Child Tax Credits May Return in 2022, Only in Some States

Some states are considering sending out additional child tax credits. Will your state be one of them? Here's what we know so far about participating states.

July 6 2022, Published 10:37 p.m. ET

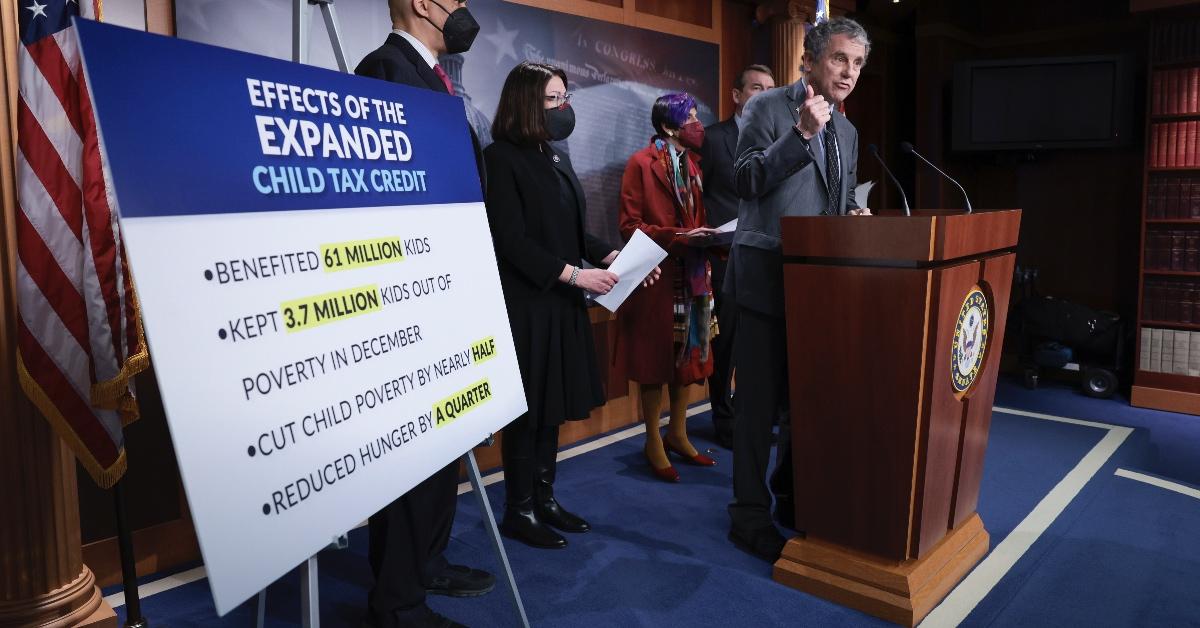

When the government failed to extend the enhanced child tax credit into 2022, families were devastated. The credit allowed many parents to collect a portion of their 2021 child tax credit early, essentially putting up to $300 per child in their pockets each month for the remaining half of 2021.

While Congress hasn’t exactly circled back to the idea, some states are considering issuing additional child tax credits, especially since inflation is at an all-time high. In May 2022, the inflation rate was 8.6 percent, reflecting the highest level it reached since 1981, reports Pew Research. So, which states are considering sending out additional child tax credits, and for how much?

Although Congress isn’t reinstating enhanced child tax credits, certain states might.

When December 2021 rolled around and the enhanced child tax credits were coming to an end, it was clear Congress wouldn’t allow payments to continue into 2022 — and the stance remains the same. However, with more children falling into poverty and costs continually rising, it’s evident people need help financially, and some states appear willing to provide it.

Here’s a look at the states that are either considering or close to sending out additional child tax credits in 2022 or are offering tax deductions.

Vermont

At the end of May 2022, Governor Phil Scott signed into law Act 138 (H.510), which calls for qualifying families to receive a refundable child tax credit. The total credit being offered is $1,000 per qualifying child aged 5 and under and begins to phase out for individuals who earned more than $125,000.

According to the bill, the credit will be reduced in increments of $20 for each $1,000 for which a person’s adjusted gross income exceeds the threshold. The refundable child tax credit is expected to help more than 30,000 children, according to VTDigger, and will be “modeled on [the] federal credit” that was provided for the second half of 2021.

Massachusetts

Massachusetts has converted the existing child tax deductions into two refundable credits, reports Fortune. The state credits are reportedly worth between $180 and $240 per child and only apply to children under the age of 12.

Although household income isn’t a factor when it comes to the refundable child tax credit, the state will only allow you to collect the refund for up to two children.

California

Although California isn’t offering monthly child tax credits, the state is giving families who qualify for the CalEITC (Earned Income Tax Credit) and have a child under the age of 6 a credit of up to $1,000 when they file their 2022 taxes.

To qualify for the state child tax credit, you need to have earned less than $25,000 during the tax filing year. If you earned between $25,000 and $30,000, the tax credit would then reduce from $1,000, reports CNET. Because the credit is refundable, it will either reduce your tax liability or provide you with a larger refund depending on your circumstances.

Colorado

Similar to California, Colorado will be offering its residents the option to claim the Colorado Child Tax Credit when they file their 2022 income tax returns in 2023. The credit is available to individuals with incomes of $75,000 or less, or $85,000 for taxpayers who are married filing jointly, and have a child under the age of 6 as of December 31, 2022.

Families will reportedly be entitled to collect between 5 percent and 30 percent of the federal credit for each qualifying child.

Idaho

Idaho is another state offering families a child tax credit incentive. The nonrefundable Idaho child tax credit is set at $205 per qualifying child. This means the credit can help lower your tax bill but won’t result in you receiving a credit.

Oklahoma

Oklahomans who earn less than $100,000 are eligible to receive 5 percent of the federal child tax credit, according to CNET.

New York

New York’s Empire State child credit allows families to collect “33 percent of the portion of the federal child tax credit and federal additional child tax credit” or $100 per qualifying child. In order to qualify, your income must not exceed $110,000 if you file married filing jointly, $75,000 (single, head of household, or qualifying widow or widower), or $55,000 if you file married filing separately.

As inflation continues to rise, putting the U.S. economy at risk of falling into a recession, states are looking for ways to combat rising costs. While some are looking to offer additional child tax credits or deductions, others are working to provide immediate relief through inflation relief checks and gas rebate cards.