How To Get Your Student Loans Forgiven

Many former students aim to extend the repayment period of their loans and lower their interest rate. Here's how to consolidate student loans.

Sept. 30 2021, Published 8:08 a.m. ET

As the cost of higher education has soared, many Americans have to borrow to go to college. If you have multiple education loans, you may want to know how to consolidate student loans. Is student loan consolidation beneficial?

Amid the tight competition in the job marketplace, demand for a college degree is soaring, driving up college costs. As a result, many families can’t rely on savings or investments to foot higher education bills, and more people are turning to student loans.

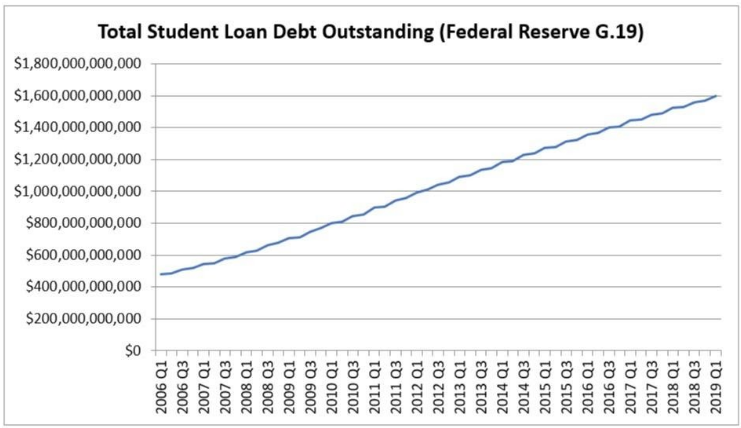

The U.S. student loans debt hit $1 trillion for the first time in 2012 and continues to rise, touching $1.7 trillion in 2021. If the trend continues, it could surpass $2 trillion in 2024 and $3 trillion in 2038. As the education debt balloons, calls for student loan forgiveness have increased.

How to consolidate student loans

If you have many outstanding education loans, managing their repayment can pose a great challenge. Consolidating them might help. If you have various federal student loans, you can use the direct consolidation loan program to combine your loans into one. The program is free, and you can complete the consolidation process in 30 minutes.

Those with private student loans can opt for loan refinancing, which is arranging with a private lender to replace their various student loans with one loan. This type of arrangement allows you to consolidate federal and private student debt.

Is it beneficial to consolidate student loans?

A major benefit of consolidating loans is that it can simplify repayment, giving you only one monthly bill. Rolling multiple loans into one can also offer you more time to repay the debt, which can reduce your monthly payment. However, if some of a loan comes with borrower benefits, you may lose those benefits when you consolidate the loan.

Student loan consolidation rates

Education loans can bear fixed or variable interest rates. You can combine the loans into one with a fixed rate if you like. With student loan refinancing through a private lender, you may get a lower interest rate for the consolidated debt if you have a good credit score.

Student loan consolidation calculator

You may use an online student loan consolidation calculator to see if rolling your various education debts into one would help. The calculator can compare your consolidated loan's monthly payment, interest rate, and total cost with your current loan's. Some popular student loan consolidation calculators are FinAid and Earnest.

How to get student loans forgiven

People with federal education loans can qualify for forgiveness after consolidating their debt. However, those who refinance their college loan through a private lender are ineligible for debt cancellation.

You need to apply for the loan forgiveness. If your application is approved, you’ll no longer be required to make payments for your student loans. Public school teachers and people working for a government or nonprofit organization may qualify for student loan forgiveness.