Student Loan Dilemma — Pay It Off or Wait for Forgiveness?

The moratorium on student loans ends in August. What’s the latest update on student loans? Should you pay off your student loan or wait for forgiveness?

July 8 2022, Published 10:18 a.m. ET

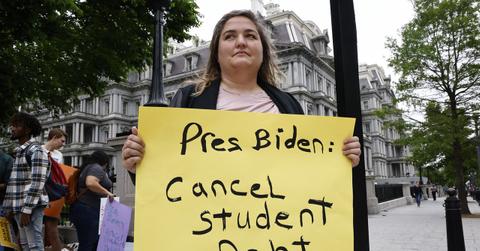

Student loans are arguably among the biggest broken sections of the U.S. economy. During his election campaign, President Joe Biden vowed to forgive $10,000 from all student loan borrowers, a promise that still hasn't been fulfilled. Now, Biden is said to be contemplating massive changes to the student loan system. What’s the latest update on student loans and should you pay off your student loan or wait for forgiveness?

In 2020, then President Donald Trump announced a moratorium on student loan repayments. While most of the stimulus that was announced during 2020 has been rolled back and even the U.S. Federal Reserve did an about-turn on its accommodative monetary policy, the student loan moratorium has been extended multiple times.

The student loan moratorium will end on August 31.

In April, the Biden administration extended the moratorium on student loans to August 31. However, it would be a folly to expect Biden to not extend the timeline again with the upcoming mid-term elections. Biden’s popularity has already taken a hit amid the multi-decade high inflation and high gas prices.

The multiple conspiracy theories on the Biden administration deliberately creating a food and energy shortage to the more recent reports of the U.S. selling oil from strategic oil reserves to China haven't helped matters either. In all likelihood, Biden will extend the student loan moratorium again to early 2023.

The administration is working to fix the student loan system.

On July 6, U.S. Secretary of Education Miguel Cardona said in a statement that the administration is working on “fixing” the “broken” student loan system. The proposals include a revamp of the PSLF (Public Student Loan Forgiveness), changes to the way interest on student loans is capitalized, and some protections for borrowers who were cheated by their college.

The guidelines, which are set to go into effect by the second half of 2023, don’t make mention of broad-based loan forgiveness. Given the federal government's already strained fiscal position, opposition from Democrats like Joe Manchin to the fiscal largesse, and Republicans’ reluctance, it looks less likely that the Biden administration will manage major loan forgiveness.

Should you make student loan payments or wait?

Given the student loan moratorium, where the loan isn't accruing any interest, it wouldn't make any financial sense to begin repayments. Even if the Biden administration doesn't go for a blanket loan forgiveness, it wouldn’t be financially prudent to make the repayments now.

If you have the money for repaying the student loans, you can instead use the money to repay other loans. With mortgage rates running at multi-decade highs, repaying your mortgage could be a better idea. If you don’t have any other outstanding loan liability, you could look at investing the surplus funds instead of making student loan repayments.

Why forgiving all students loans isn't a good idea.

While governments globally forgive loans, it isn't usually a good idea. First, it negatively impacts the credit culture in the country. Secondly, it's a drain on the country’s finances, which are paid for by taxpayers. Also, there's the question of morality as those who repaid their loans on time, or did not take any in the first place, end up paying the price.

However, this doesn't mean that the administration shouldn't take steps to fix the student loan system. A relief for those who were defrauded by their colleges is certainly an idea worth considering. Also, the repayments can be started gradually so that borrowers can cope with the changes.

Resuming student loan repayments would also help lower inflation. Both the fiscal stimulus and the Fed’s accommodative monetary policy played a part in pushing U.S. inflation to a multi-decade high. The Fed has already started the process of unwinding its accommodative fiscal policy and the government should also follow suit.