How to Buy WISE Stock in the Direct Listing and Whether You Should

Should you buy WISE stock and what’s the forecast for the stock after the listing? How can U.S. investors buy WISE stock?

July 7 2021, Published 11:03 a.m. ET

British fintech company WISE has gone public through a direct listing. The stock opened at £8, which gave the money transfer company a valuation of almost $11 billion. Should you buy WISE stock and what’s the forecast for the stock after the listing? How can U.S. investors buy WISE stock?

Companies in Europe have preferred the traditional IPO route, which involves the underwriting process. However, U.S. companies willing to go public have been more experimental with the way they go public. Over the last year, several U.S. companies have gone public through a reverse merger with SPACs, which are floated with the sole aim of taking one or more companies public.

WISE opted for a direct listing

WISE has opted for a direct listing where the company going public does away with the underwriters and sells the shares directly to investors. In 2021, Roblox and Coinbase have opted for a direct listing.

In 2020, Asana and Palantir went public through a direct listing. The strong response to WISE IPO is a welcome break for U.K. capital markets. Deliveroo, which went public earlier in 2021, slumped on the listing.

WISE stock valuation

WISE posted revenues of £421 million (almost $582 million) in fiscal 2021. Based on the $11 billion market cap, this implies a trailing price-to-sales multiple of just over 26x. The company posted a net profit of $42.7 million in the year, which gives us a trailing PE multiple of 257x.

The company was valued at $5 billion in a private market transaction in 2020. Affirm went public at over five times its most recent private market valuation.

What’s the forecast for WISE stock?

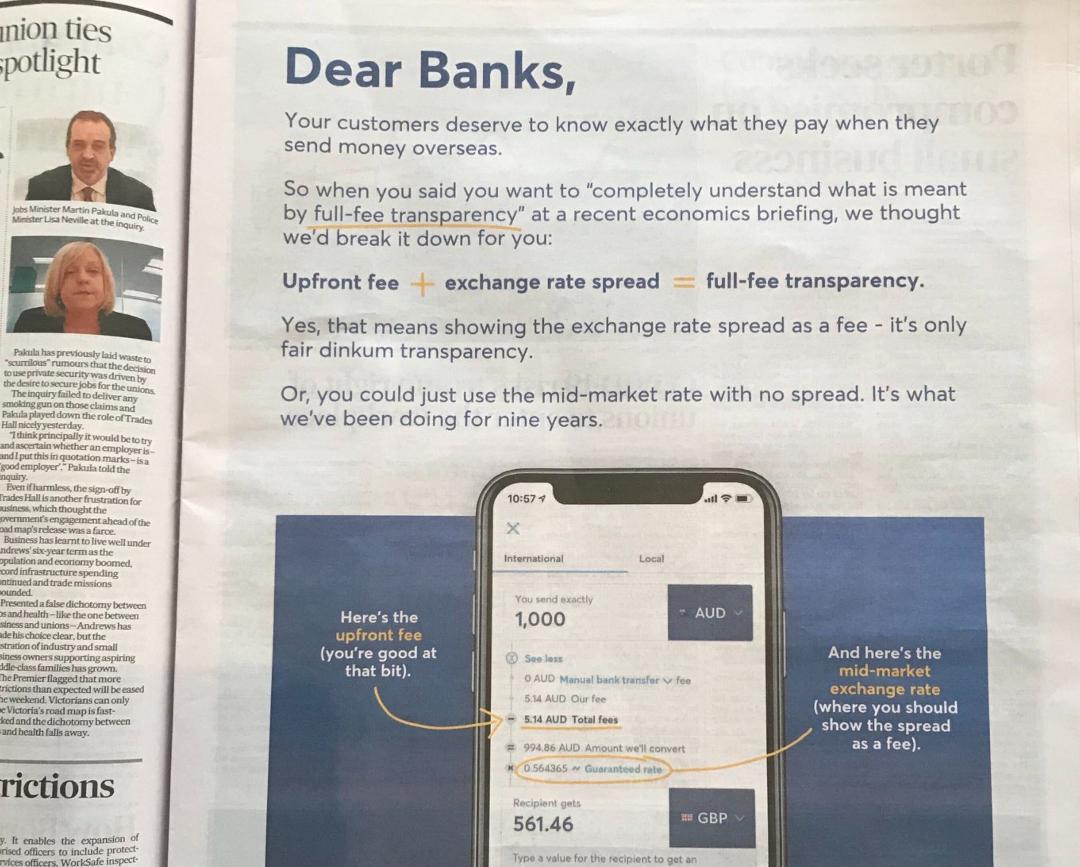

WISE, which was previously known as TransferWise, was founded in 2010. The company provides cross-border money transfers. While many financial institutions claim to transfer money for “free” in reality there are hefty currency markups. WISE, which gets most of its revenues from Europe, works towards a transparent pricing system for money transfers.

WISE competes with companies like MoneyGram and Western Union as well as several startup companies. The business model for WISE looks strong and it’s a profitable company unlike most of the recently listed U.S. fintech companies that are posting losses. The forecast for WISE stock looks positive considering the strong business model and tepid valuations.

Should you buy WISE stock?

WISE looks like a good stock to buy. However, the market sentiments towards fintech companies have been very subdued in 2021. Affirm stock trades at less than half of its 52-week highs. Paysafe and SoFi, both of which went public through a SPAC merger, have also struggled.

WISE's profitable and differentiated operations make it a standout. Its revenues increased 39 percent in fiscal 2021, while the net profits doubled during the year. The company is targeting a niche segment and offering a consumer-friendly product, which makes it an attractive buy.

How to buy WISE stock

Several brokers in the U.S. let you trade in U.K. stocks. Saxo, IG, and Trading 212 are among the brokers that let you buy WISE stock.