VanEck’s Russia ETF Almost Became the Next Meme Stock for Contrarian Investors

The VanEck Russia ETF (RSX) is the center of attention for many meme stock traders. But the run won't last as Russia’s deadly invasion of Ukraine rolls on.

March 3 2022, Published 12:06 p.m. ET

ETF manager VanEck isn’t a stranger to meme stocks. In fact, its Social Sentiment ETF (BUZZ) focuses on just that: retail traders making trades not on fundamentals, but the sentiment of trading peers. Recently, meme stock traders have targeted a more covert place for their sentiment-based trades: the VanEck Russia ETF (RSX).

RSX has fallen off a cliff in the last month as traders are divesting from Russian securities. However, meme traders proved that even the most obvious bear runs aren't cut and dry. The Russia ETF is facing a frenzy of trading as investors seek to capture quick gains.

Russia ETF sees surprise boost in trading activity amid Ukraine invasion

In premarket trading on Mar. 3, RSX saw an 8.9 percent increase, with shares trading as high as $7.83 at market open. This comes after the ETF lost more than 70 percent of value in the previous two weeks.

The losses are a result of the Russia-Ukraine conflict and global sanctions on Russian assets. The recent surge in trading activity traces back to meme stock investors seeking to capture quick gains from the bottom. Trading volume reached 27 million on Mar. 2, about double the normal volume.

Despite meme stock traders digging into RSX, short-sellers are still on top. RSX shorts have reportedly earned investors nearly $300 million in profits year-to-date. To pad the ETF and shield its investors from Russian volatility, VanEck temporarily suspended any creation of new RSX shares.

While the ETF’s stock saw trading volume double, options contracts swelled even bigger, with 211,000 contracts traded (or quadruple the expected volume). Members of Reddit community WallStreetBets have been eyeing RSX for weeks, but the concept of war profiteering is not beyond them. Still, some are comfortable with launching trades or options contracts despite Russia’s deadly impact on Ukraine.

Details on the VanEck Russia ETF

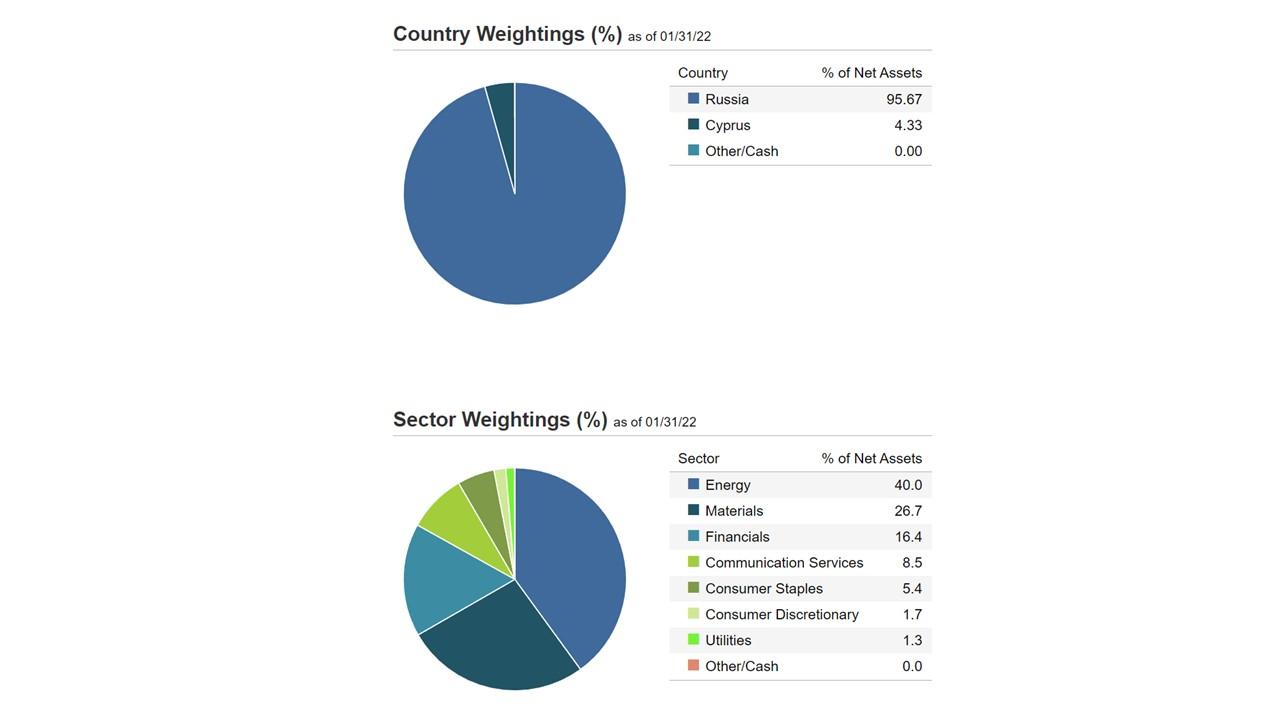

According to VanEck, RSX “seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS®Russia Index (MVRSXTR), which includes publicly traded companies that are incorporated in Russia or that are incorporated outside of Russia but has at least 50 [percent] of their revenues/related assets in Russia.”

The fund has a 0.61 percent expense ratio and rebalances quarterly with $124.1 million in total net assets. Options are available, meaning investors can trade puts amid RSX volatility.

Will the Russia ETF meme stock frenzy last?

Shortly after markets opened on Mar. 3, the Russia ETF is already seeing its meme stock frenzy dwindle. Shares fell 14.88 percent within the first half-hour of trading, eliminating any premarket gains. While some meme stock traders profited on gains, others are waiting to profit on puts as the ETF prepares to sink below the $6.00 mark. For the time being, RSX stock is halted, meaning any puts will have to be put off. If RSX continues its volatile streak, the ETF could become delisted.