What do analysts forecast for VFF stock in 2021 and will its good run continue?

Feb. 11 2021, Published 8:29 a.m. ET

Marijuana stocks have risen sharply since the U.S. presidential election in November 2020. Village Farms (VFF) stock has gained 91 percent YTD and is up 287 percent over the last year. What do analysts forecast for VFF stock in 2021 and will its good run continue?

Village Farms stock isn't a pure-play marijuana company like Tilray and Aurora Cannabis. It's a Canada-based greenhouse produce company. It diversified into the marijuana industry through its subsidiary Pure Sunfarms.

Marijuana stocks have been in an uptrend

There has been a broad-based rally in all marijuana companies this year. The Democrats took control of the U.S. Senate in January, which raised the hopes of federal marijuana legalization. Earlier this week, Virginia became the 16th U.S. state to legalize adult-use marijuana.

In November, four U.S. states voted to legalize adult-use marijuana. The positive earnings report from Canopy Growth, where it talked about sales growing by 40 percent–50 percent between fiscal 2022 and fiscal 2024, also help buoy sentiments in the marijuana industry.

Why Village Farms stock is rising

Along with the broader uptrend in the marijuana space, some company-specific factors are also at play in VFF stock’s rally. On Feb. 8, the company announced that it has fully repaid the promissory note related to its acquisition of Pure Sunfarms. The company also announced that it has increased its investment in Altum International to 10 percent. Altum is an Asia-based cannabinoid company and VFF held a 6.6 percent stake in the company.

Analysts' projections for VFF stock

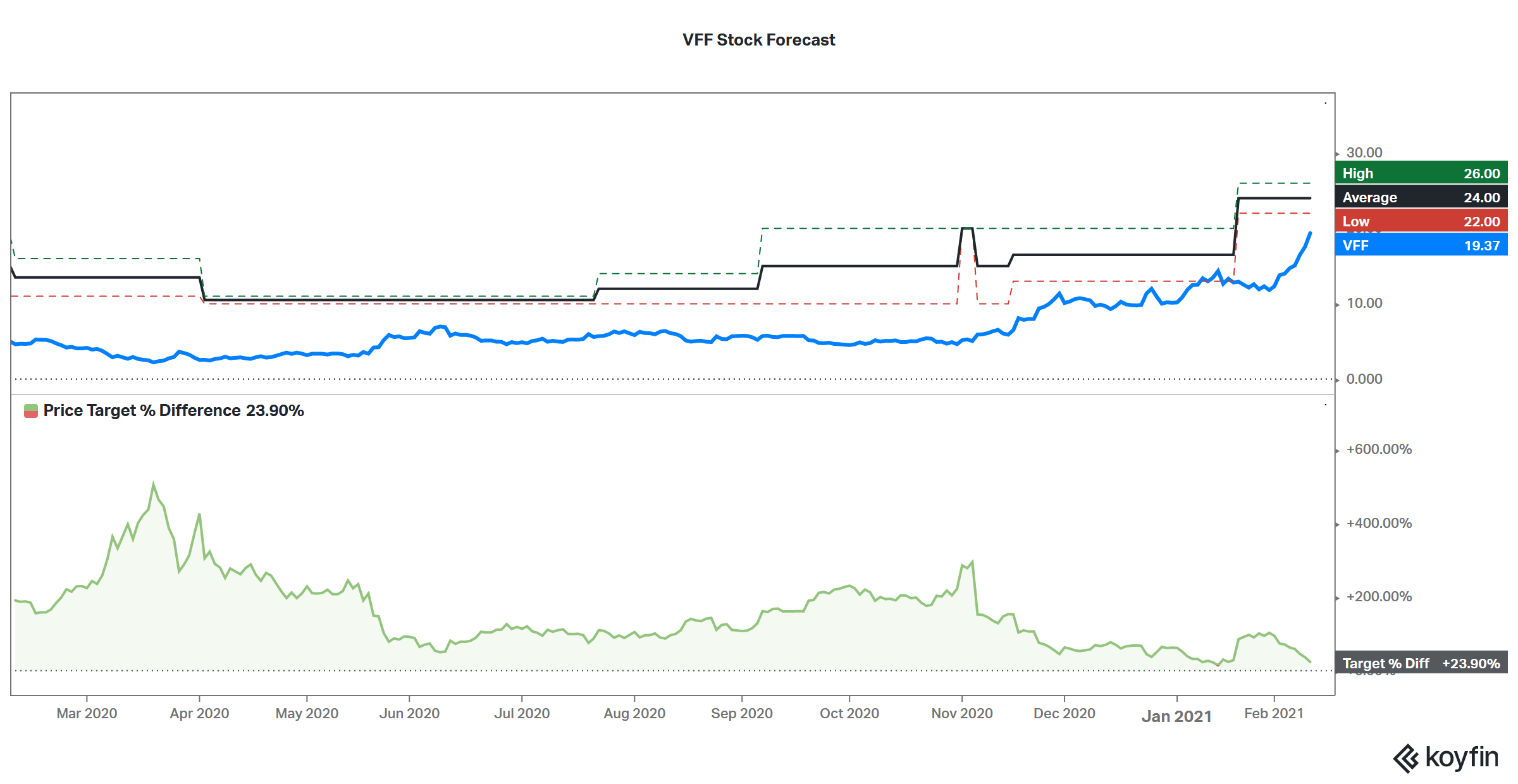

Most marijuana stocks are trading far ahead of their target prices. While their stock prices have spiked over the last four months, analysts’ target prices haven't kept pace. The average target price for VFF stock is $24, according to the estimates compiled by Koyfin. The target price represents a potential upside of about 24 percent from the closing prices on Feb. 10.

