Should Investors Buy UiPath IPO Stock or Stay Away?

Robotic process automation platform UiPath is going public this week through the traditional IPO route. Should you buy UiPath IPO stock?

April 20 2021, Published 12:25 p.m. ET

Robotic process automation platform UiPath, which confidentially filed for an IPO in 2020, is going public this week. However, looking at the crash in growth stocks and the tepid response to some of the other IPOs, should you buy UiPath IPO stock or stay away?

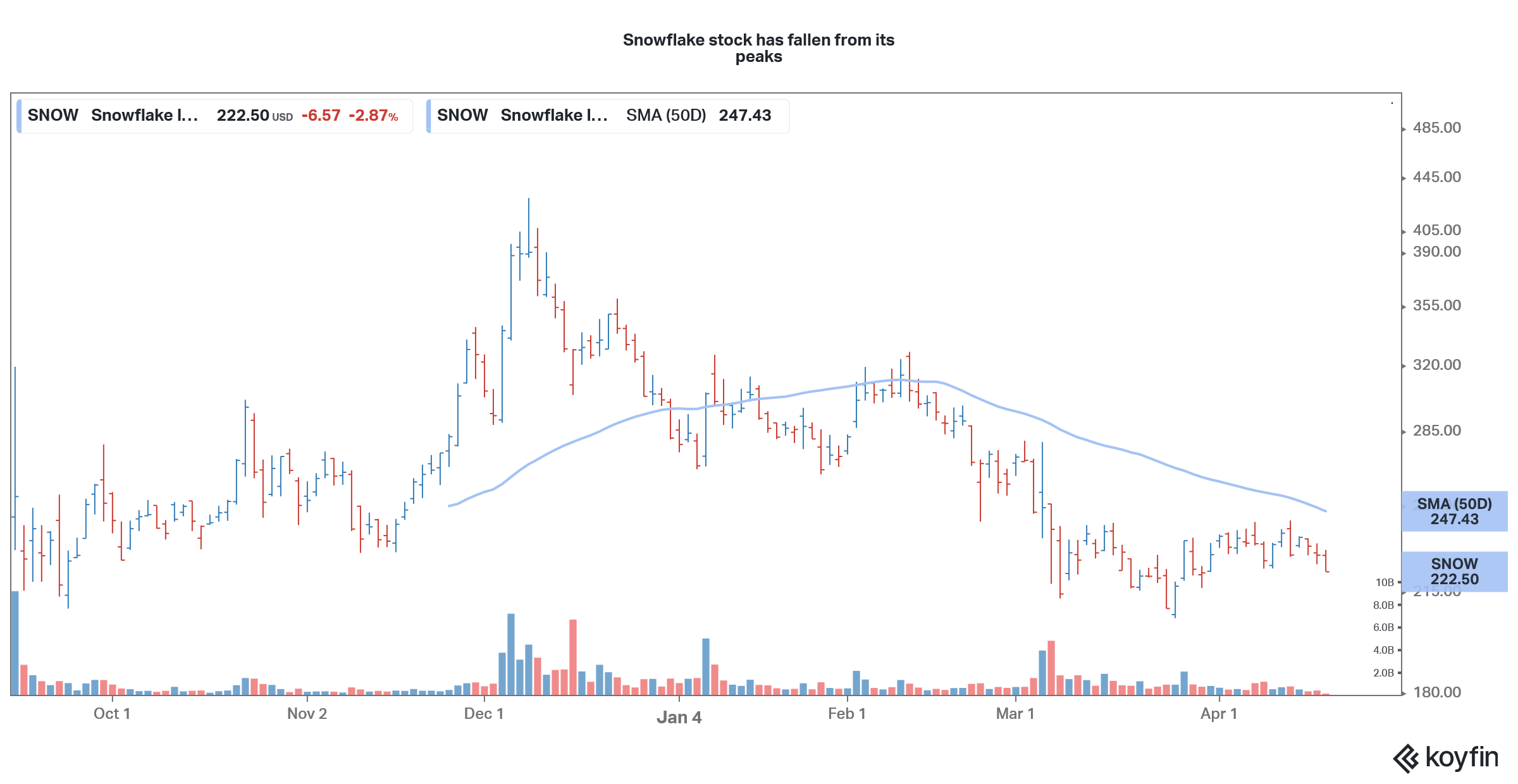

While 2020 was a record year for the U.S. IPO market, investors have been getting apprehensive about the kind of valuations that perennially loss-making companies are seeking while going public. Some of the high-flying IPOs of 2020 including Snowflake, where Berkshire Hathaway also invested, have tumbled from their highs due to concerns about their high valuations.

UiPath IPO date and price

UiPath is expected to list on April 21. The company has kept the IPO price range at $52–$54. It has increased the range from the previous range of $43–$50. The increase in the IPO price range signals strong demand from investors. In 2020, it was almost customary for companies going for an IPO to increase the price range before the final listing. The stock will list under the ticker symbol “PATH” on the NYSE.

UiPath IPO valuation

At the top end of the IPO price range, UiPath would have a market capitalization of around $28 billion. The proposed valuation is lower than the $35 billion valuation that it commanded in a private funding earlier this year.

The valuation in the most recent funding round was over three times the $10.2 billion valuation that it commanded in the previous funding round last July. The tepid valuation that UiPath is now seeking reflects the changed market sentiments. Investors have been wary of loss-making growth companies amid the rise in bond yields.

UiPath isn't profitable.

Like most other companies that have gone public over the last year, UiPath is posting losses. However, the company’s net losses narrowed to $92.4 million in the fiscal year ended January 31, 2021, compared to a net loss of $519.9 million in the same period last year.

UiPath stock forecast

Since UiPath hasn't listed yet, none of the Wall Street analysts have assigned a target price or forecast for the company. Analysts will start providing a forecast for the stock soon.

UiPath stock on Reddit

While Reddit groups like WallStreetBets have been instrumental in pumping several stocks in 2021, UiPath isn't among the popular stocks on the platform. While there's a subreddit with 2,500 members specifically for the company, there isn't much discussion about the IPO on the forum.

Is UiPath IPO a good buy?

UiPath reported revenues of $607.6 million in the fiscal year ended January 31, 2021, which was 81 percent higher than what the company posted in the same period last year. Looking at the $28 billion valuation that UiPath is seeking, it's valued at a trailing price-to-sales multiple of 46x.

Snowflake stock has fallen

While the multiple would have looked comfortable in 2020, it looks high now based on the bloodbath in growth names. While the IPO might see the typical listing bump like we saw with Coinbase, eventually the sell-off in growth stocks will catch up with UiPath.

How to buy UiPath stock

You can buy UiPath stock after the listing through any of the brokers. You need a funded account to place an order for the desired number of shares.