These Trump-Linked Stocks Are in Focus Right Now

DWAC stock skyrocketed following a deal to take Trump’s media startup public. The focus has turned on other Trump-related stocks.

Oct. 26 2021, Published 6:43 a.m. ET

Digital World Acquisition Corp. (DWAC) is a SPAC run by former Deutsche Bank trader Patrick Orlando. DWAC stock price skyrocketed from $10 to $175 in just a few days following the announcement that it will take former president Donald Trump’s media startup public. Many investors made huge profits as a result. The DWAC spike has investors interested in other Trump-related stocks.

Facebook and Twitter cut off Trump from their platforms on grounds that the former president incited the Jan. 6 Capitol riot. Trump plans to launch his own social platform, TRUTH Social, to counter them. Trump’s social network is part of his media startup, which is merging with the DWAC SPAC to go public.

DWAC spike puts focus on these Trump-related stocks

If you missed the DWAC rally or just looking for more stocks with Trump ties, you may want to look into these:

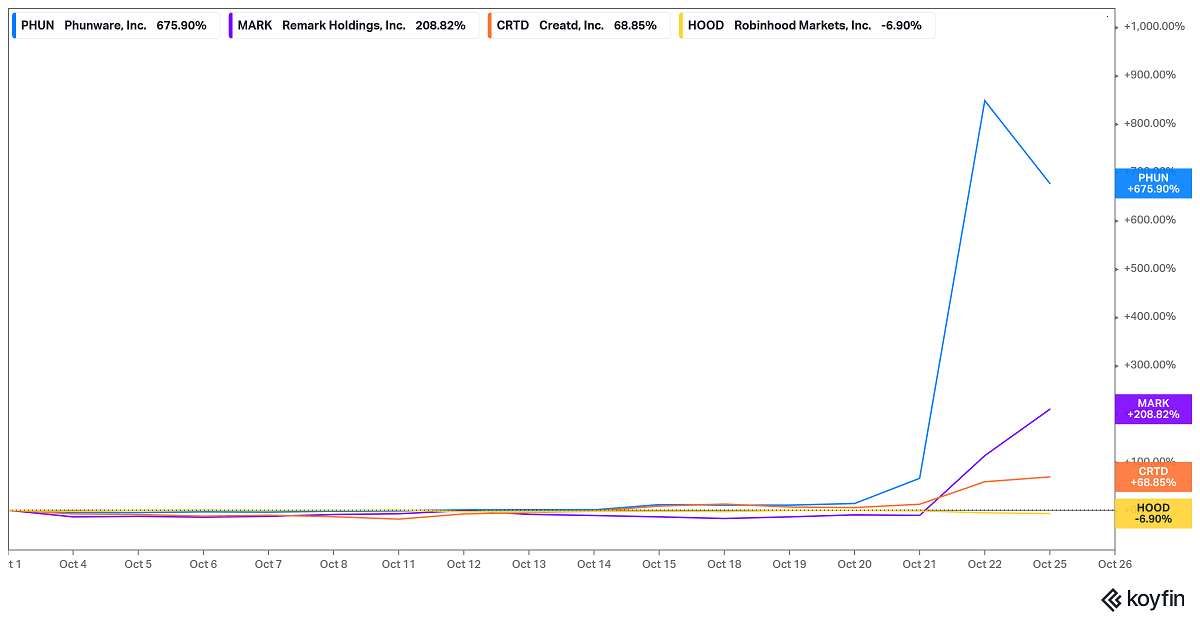

Phunware (PHUN).

Remark Holdings (MARK).

Creatd (CRTD).

Benessere Capital Acquisition Corp. (BENE).

Yunhong International (ZGYH).

Robinhood (HOOD).

Phunware is a software company that worked on Trump’s 2020 re-election campaign. Away from politics, Phunware offers mobile advertising solutions. Some investors speculate that Phunware could get a role in helping Trump’s TRUTH Social monetize its audience. Facebook and Twitter primarily make money through ad sales, and TRUTH may want to do the same.

Remark provides AI (artificial intelligence) solutions that can be used to deliver relevant content and in e-commerce products. AI technology underpins many features on Facebook and Twitter. There are speculations that Trump’s TRUTH Social could turn to Remark for AI solutions.

Creatd offers technology tools that brands can use for the creative efforts. After Trump announced plans for TRUTH Social and the DWAC SPAC merger, Creatd launched a line of Trump NFTs.

Benessere Capital Acquisition and Yunhong International are two other blank-check companies run by Patrick Orlando, whose DWAC SPAC is taking Trump’s media startup public. Benessere targets investments in American technology businesses, and China-based Yunhong targets investments in Asian consumer and lifestyle businesses.

The spike in Trump-related stocks has been credited to excitement among retail investors. Robinhood, a popular broker for retail investors, saw its app downloads increase after Trump announced his media plans.

Shorting Trump-related stocks

Iceberg Research has decided to short DWAC stock, arguing that the party is over for the SPAC taking Trump’s media startup public. The short-seller believes that the former president will renegotiate a deal that benefits him at the expense of the retail investors who rushed to buy DWAC stock. Iceberg is also short on AMC stock.

Hedge funds Lighthouse Investment Partners and Saba Capital Management were large investors in DWAC. They decided to sell their shares in the blank-check company after learning about its plans to merge with Trump’s media startup and take it public.

Some investors are making bearish bets on Trump-linked stocks, but they’re not heavily shorted. Phunware stock carries a short interest of about 3 percent, and Creatd and Remark have short interest of about 6 and 12 percent, respectively.