Village Farms is set to join the league of marijuana companies that are trading above their target prices. VFF stock is up almost 12 percent at $21.71 in pre-market trading on Feb. 11.

Should you buy or sell VFF stock?

The marijuana industry has been rerated by the markets because investors are bullish on the legalization story. While VFF isn't a marijuana stock in a strict sense, it has exposure to the industry. The company is betting heavily on marijuana sales for its growth.

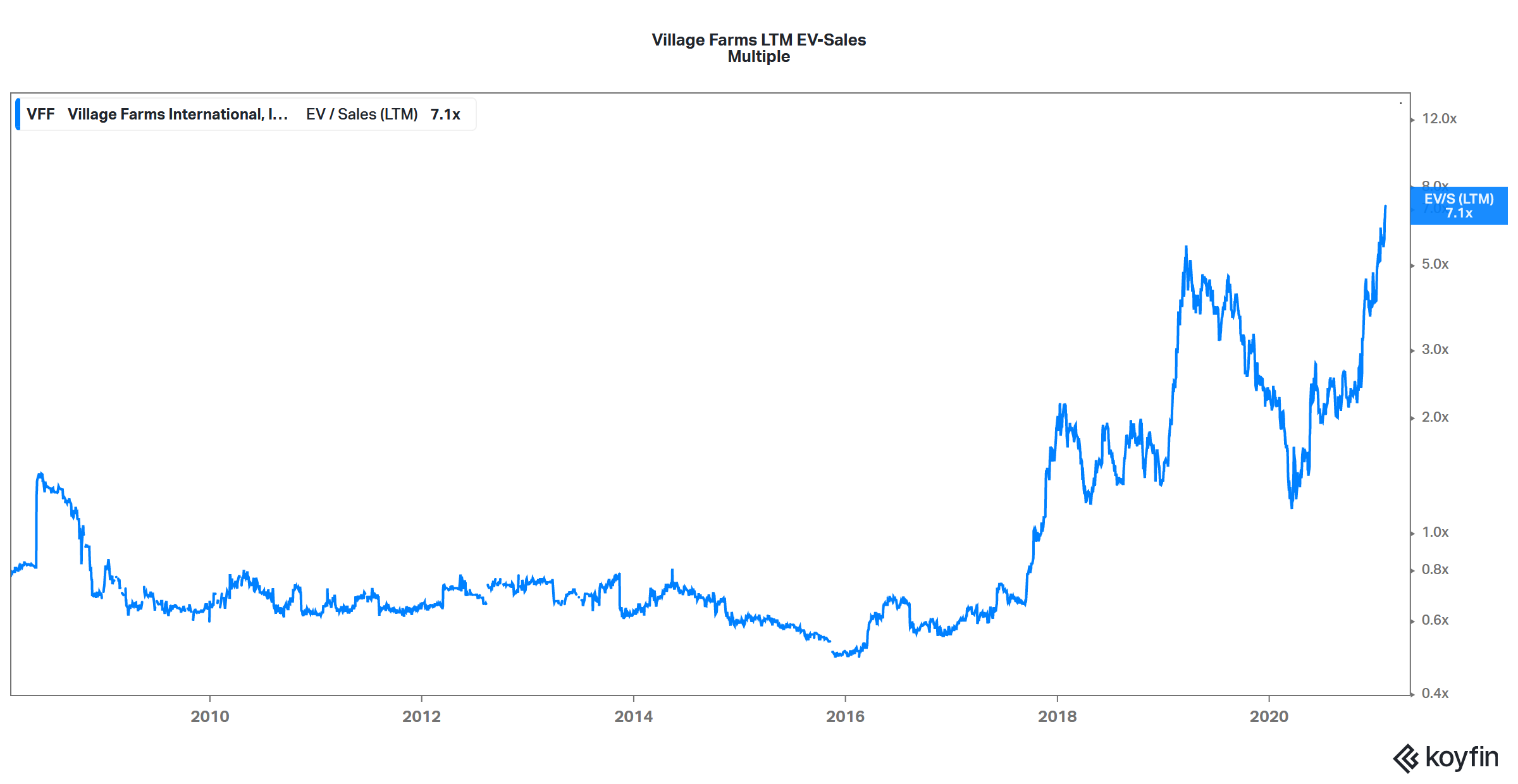

However, investors should also be mindful of VFF's soaring valuations. The stock trades at an NTM EV-to-revenue multiple of 5.96x, which is way above its historical multiples. Also, the stock’s valuation multiples are the highest that they have ever seen.

Markets seem to be valuing VFF stock as a marijuana company from a greenhouse agricultural products producer. Most of the rerating probably already happened, which is visible in the stock’s recent price action.