Student Loan Forgiveness Scams: What Alumni Should Watch For

As an overhaul of the student loan forgiveness policy is underway, scams are targeting debt-bearing alumni. Here's what to watch for.

Oct. 5 2021, Published 11:39 a.m. ET

As an overhaul of the student loan forgiveness policy is underway, scams are targeting debt-bearing alumni. Student loan forgiveness scams have increased during the COVID-19 pandemic as attackers home in on the confusion surrounding payment moratoriums.

What kind of scams are targeting student loan carriers? More importantly, what are the tell-tale signs of a student loan scam to help people avoid illicit activity aimed their way?

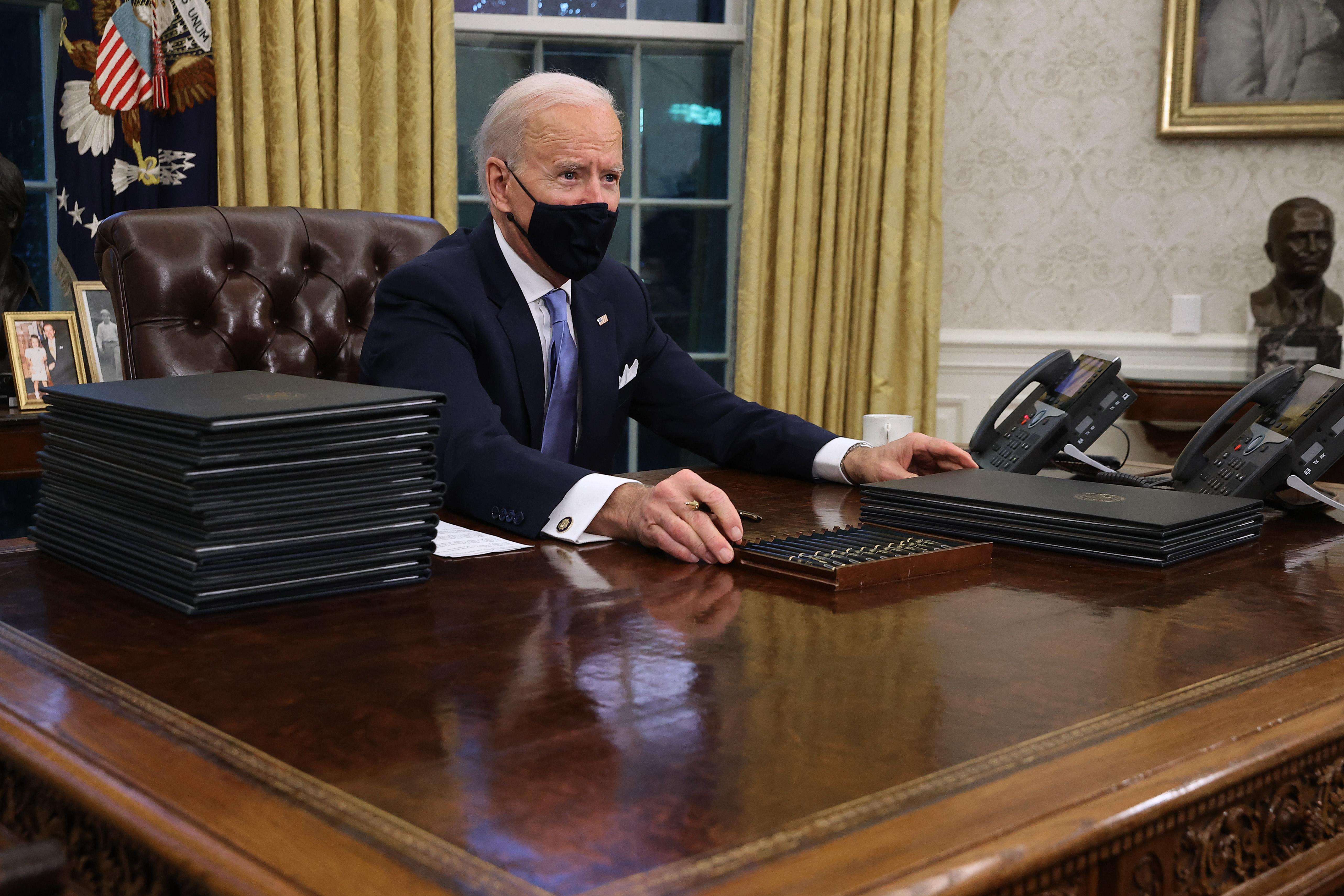

As Biden dives into student loan regulation, scams abound

On Oct. 4, President Biden started a regulatory overhaul of key policy surrounding student loan forgiveness, repayment, and relief programs. The negotiated rulemaking process involves public hearings, a review of current student loan programs, and proposed changes.

The committee overseeing this change is diverse, including:

Current student loan borrowers

Financial aid administrators

Colleges and universities

Individuals with disabilities

Legal services organizations

Military service members

Lenders

The committee will address programs like Public Service Loan Forgiveness, Closed School Discharge, Borrower Defense to Repayment, and Total and Permanent Disability Discharge.

This process will likely take place over the next several months (negotiated rulemaking tends to take a while).

Scammers are targeting confusion around student loan payment moratorium

Amid regulation overhaul and a student loan payment moratorium, student loan forgiveness scams are increasing. Beginning on March 13, 2020, the U.S. government suspended payments for eligible loans. Student loan payments are set to restart after January 31, 2022, following a final extension in early August.

Types of student loan forgiveness scams

Scammers might use a phone call, email, or letter to contact you for a fake student loan forgiveness opportunity. If they ask for your social security number, federal student aid ID, credit card, or bank account information—especially over email, but through other methods as well—be wary.

How to spot a student loan forgiveness scam before it gets you

Even if someone who calls or sends a letter has access to personal credit report information like your student loan balance, it doesn't mean they're legit. You should still check with your loan servicer for verification.

Names like "Biden loan forgiveness," "CARES Act loan forgiveness," and "pandemic grant" aren't real programs. Any correspondence that uses a fake program name should be flagged.

Anyone sending an email from an address that doesn't end in ".gov" should be flagged as suspicious as well.

Once you spot a scammer, you are more than welcome to block them, mark their email as spam, or simply ignore them and toss the correspondence. Alternatively, you can notify the FTC so they can make more people aware of the type of scam you received.

How to course correct if you've already fallen victim to a student loan scammer

If you provided credit card or bank account information, cancel your accounts or stop payments immediately. Make sure your banks and student loan servicer know about the fraud. Loan servicers can keep tabs on your federal student aid ID to see if there's any illicit activity.

If you provided a scammer with your social security number, call the FTC's identity theft hotline toll free at 1-877-IDTHEFT and place a fraud alert on your SSN.