Is THBR a Good Stock to Play the Global Chip Shortage?

Thunder Bridge Acquisition II (THBR) stock is down 27 percent from its 52-week highs. What’s the forecast for THBR stock and is it undervalued?

April 5 2021, Published 7:20 a.m. ET

There has been a sell-off in SPAC stocks. Investors have sold off growth stocks as well as speculative names and SPACs. Thunder Bridge Acquisition II (THBR) stock is now down almost 27 percent from its 52-week highs. What’s the forecast for THBR stock and is it undervalued after the fall?

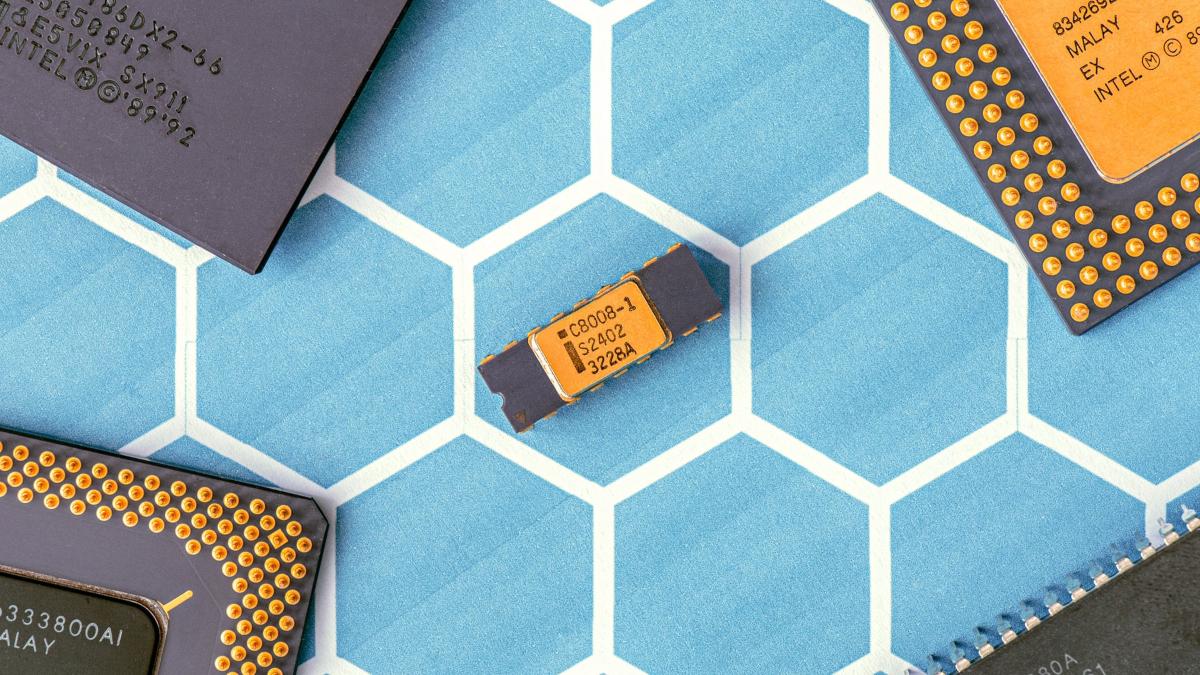

THBR would merge with Indie Semiconductor and the combined entity would trade under the ticker symbol “INDI.” Indie Semiconductor provides chips for the automotive industry. There's a severe shortage of chips, especially for those that are used in automotive production.

Jim Cramer on THBR stock

Indie Semiconductor’s co-founder and CEO Donald McClymont did an interview with Jim Cramer where he talked about the outlook for the business. Indie Semiconductor has profited from the global chip shortage. The shortage has also given some pricing power to chipmakers.

THBR stock price

Cramer, who is otherwise not very bullish on many SPACs given their speculative nature, sounded bullish about THBR stock. Looking at a business perspective, Indie Semiconductor is into the automotive supply chain where it can take years to build relationships.

What’s the forecast for Indie Semiconductor?

Indie Semiconductor has been in the business for over 10 years and has built relationships. It supplies products to companies like Ford, General Motors, Volvo, and Tesla. The demand for chips from the automotive industry will increase multifold as the industry transitions towards smart electric vehicles.

The deal valued Indie Semiconductor at an equity value of $1.4 billion. Based on THBR’s current stock price, its pro forma market cap would be around $1.58 billion. The company expects the TAM (total addressable market) for automotive semiconductors to grow to $59 billion by 2025 from $33 billion in 2020. Indie Semiconductor expects its TAM to increase at a CAGR of 19 percent to $38 billion over this period.

THBR is a play on the automotive semiconductor market.

Indie Semiconductor has already done the hard work by building relationships with automotive companies and has shipped 100 million devices to OEMs. The company’s revenue run rate was around $20 million in 2019 and 2020. However, it expects the revenues to rise at a CAGR of 85 percent and reach $501 million in 2025.

Forecasts stretching as far as 2025 should be taken with a pinch of salt. However, the market for automotive semiconductors is expanding rapidly, which bodes well for Indie.

THBR stock forecast

Usually, analysts start forecasting the target price for SPACs after they merge and release their audited results. However, two analysts have provided the forecast for THBR stock even before the merger. Roth Capital’s Suji Desilva has set a $20 target price for THBR stock, according to TipRanks. Ruben Roy of Benchmark has a $17 target price on the stock.

This would mean an average target price of $18.5 for THBR stock, which is a premium of almost 70 percent over the current prices.

Is THBR stock undervalued?

THBR stock trades at a 2025 price-to-sales multiple of around 3x. It expects to post an EBITDA margin of 30.8 percent in 2025 and an absolute EBITDA of $154 million in the year. This would mean a 2021 EV-to-EBITDA multiple of 7.1x.

After the merger with THBR, Indie Semiconductor would get around $465 million as cash (after adjusting for deal expenses). This includes the PIPE (private investment in public equity) and the cash held by THBR SPAC. The company would use this cash to strengthen its balance sheet and invest in growth.

THBR stock is trading near $10, which is the price level at which the smart money from PIPE investors would come. Also, given the reasonable valuations, it looks like a good stock to buy for the long term and a bet on the automotive industry’s chip demand.